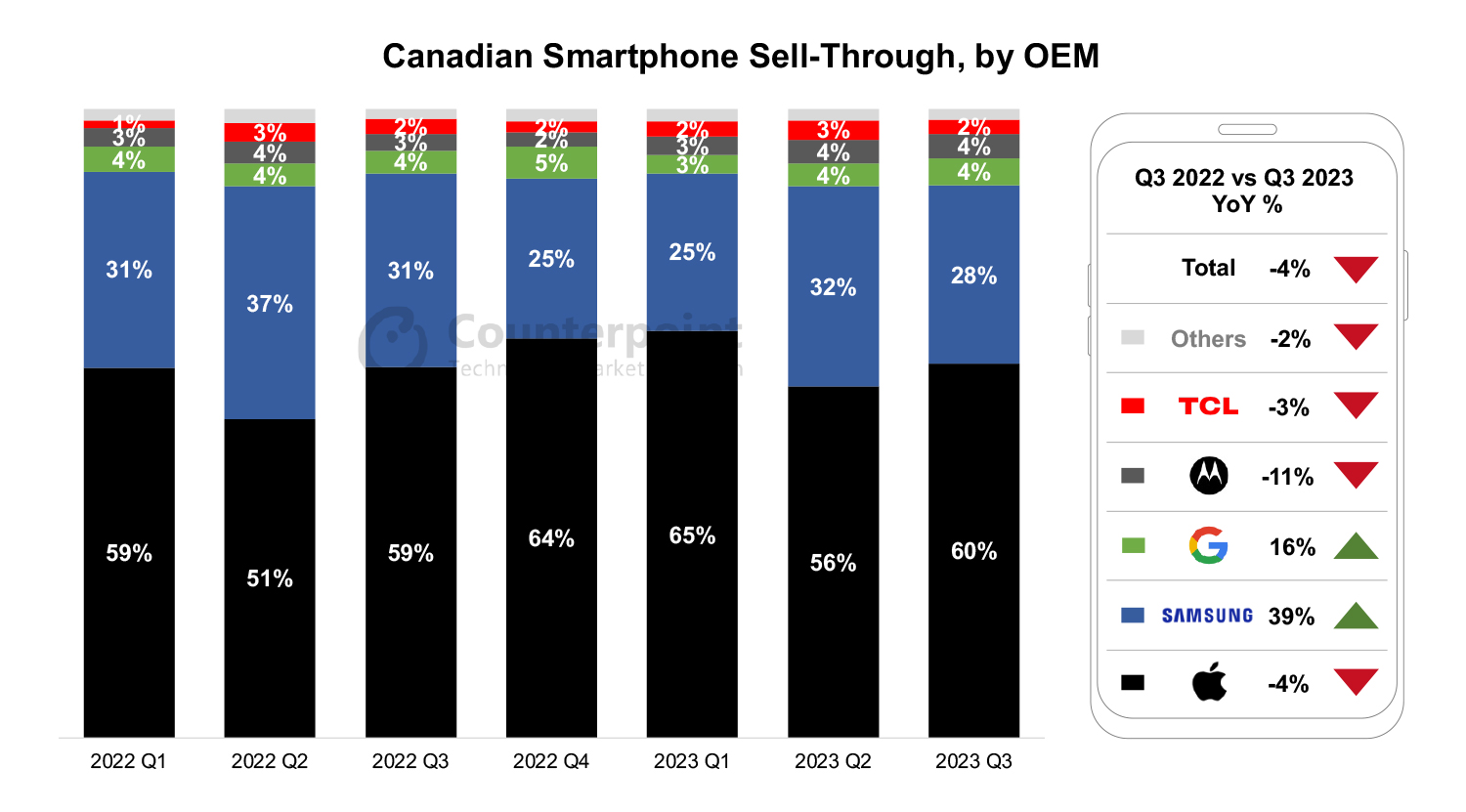

- Canada experiences second quarter in a row with YoY decline, inflationary pressures, longer replacement cycle and carrier BYOD/CPO focus causing new sales decline.

- Apple registers YoY sales decline but performs better than Android OEMs.

- Samsung down 11% as the OEM continues to push for flagship sales, causing longer holding periods and less upgrades.

- Google and Motorola continue to grow from a small base with improved retail presence.

Although Q3 was a strong quarter as it normally is in Canada with aggressive carrier promotions during back-to-school promotions followed by new flagship smartphone launches, the YoY sales were down as Canadians continue to experience inflationary pressures. Affordability became a major issue for majority Canadians due to lower household savings and higher cost of living. This is causing more consumers to delay smartphone purchases.

Apple had a successful iPhone 15 launch despite the 3% YoY decline, as the iPhone 14 series experienced a week more of sales in Q3 2022 than the iPhone 15 had in Q3 2023. Samsung declined 11% YoY due to weaker flagship sales and increased competition from Motorola in mid-tier price band. Google gained from a small base driven by promotions and targeted channel marketing.

Commenting on the Canadian Q3 2023 smartphone sales performance, Research Analyst Emily Herbert said, “As higher priced flagships experience a decline due to economic pressures, mid-priced devices experience an uptick as promotional strategies have been more aggressive in carrier channels as well as national retail, like Best Buy. Although flagship sales are down, ASPs of new devices are higher causing a growth in revenue for carriers, customers are signing onto higher value unlimited plans with the driving sales of premium devices.

Research Director, Jeff Fieldhack comments: “Inflationary pressures has Canadian carriers utilizing the development of trade-in and CPO device sales, thus causing the YoY smartphone sales decline for the last two quarters. Many carriers have pushed for BYOD plans in Q3 to encourage immigrant and international students to bring their device onto a plan without purchasing a device. Carriers have also leveraged CPO device portfolios to offer more affordable options on n-1/n-2-year-old flagship smartphones.”

Commenting on forward-looking trends into Q4 2023 and 2024, Associate Director, Hanish Bhatia said,” Carriers have noted that the quality of new additions will be of top priority, not necessarily the quantity, now that the country is seeing an economic slowdown with uncertainties around geopolitical environment and immigration policies in 2024. This means leaning into the premium device sales with Black Friday and Boxing Day promotions that brings in high volumes of flagship sales. Secondly, bundling high value mobile plans with other services like internet, TV, security and other IoT plans will be an important method for carriers to continue positive revenue growth.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research