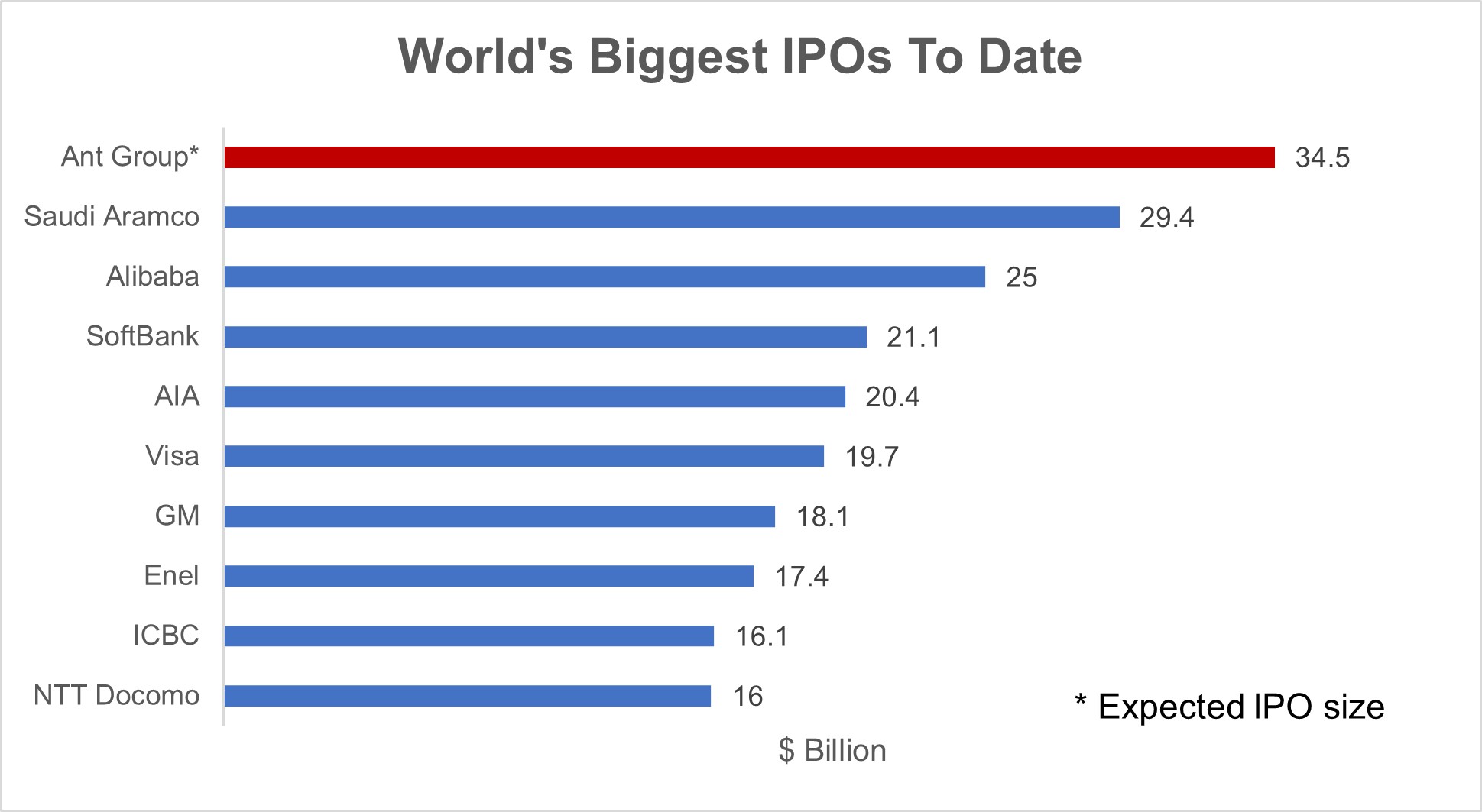

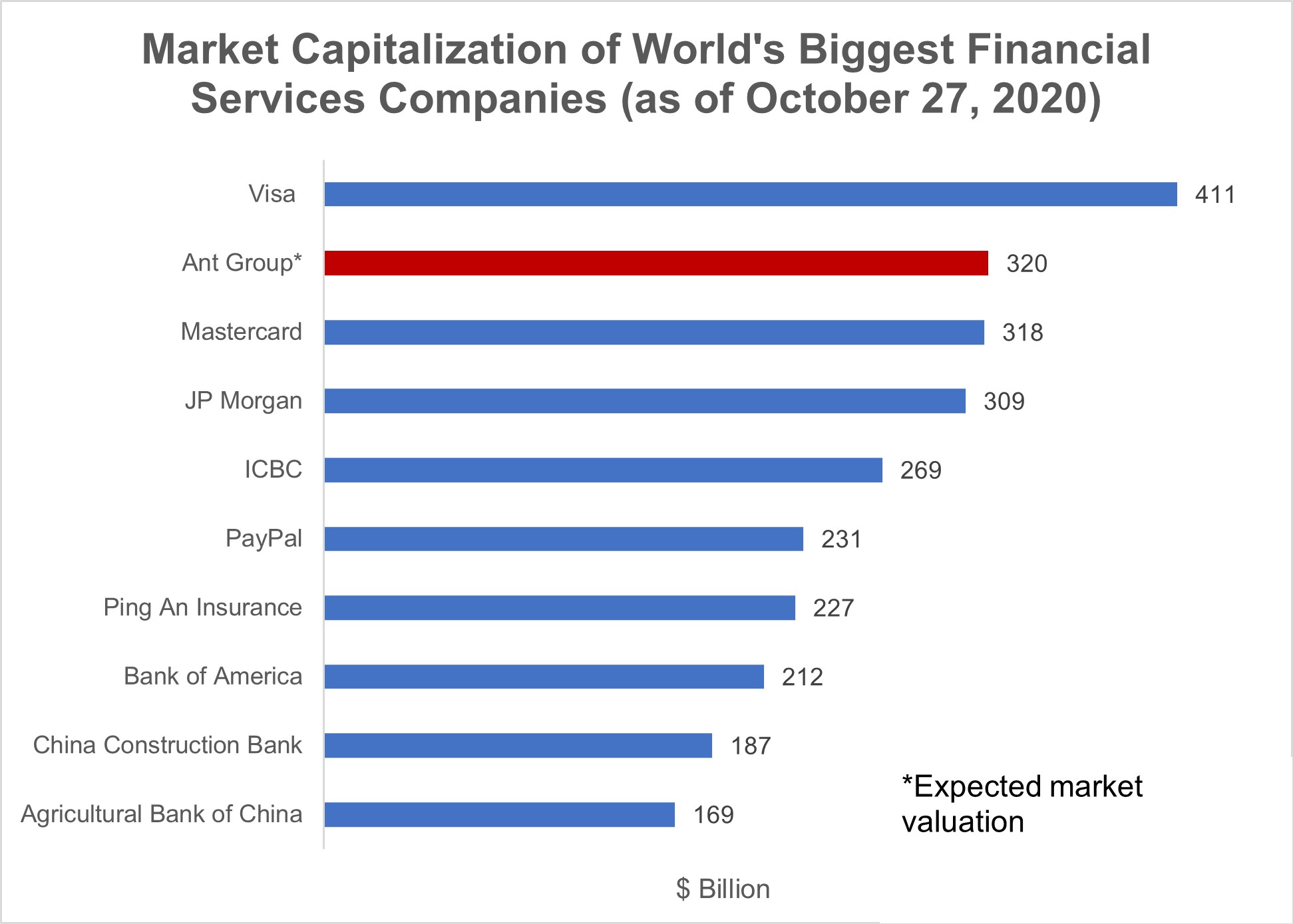

Ant Group is expected to raise about $34.5 billion in a dual listing on the Hong Kong and Shanghai bourses on November 5, likely becoming the biggest IPO ever. At $320 billion, Ant Group would become one of the biggest financial services companies in the world – bigger than any bank in the world, or more than four times the size of Goldman Sachs.

(Update: On November 3, the Shanghai Stock Exchange halted Ant Group’s IPO, citing a “significant change” in the regulatory environment)

This Ant is Big

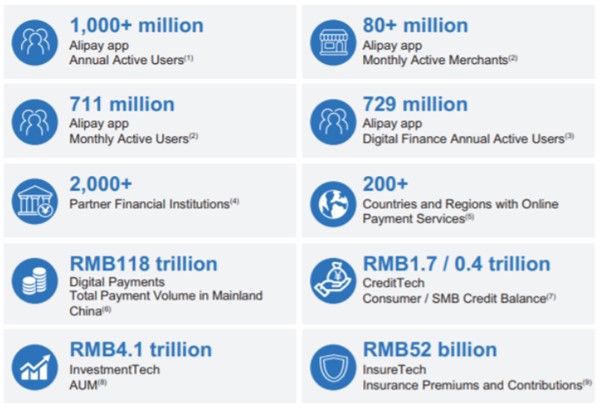

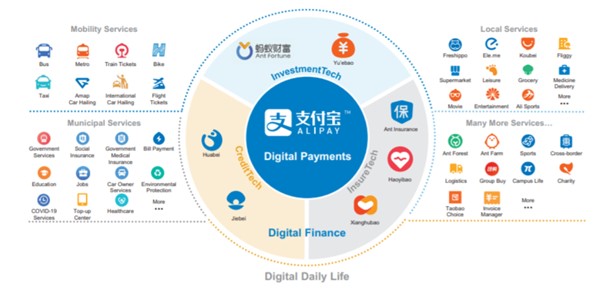

In contrast to the lexicology of the company name, Ant Group is one of the biggest technology and financial services companies in China and the world. As of Q1 2020, the company had 1.3 billion registered users globally and served over 80 million merchants. Alipay, the third-party mobile and online payments platform owned by Ant Group, processed RMB 118 trillion ($17.6 trillion) digital payments during the 12 months ended June 30, 2020, which is roughly over 55% of online payment transactions in China. Alipay enjoys a duopoly position in China together with Tenpay, a payments service incorporated in the popular messaging app WeChat, owned by Tencent Holdings. The two services account for 94% of mobile payments in China.

Despite its size, Ant Group runs on an ever-expanding racecourse. In Q2 2020, mobile payments increased 27% YoY, accounting for 30 billion transactions, or more than half of non-cash payments in China. We expect mobile payment transaction values to continue to grow at mid-teen annual rates by 2025.

Snapshot of Ant Group’s Size and Scale

(Source: Part of ‘application proof’ published by Ant Group to meet the requirements of the Stock Exchange of Hong Kong and the Securities and Futures Commission)

Putting User at the Center of Growth

(Source: Part of ‘application proof’ published by Ant Group to meet the requirements of the Stock Exchange of Hong Kong and the Securities and Futures Commission)

(Source: Part of ‘application proof’ published by Ant Group to meet the requirements of the Stock Exchange of Hong Kong and the Securities and Futures Commission)

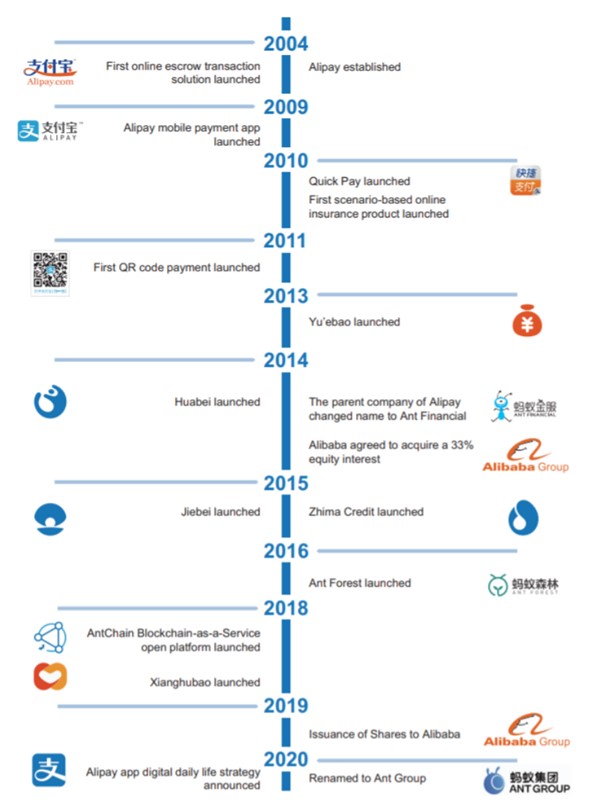

The beginning of what eventually became Ant Group was made in 2004 alongside Alibaba (both founded by Jack Ma), in the nascent days of e-commerce. Alipay was conceived as the payment gateway of Taobao, the B2C e-commerce platform of Alibaba Group. Alipay was to be the crucial cog in solving the trust issue between buyers and sellers in online transactions. As Taobao took off with Chinese consumers embracing e-commerce, backed by rapid urbanization, infrastructure improvement and widening internet adoption, Alipay also caught on the rising momentum of mobile commerce, and became the dominant payment method within Alibaba’s marketplaces and even beyond – other online and offline ecosystems and eventually physical stores.

Alipay’s strength lies with user experience, including a superior payment authorization rate, boosting convenience and reliability. The fact that all the services (more on this below) are embedded in one app means that take-up is hassle-free for even an entry-level user. Alipay charges a merchant fee of about 0.6% on transactions, which is less than the typical 1% charged by debit cards. This lowers costs for consumers and merchants alike.

Alipay as One-stop Shop for Digital Payment and Digital Finance Services

(Source: Part of ‘application proof’ published by Ant Group to meet the requirements of the Stock Exchange of Hong Kong and the Securities and Futures Commission)

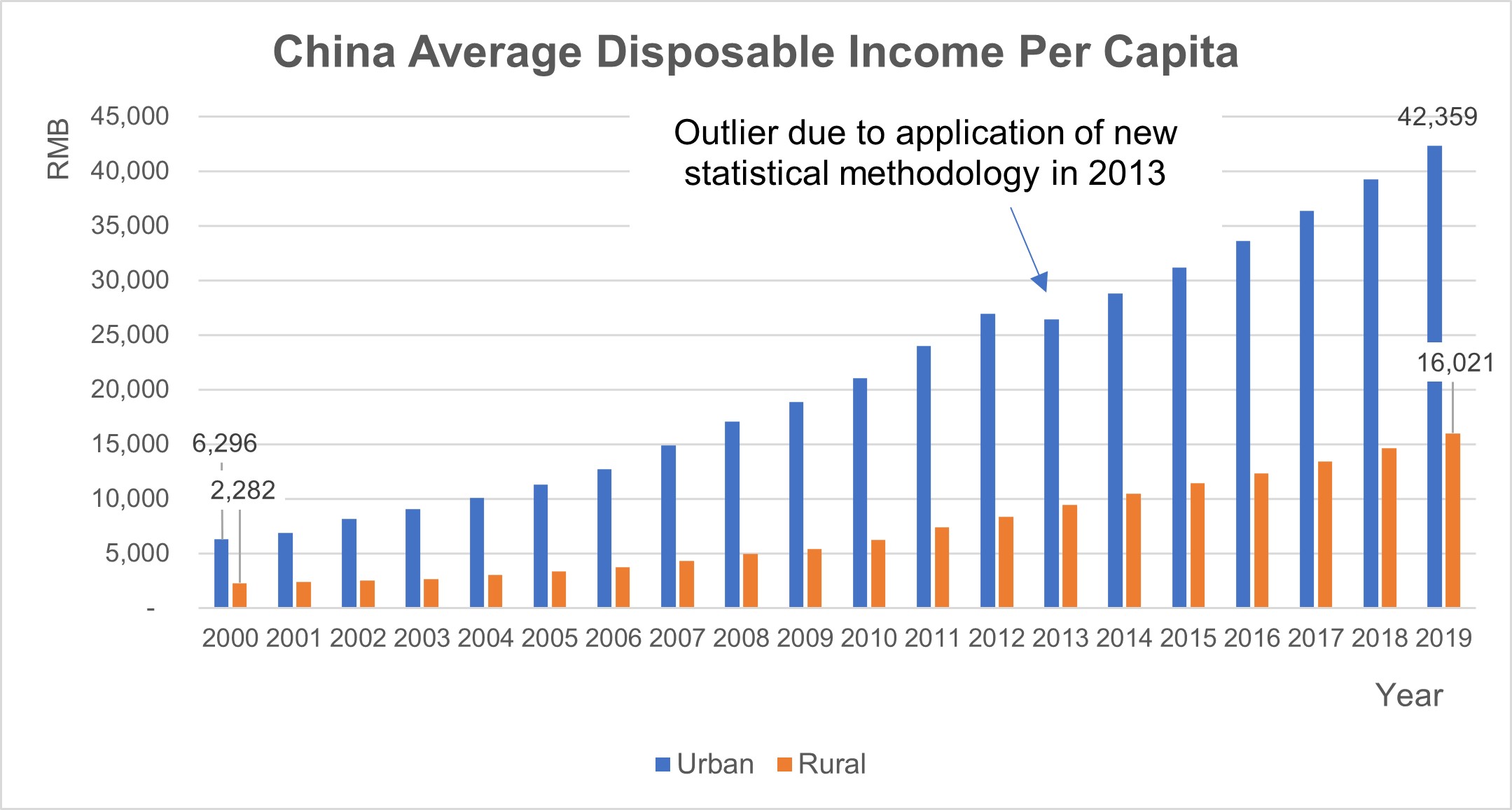

As the Chinese consumer class blossomed (see chart above) and transactions picked up, Alipay’s deposit pool started accumulating cash in big amounts, sufficient enough for the company to think of a way to benefit shoppers when they were not shopping, besides enhancing user stickiness. In 2013, the company launched Yu’ebao, a money market fund that offered superior interest rates than banks. This was the first step to expand beyond just payments and into a full-fledged financial services behemoth – Ant Financial – that provides services like virtual credit card, wealth management, insurance, foreign exchange, securities trading, micro-loans, credit filing and rating, and identity verification. The company is further branching out to emerging technology in areas such as block chain, cloud computing and artificial intelligence.

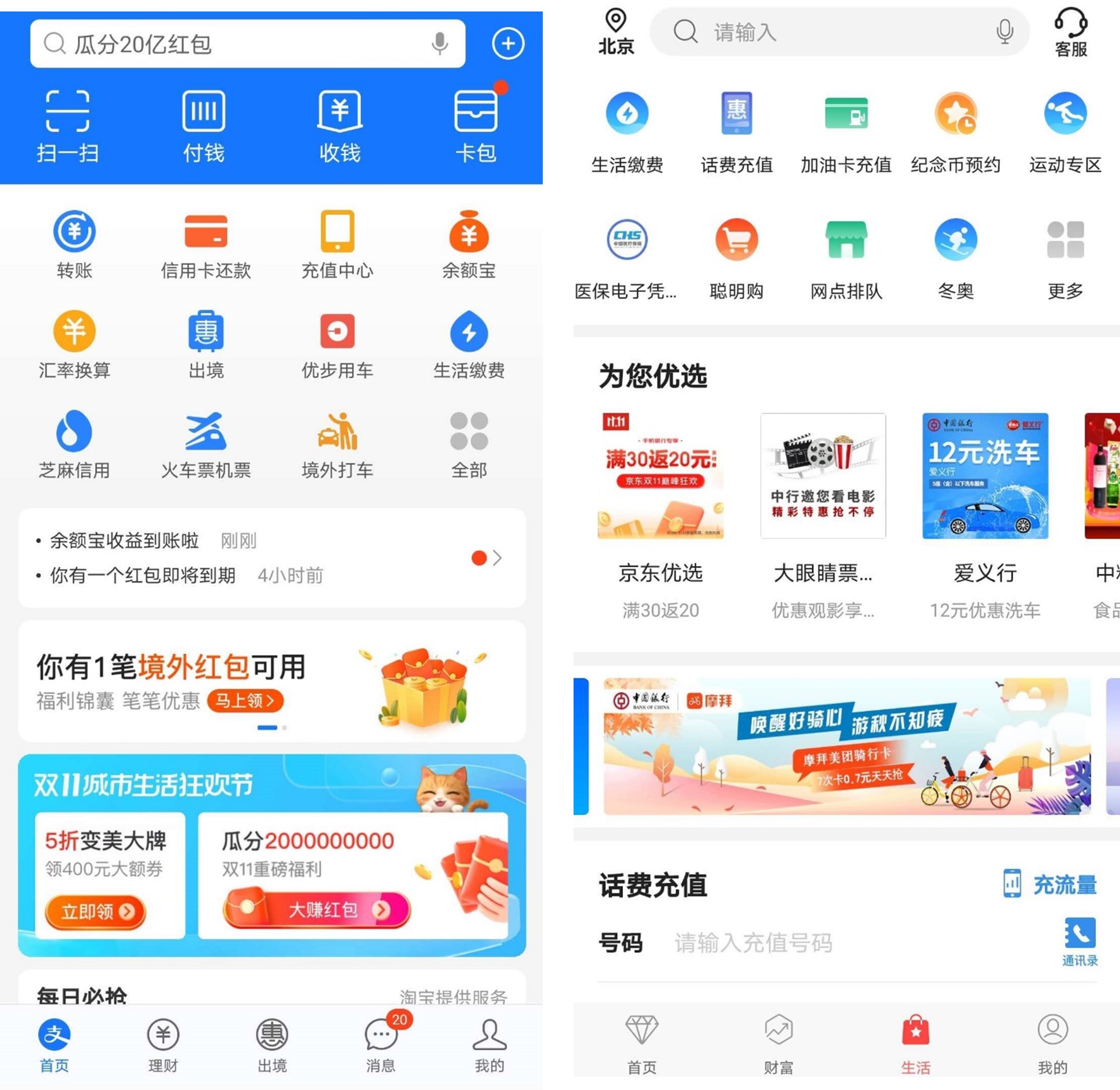

Why was Ant Group capable of such extraordinary growth? The answer lies in the market realities of financial institutions over a decade ago. Back then, visiting a bank in China was hardly an enjoyable experience. It involved heaps of paperwork, long queues, and dubious stares and questioning by the staff for even the simplest tasks. To many, instantaneous access to money via Alipay and Tenpay was a far more superior experience, leading them to consider mobile money platforms, not banks, as the go-to place for financial life. As the market evolved, the duopoly consolidated market power in online payments, while simultaneously bringing competition to the wider Chinese financial industry. They have forced the mainstream state-owned financial institutions to become more like Alipay and Tenpay – platforms that are data-driven, with enormous scale built on network effect and negligible marginal cost of cross-selling, so much so that even the UIs of bank mobile apps are converging on those of mobile money providers (see below).

Convergence of Mobile Money and Bank Apps

(Left – Alipay app’s home tab; Right – Bank of China app’s ‘lifestyle’ tab)

Home Sweet Home

Over the past month, there has been a rumour that the Trump administration is seeking restrictions on Ant Group over concerns that its digital payment platforms threaten US national security. For what the allegations are worth, we do not think they will pose a material risk to Ant Group’s operations, bottom line or the IPO, simply because the company’s focus is on the domestic market and it has a limited international exposure. Ant Group recorded RMB622 billion worth of international transactions in the year ended June 30, 2020, or 0.53% of the total.

We have seen Ant Group venturing modestly abroad in recent years, mainly in the payments arena, and mainly following Alibaba’s global expansion footprint (as of today, Alibaba has a 33% stake in Ant Group). It has launched e-wallets in 10 countries (mostly in Southeast Asia and South Asia), as well as striking partnerships that allow its payments to be accepted in 56 countries.

Ant’s international strategy can be broadly summarized in three areas: consumers purchasing internationally, merchants selling internationally, and international travellers. In our view, these represent ‘bolt-on’ services for Chinese consumers/merchants conducting transactions with a foreign counterpart, rather than a substantial strategic venture abroad. Therefore, these initiatives are unlikely to contribute materially to Ant’s bottom line, especially as international commerce and travel continue to be in the doldrums due to the COVID-19 pandemic.