- Global smartphone revenues remained flat YoY at just over $100 billion in Q3 2023.

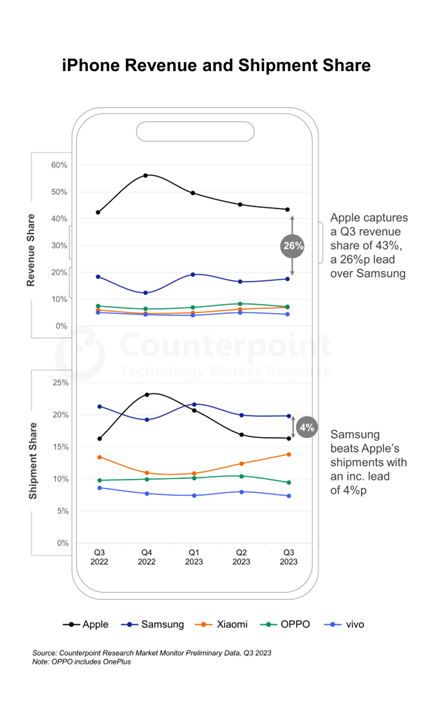

- Apple led the global smartphone market with record Q3 revenue and revenue share.

- Samsung, which led the market in terms of shipment share, took the second spot in terms of revenue, which stood at 18%.

- Growing shipments helped Chinese OEMs such as Xiaomi, HONOR and Huawei see higher revenues.

London, New Delhi, Hong Kong, Seoul, Beijing, Denver, Buenos Aires – Nov 3, 2023.

Global smartphone market revenues remained flat YoY despite growing by 15% QoQ to just over $100 billion in Q3 2023. Apple led the market with 43% share of global smartphone revenues, its highest-ever for a calendar Q3. This was despite Apple’s latest iPhone 15 series being available for one less week in the third quarter of 2023 compared with its predecessor in the same period of the last year. This translated into Apple also clocking its highest-ever share of global smartphone revenue for a September-ending quarter.

Commenting on evolving market dynamics, Senior Analyst Harmeet Singh Walia noted, “Pro Max being the best-selling variant of the iPhone 15 series contributed to Apple also achieving its highest-ever Q3 operating profit. However, its global smartphone operating profit share remained flat due to a resurgence of Huawei and HONOR, and an increased focus on profitability by other Chinese OEMs such as Xiaomi and OPPO. Consequently, the global smartphone operating profit reached an all-time high, signaling more definitely how the smartphone market has adjusted to the post-pandemic trend of lower shipments.”

Samsung’s ASP grew 4% YoY thanks to the successful launch of Fold 5, maintained momentum in S23 series’ sales, and a higher flagship share in major product lineups. Nevertheless, an 8% shipment decline in the same period, offset the ASP increase, causing Samsung’s revenue to decline by 4% annually.

While OPPO’s focus on phones with higher ASPs, such as foldables — of which the OPPO Find N2 Flip is the top-selling in China — is helping it achieve profitability, a slowdown in its expansion outside of China and India has brought about a YoY shipment decline, and OPPO’s smartphone revenue in the first three quarters of 2023 being the lowest since the pandemic. vivo, while remaining profitable, has faced greater challenge in its home country, China, where its promotions have been less aggressive than HONOR and Xiaomi. Consequently, vivo’s smartphone revenue fell 12% YoY, and is almost half of Q3 2021.

Xiaomi is the only top five smartphone brand to see shipment increases both QoQ and YoY in Q3 2023 as it strengthened its positions in key markets such as China and India, offered more affordable mid-range products at promotional prices to both retailers and consumers and on the back of strong sales of the Redmi K and Note series. Consequently, it achieved both revenue and operating profit growth both sequentially and annually.

Research Director Jeff Fieldhack commented, “Counterpoint Research estimates that the China smartphone market declined about 3% during the quarter. Apple’s China revenues fell 2.5% during the quarter. Considering the increased competition from Huawei 5G devices, this is a good signal for Apple and the iPhone 15 series. Especially since the Pro Max and Pro were supply-constrained.”

The full impact of the iPhone 15 series is yet to be seen during the global holiday season expected to be boosted by upgrades from iPhone 11 and 12 users. While the latest iPhone series had underperformed in China in the launch quarter due to a shorter pre-holiday shopping period coupled with supply mismatches on the Pro Max, it could see improvement in the year-ending quarter with a strong 11.11 sales event performance which should also benefit other Chinese smartphone vendors. The elongated festive season in India would boost shipments and revenues in the world’s second-largest smartphone market where pent-up demand and 5G upgrades will also contribute to growth. On the whole, the global smartphone market could end the year with cyclical growth.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research