India’s smartphone shipments in the premium segment (≥₹30,000 or roughly ≥US$420 retail price) grew 29% YoY to reach a record high in 2019. The availability of affordable premium smartphones, aggressive offers like significant price cuts, and user upgrades were the main reasons for the growth.

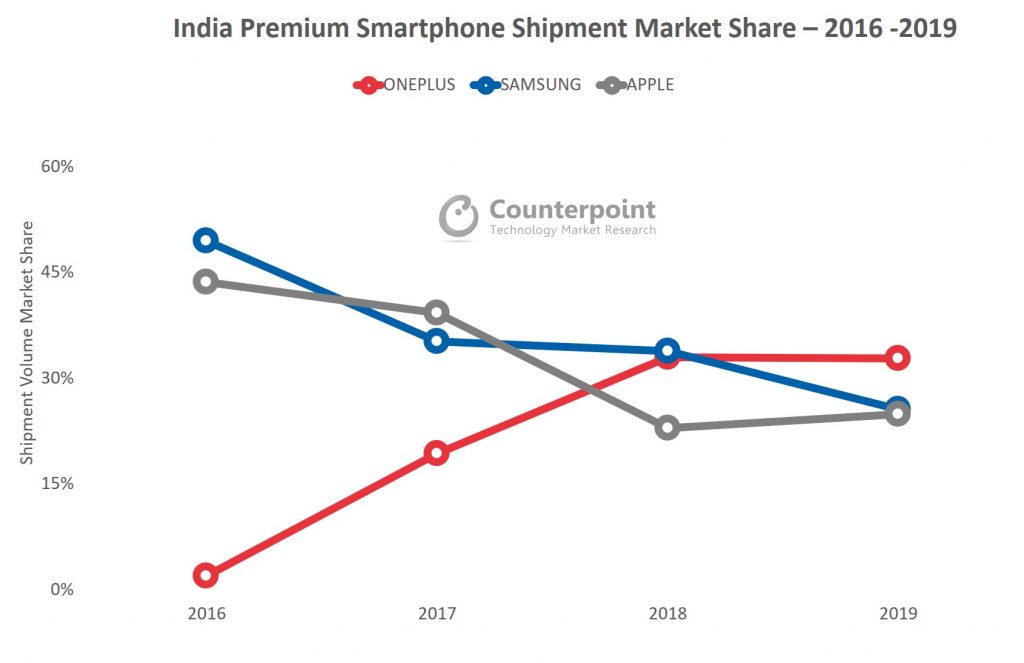

In 2019, OnePlus was the number one premium brand. The first time it managed this for a full year. Its shipments grew 28% YoY and captured one-third of India’s premium segment. Existing users upgrading and the acquisition of new consumers, led by strong word-of-mouth were the main reasons for the growth. OnePlus is continuously listening to users’ feedback and bringing industry-first innovations and features. Customer feedback platforms such as the “OnePlus community” have helped the brand gauge the needs of Indian consumers. Examples of innovations include its adoption of high refresh rate (90Hz), almost bezel-less displays and being first to launch smartphones with Qualcomm’s Snapdragon 855 Series application processor in India.

OnePlus also became the first ever premium smartphone brand to cross two million shipments in a year in 2019. The contribution of OnePlus’s ultra-premium segment (≥₹45,000 or roughly ≥US$634 retail price) to the overall OnePlus portfolio grew to 25% in 2019 driven by the OnePlus 7 Pro.

OnePlus also became the first ever premium smartphone brand to cross two million shipments in a year in 2019. The contribution of OnePlus’s ultra-premium segment (≥₹45,000 or roughly ≥US$634 retail price) to the overall OnePlus portfolio grew to 25% in 2019 driven by the OnePlus 7 Pro.

Samsung dropped to second position and declined 2 percentage points YoY in the premium segment. The Galaxy S10 Plus was the top-selling flagship for Samsung in 2019, despite the availability of cheaper models like Galaxy S10e. As a result, Samsung’s ultra-premium segment shipments grew by 24% YoY and the segment’s contribution to Samsung’s overall premium shipments reached 79% in 2019, compared to 62% in 2018.

The competition from OnePlus and affordable premium offerings from Oppo (Reno Series), Asus (6Z) and Xiaomi (Redmi K20 Pro) took its toll on Samsung. In response, Samsung launched the lite versions of its flagships, Galaxy S10 Lite and Note 10 Lite, for the first time in 2020 to compete in the affordable premium offerings range.

Apple was the fastest growing premium smartphone brand in 2019 with 41% YoY driven by multiple price cuts on iPhone XR throughout the year. Apple iPhone XR was the number one ultra-premium smartphone model in India followed by Samsung’s Galaxy S10 Plus and OnePlus 7 Pro. Additionally, this year Apple saw the fastest rollout of its new iPhones (11 series) in India with aggressive pricing and channel strategy. In fact the new series especially iPhone 11 was introduced at a lower price point than the last year’s iPhone XR launch. This has helped to gain share during the festive season and in its launch quarter in India

We expect the strongest 2020 for Apple in India as it has expanded its production capacity in India and is now manufacturing iPhones on a Completely Knocked Down (CKD) basis. These activities will help the brand to offer competitive pricing in a price-sensitive market like India.

It is becoming challenging to compete in the India premium segment due to the growing number of flagship devices and brands. We are expecting significant growth in the purchase of premium smartphones in 2020 with the Indian market ASP likely to reflect this shift in focus. The growth drivers in 2019, such as price cuts, upgrade plans, EMI offers, etc., are expected to continue in 2020 leading more Indian consumers upgrading to premium devices.