Services to be New Strategic Growth Focus

Lenovo Group has posted a second consecutive record quarter in October-December 2020 in terms of revenue and profit. A part of this growth was driven by the tailwinds generated by the COVID-19 pandemic. Lockdowns brought changes in consumer habits with people working from home and spending more time with their gadgets. Work from home pushed a huge number of enterprises to adopt digitization and cloud, allowing Lenovo to make the most of it with its end-to-end offerings. Some key takeaways from the company’s earnings call:

- With a 22% YoY increase in revenue and a 53% YoY increase in profit, the October-December 2020 quarter gave Lenovo its best performance ever.

- The PC and Smart Devices, and Data Centre units achieved record revenue while the Mobile unit’s revenue also improved.

- The high-margin Software as a Service business also had a record quarter. Lenovo wants to focus on the service segment in future.

PC and Smart Devices Shine

The pandemic has brought fundamental changes in consumer behavior. People have been spending more time in consuming content on their devices, something which has also resurrected segments like tablets. Work from home has increased the demand for devices associated with remote working, besides pushing the demand for one device per person. As a result, the PC and Smart Devices segment’s revenue increased 26.5% YoY, setting a new record.

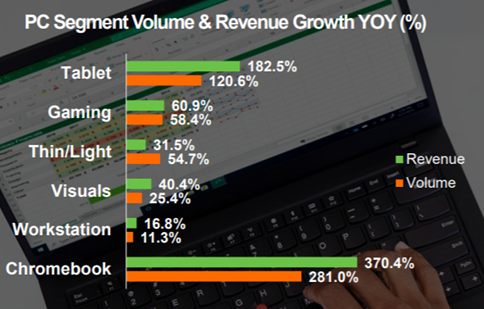

Exhibit 1: Lenovo PC Volume and Revenue Growth

Source: Lenovo IR Presentation

Another key takeaway here is the growth in PC segment volumes in the China market. The volume in China for the Lenovo PCSD segment grew 30% YoY. This is another indication of recovery in China market after the pandemic. We have also seen Apple having very good China results during the quarter.

The performance comes despite the ongoing component shortages across the semiconductor value chain. Lenovo, being the top player in the PC market, has some higher bargaining power with the suppliers, and was able to somewhat manage the shortages well. However, its channel inventory in the US, Europe, China and APAC has been low. The usual channel inventory for Lenovo is around six weeks, but it was around three weeks during the October-December quarter.

The group’s smartphone revenue also increased 10% YoY. During the first half of 2020, Lenovo’s operations were hit by the pandemic as its manufacturing units are located in Wuhan, the initial epicenter of the coronavirus. However, as the supply resumed and pent-up demand across regions converted to sales, the shipments recovered.

Data Centre Unit Posts Record Revenue but Continues to Make Losses

The Data Centre unit also posted record revenue, driven by strong growth across the Cloud Services (Enterprise and Small and Medium Business) segment. COVID-19 has also increased the demand for data centres. With the work-from-home trend, the enterprise is going digital and availing more cloud services. Cloud also is more suitable for small and medium enterprises, as it is more scalable, faster and cheaper to implement than the on-premises solutions. The Enterprise and Small and Medium Business segment delivered the highest revenue in three years. The demand increased across storage, computing and services. The higher-margin product mix also improved profitability in the segment and narrowed loss for Lenovo. The company has been developing and investing in its Data Centre business since the time it acquired IBM x86 Server. Though the segment is still making losses, considering the demand for data centres is set to increase over the next decade, it will eventually turn profitable.

Margins Improve Due to Sale of Higher ASP Devices and Growth in Services

Improvement in margins was another key takeaway from the quarterly results. The group’s growth margin improved 10 basis points YoY and the Expense to Revenue ratio reduced by 0.5 percentage point to 12.1%. This was a result of operational changes, change in demand profile for hardware business, and a rise in the high-margin software as a service play.

In terms of hardware, there was an increased demand for products like gaming graphic cards with larger capacity SSD. This was a result of users consuming more content over their devices and playing more games during the lockdown. This has led to an increase in the average selling prices (ASPs) for the Lenovo hardware business.

The improvement in margins was also a result of an increasing share of the high-margin service segment in Lenovo’s revenue. The software and services segment also posted record revenue for Lenovo, growing 36% YoY and contributing to 8% of the total group revenue.

Restructuring: Services to be New Strategic Growth Focus

Lenovo is restructuring with an increased focus on the service sector. The company is aiming to leverage the end-to-end product offering and power of 5G by developing Business Vertical Solutions.

Exhibit 2: New Organization Structure for Lenovo Group

Source: Lenovo IR Presentation

Effective April 1, 2021, Lenovo will form a new business group – Solutions and Services. The new structure will be as follows:

- IDG: Intelligent Device Group will focus on smart IoT.

- ISG: Infrastructure Solution Group (renamed from Data Centre group) will focus on smart infrastructure.

- SSG: Solutions and Services Group will be responsible for the Smart Vertical and Services. It will integrate all the existing service and solution teams across the company into a single unit.

The services business for Lenovo has grown and it now contributes over 8% of the revenue. It also fetches higher margins and contributes to recurring revenue. The 5G capability brings a large opportunity for a solution-driven strategy. Therefore, it makes strategic sense to create a new vertical for services, which would be an important growth avenue once 5G share starts picking up pace.

The new services group will focus on developing vertical solutions like smart manufacturing, smart education and smart healthcare. Lenovo will have an edge as it can integrate these solutions to run seamlessly on its existing infrastructure, giving the company an advantage against competition during deployment. These deployments will also give a boost to its managed services business in future. Lenovo is a unique player providing a full range of IT infrastructure, from the data centre to the cloud and devices. Developing a service prowess and leveraging the capabilities of 5G by providing end-to-end solutions will future-proof the company’s growth in the next transformational phase.