India’s smartphone shipments in the premium segment (≥₹30,000 or roughly ≥US$493 retail price) grew 66% YoY to reach an all-time record high in Q3 2019. The growth in the segment was driven by new launches, aggressive offers, and channel push, ahead of the crucial festive season. Offers on premium smartphone started well-ahead of the festive season – many in the last week of September. Offers included payment plans (EMI), cashback and exchange offers.

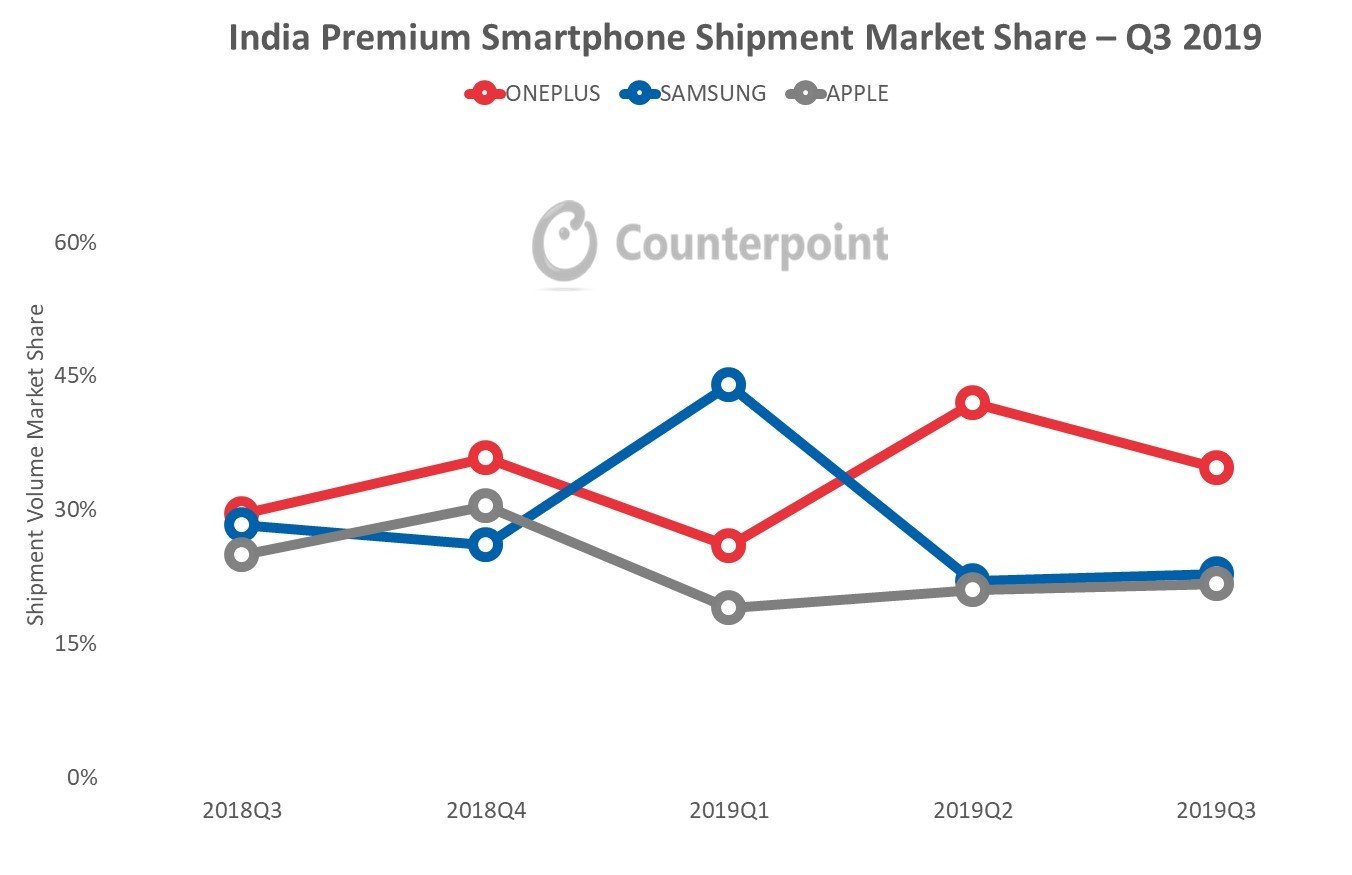

Among the brands, OnePlus (35%) led the premium market segment followed by Samsung (23%) and Apple (22%). OnePlus grew faster (+95%) than the segment (+66%) and remained the fastest-growing brand, driven by strong performances of both the 7 and 7T series. Samsung shipments were helped by the new Galaxy Note 10 series, while the price cut for iPhone XR drove Apple’s shipments. However, the cumulative share of top three brands declined to 79% in Q3 2019 as compared to 83% in Q3 2018, highlighting a growing presence of other brands in the segment, mainly OPPO, Xiaomi, and Asus. More than 20 flagship phone variants launched in Q3 2019, the highest ever in a single quarter.

India is an important market for OnePlus, contributing a quarter of its global shipments.

With the 7T and 7T Pro, OnePlus now has its widest ever portfolio in India. This is helping it target users looking to upgrade at various price tiers within the all-important premium market. Additionally, the aggressive product features and expansion in offline channels, further helped it to attract more users. The OnePlus 7 and OnePlus 7 Pro were the best-selling and third best-selling models during the quarter, respectively. The brand is consistently gaining both mind and market share in India thanks to marketing campaigns focused on connecting with its user community.

Samsung was the second-largest brand in the premium segment during the quarter. Price cuts on older flagships and the launch of the Galaxy Note 10 series, helped Samsung to grow 34% annually. Almost half of the Indian ultra-premium segment (≥₹45,000 or roughly ≥US$636) shipments captured by Samsung were driven by the Galaxy Note 10 series. The initial strong sales uptick of the Note 10 series can be attributed to its multiple variants, giving more choice to the Note series loyalists.

Apple iPhone shipments in the premium segment grew with an impressive 45% YoY. It recorded growth for the last two quarters following a series of quarters with negative growth, since Q4 2017. Apple’s comeback is largely thanks to the iPhone XR which captured half of Apple’s premium shipments in Q3 2019. The price cuts and strong promotions (cash back and EMI) on iPhones helped Apple to perform strongly in the market. The iPhone XR was the second best selling premium smartphone during the quarter. Due to the China-US trade war, Apple is considering India as an alternative manufacturing location and is making efforts to grow through partnerships and investments. This will help Apple in the long run.

To conclude, while India’s premium segment is seeing strong growth the segment is still at a nascent stage, contributing just 5% of the market by volume. This is still low when compared to markets like USA and China, where the premium segment accounts for 50% and 22% respectively. Brands are now increasingly focused on the premium segment to drive both their share and profitability. Additionally, In a price-sensitive market like India, the growth of premium market will depend a lot on how OEMs will strike partnerships to reduce the upfront cost of the devices. EMI have been the preferred method so far.