- Global ODM (including IDH) smartphone shipments fell 6% YoY in H1 2023 due to the macro headwinds after COVID-19.

- Outsourced design shipments decreased in H1 2023 but their share increased when compared to the same period last year.

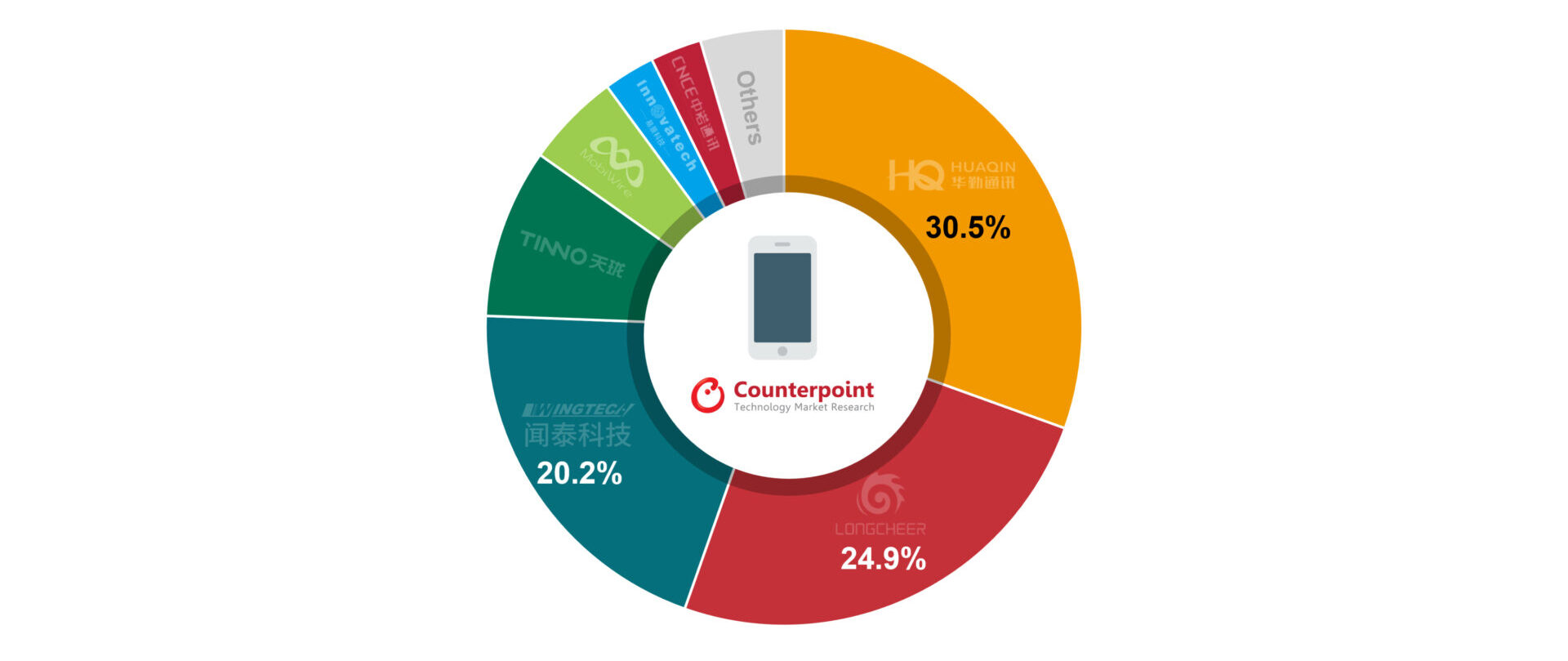

- The top six ODMs took 95% share of the total ODM shipments.

Beijing, New Delhi, Hong Kong, Taipei, Seoul, San Diego, Buenos Aires, London – October 03, 2023

Smartphone shipments from Original Design Manufacturers/Independent Design Houses (ODMs/IDHs) declined 6% YoY in H1 2023, according to Counterpoint Research’s latest Global Smartphone ODM Report and Tracker.

Senior Research Analyst Shenghao Bai said, “The YoY decline in ODM/IDH companies’ H1 2023 shipments was driven by Samsung, Xiaomi and Lenovo Group’s weak performance. However, vivo, HONOR and Transsion Group’s rise offset part of the decline.”

Huaqin, Longcheer and Wingtech continued to dominate the competitive landscape of the global smartphone ODM/IDH industry in H1 2023. The companies, also known as the ‘Big 3,’ accounted for 76% of the global ODM/IDH smartphone market in the first half of 2023.

Global Smartphone ODM/IDH Vendors’ Shipment Shares, H1 2023

Commenting on the leading ODMs’ performance, Senior Research Analyst Ivan Lam said, “The ‘Big 3’ witnessed declines in the first half. Huaqin experienced a relatively smaller decrease and took the leading position. Longcheer’s shipments were impacted by Xiaomi’s performance but eased by the soaring orders from vivo. Wingtech saw similar declines as Longcheer but still received modest orders from Samsung, Xiaomi and OPPO Group.”

Bai added, “In Tier 2 ODMs, Tinno’s shipments continued to grow steadily due to its loyal client base of major carriers and local kings. Transsion Group’s good performance has been bringing a concrete boost to MobiWire and Innovatech, which have collaborated with the group for years. Their product offerings and supply chains are giving the group cost and quality advantages in its major target markets.”

Commenting on global manufacturing trends, Lam said, “India is now the second-biggest manufacturing hub for mobile phones due to heavy investment from OEMs, ODMs, and companies dealing in components and parts. India is expected to export about 22% of its total assembled mobile phones in 2023. However, China’s manufacturing and supply chain will still maintain its essential role in the longer run.”

Counterpoint Research’s market-leading Global Smartphone ODM Report and Tracker is available for subscribing clients.

Feel free to contact us at press@counterpointresearch.com for questions regarding our in-depth research and insights.

You can also visit our Data Section (updated quarterly) to view the smartphone market share for World, USA, China and India.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Counterpoint Research

press(at)counterpointresearch.com