Beijing, San Diego, Buenos Aires, London, New Delhi, Seoul – June 30, 2021

Exactly 14 years ago, Apple disrupted the smartphone market as the first iPhone went on sale. There has been no looking back for Apple since then. It has emerged into a powerful ecosystem of over a billion users. It is not only the largest smartphone OEM by revenue but has also set up numerous benchmarks in the smartphone industry. The latest iPhone 12 series carries forward this legacy.

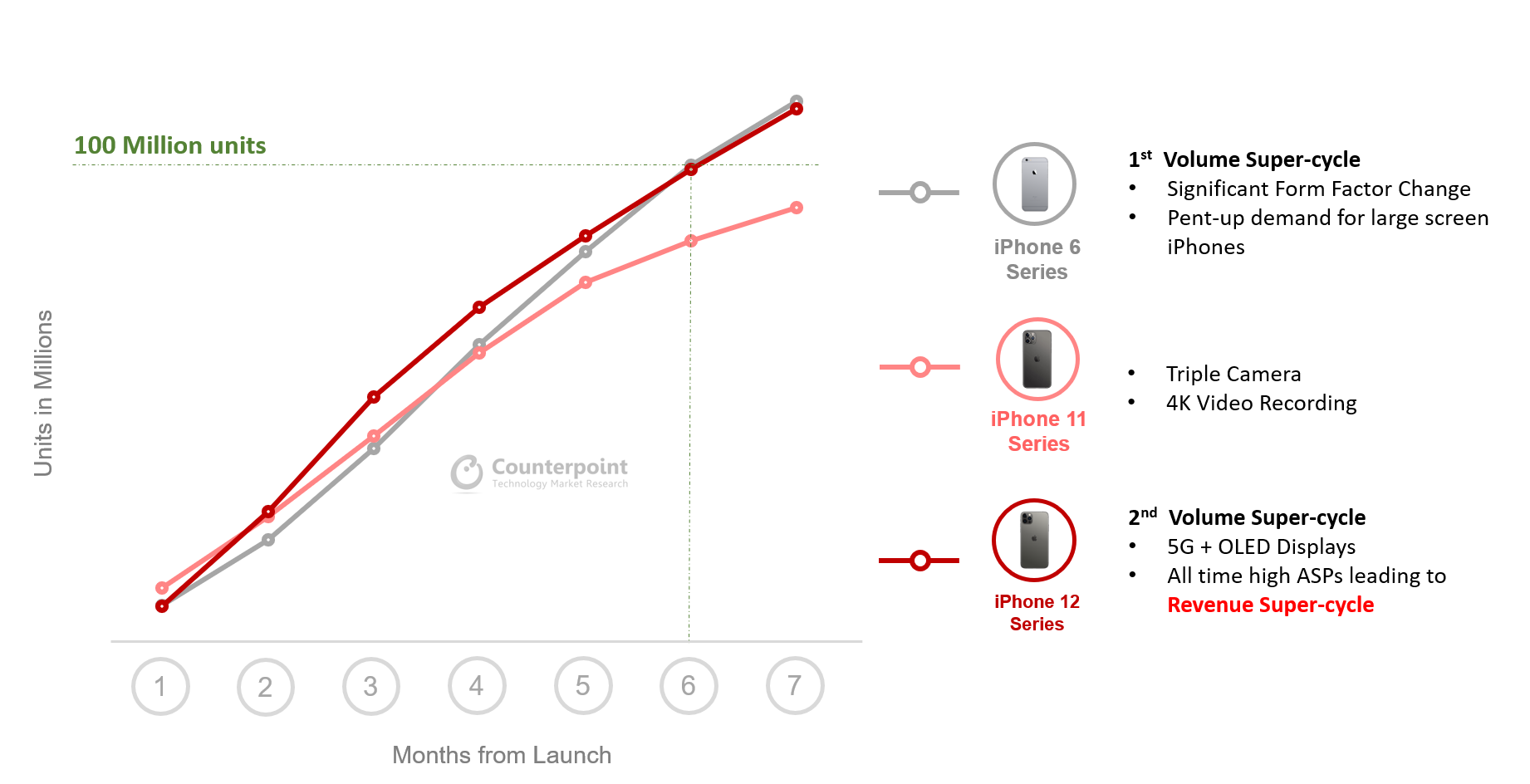

The iPhone 12 series’ cumulative global sales crossed the 100 million units mark in April 2021, according to Counterpoint Research’s mobile handset Market Pulse Service. The series was able to achieve this feat in the seventh month after its launch, which is two months earlier than the iPhone 11 series and almost the same as the iPhone 6 series that helped Apple achieve its first volume super-cycle at the cusp of 4G transition. With the iPhone 12 series, Apple has achieved another volume super-cycle after six generations of iPhones and at the cusp of 5G transition.

In the case of the iPhone 6 series, the strong pent-up demand for larger-screen iPhones drove the sales, while for the iPhone 12 series, the addition of 5G capability and a full OLED screen attracted customers. With the ASP for Apple phones being at an all-time high, the iPhone 12 series’ volume super-cycle will also lead to a revenue super-cycle breaking its own record every year.

Exhibit 1 – iPhone 6, iPhone 11 & iPhone 12 Series Cumulative Sales Comparison by Months from Launch

There has also been a shift in model preferences between the iPhone 11 and iPhone 12 series. Consumers preferred the highest version of the iPhone 12 series during the first seven months after the series’ launch. The share of the Pro Max version in the iPhone 12 series sales was 29%, compared to the 25% for the same model of the iPhone 11 series. This is also one of the reasons for the iPhone 12 series grossing 22% more revenue than the iPhone 11 series in the first seven months of its launch.

The launch price of the base variants of the iPhone 11 Pro Max and the iPhone 12 Pro Max was the same at $1,099. The notable upgrades in the 12 Pro Max were 5G capability, a higher RAM/memory, and the A14 Bionic chip. There was also a trade-off as the charger and headphones were missing from the box. However, this did not seem to be a deal-breaker for consumers, especially in the US, which contributed to 40% of the global iPhone 12 Pro Max sales till April. The upgrades, which came at the same price as that of the iPhone 11 Pro Max, supported by aggressive operator promotions, helped the 12 Pro Max sales soar to make it the highest-selling device in the US consistently since December 2020. Moreover, the iPhone 12 series was also comparatively less affected by the pandemic than the iPhone 11 series. Also, consumers who held on to their devices last year due to the pandemic, upgraded to the 12 series.

Supported by the stellar performance of the iPhone 12 series, Apple achieved a record-high market share for April. It has also consistently achieved a record-high market share in the US since October 2020 and the trend is likely to continue in May 2021.

Background:

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts:

Follow Counterpoint Research

press(at)counterpointresearch.com