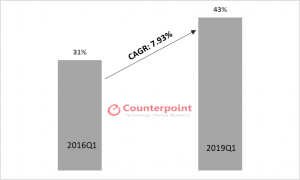

The sales channel landscape for the LATAM mobile devices market has been going through significant changes in the last few years. Just two years ago, nearly 70% of the quarterly mobile device sales in LATAM came from operators. Today, the open channel has a more even share (43%) of the market. And it is growing fast.

In a market where sales of mobile devices have grown at a CAGR of only 0.24% between 2016 and 2018, the open channel has grown at almost 8% CAGR. As a result, operators have been slowly pivoting towards being a service provider after years of being device driven business.

Exhibit 1: Open Channel Mobile Devices Market Share 2016Q1 vs. 2019Q1

Source: Counterpoint Market Monitor Q1 2019

At Counterpoint, we have been mapping the top three operators’ share in mobile device sales for more than three years. The findings reveal starkly different strategies of LATAM’s two biggest operators, America Movil, and Telefonica, resulting in very distinct outcomes and share of the mobile device market. America Movil, which operates under the brands Claro and Telcel, and Telefonica, which operates under the brands Movistar and Vivo, still account for 70% of the mobile handsets sold through the operator channel. Counterpoint’s latest research tracks the changing trends of the sales channel and OEMs for mobile devices in the LATAM region over the last few years in great detail. The comprehensive and in-depth report is available exclusively for clients here.

We believe the LATAM mobile devices market is heading towards an open channel ecosystem. Every other quarter, operators do regain some share. However, in peak season, the open channel claws back its lost share and even gains marginally. Over time, operators will continue to lose share. This forces OEMs to negotiate with the retail sector directly.

The open channel, which consists of big retail chains as well as small shops, in some instances, can be tougher to work with than an operator. However, the rise of the open channel has allowed more brands to enter the region. All the top five selling brands, that account for 78% share in LATAM, have a different approach to the operators and open channel when it comes to their channel strategy. Huawei is extremely strong within operator channels. Samsung, on the other hand, the leader of the market in LATAM, and its participation across different sales channels is very similar to that of the market.

This is why we believe that the increasing importance of the open channel is positive for OEMs. Although the operator channel was large, operators were often very selective about the models they stocked. For example, Claro (America Movil) Brazil would only range four brands. However, the same company in Mexico, under the brand name Telcel, would offer more than 22 brands. An increasing share of open channel sales removes such arbitrariness of distribution. But the open channel requires a more aggressive turnover than operators. We examine this and much more in our latest analysis, exclusively for clients, titled. ‘ LATAM Mobile Devices Sales Channel Analysis: The Rise of the Open Channel’.