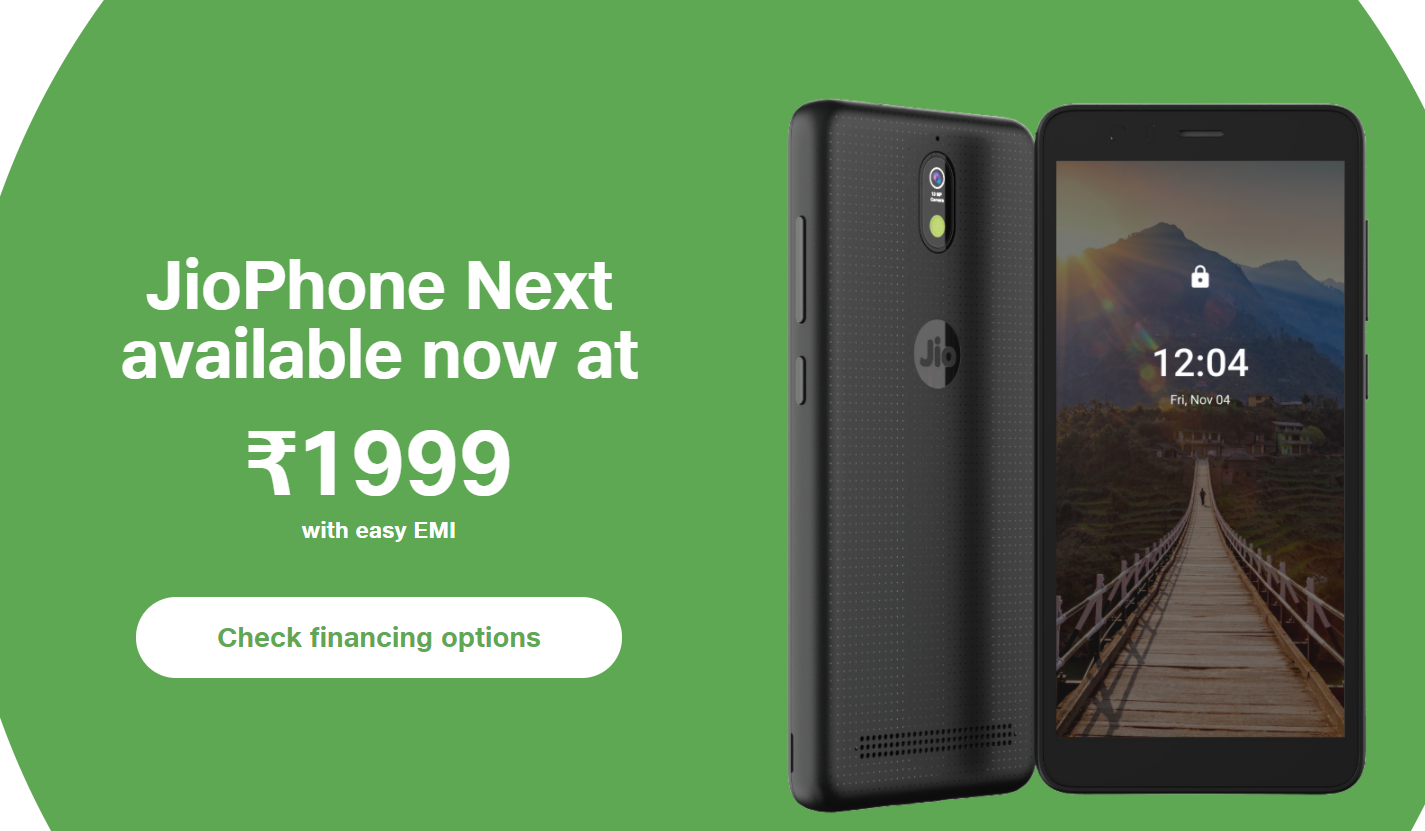

On November 4, Jio launched the JioPhone Next, its much talked about and anticipated smartphone with Google. The device is being marketed as the most affordable smartphone. It comes at a down payment of INR 1,999, with the rest required to be paid via EMIs bundled with various plans.

Exhibit: JioPhone Next

The retail price of the phone is INR 6,499 when paid in full. The device also comes with a customized version of Android Go – Pragati OS.

Jio’s Value Proposition, Target Consumers

- India is still an underpenetrated smartphone market with over 300 million feature phone users, out of which over 60 million are JioPhone users, which represents an immediate opportunity.

- Jio is also aiming to make India 2G free and connect the unconnected. Notably, Jio does not offer 2G services, and upgrading 2G users to 4G can increase its consumer base substantially.

- Then there are existing smartphone users who are willing to upgrade. There are very few players in the entry-level market due to low margins and high distribution costs related to lower-tier cities, where most of the target customers live. However, Jio already has an extensive retail network which it can leverage to distribute the device.

- Jio offers the JioPhone Next device on easy EMIs, and a consumer does not need a debit or credit card to access the same. Almost all OEMs are now offering EMIs but consumers need to have a debit or credit card for the same in most cases.

- In terms of specs, Jio has prioritized certain aspects like camera, one of the most sought after features by consumers.

- The phone also comes with Corning Gorilla Glass covering at a low price point. The repair cost here will be a big burden and Jio understands this.

- Features like Voice First, Read Aloud and Translate Now help increase the ease of use and flatten the learning curve of smartphone usage. The phone also comes with the promise of future updates.

- While the device overall has a feature set, which reduces the barriers to the adoption of smartphones, pricing remains the most important aspect for this segment.

Pricing Analysis

The biggest value proposition for Jio is the down payment of INR 1,999, which makes it the most affordable device. The consumers will also have to pay an INR-501 processing fee, while the remaining amount can be paid through EMIs which are bundled with a service plan. Jio has a device lock software, which restricts access to the device if the EMIs are not paid on time.

Exhibit: JioPhone Next Plans

The low down payment is great for entry-level consumers, who cannot spend a large sum for a device initially but can pay small monthly amounts. However, notwithstanding the low down payment, the total cost of ownership for the JioPhone Next is very high.

The entry-level Always-on plan for Jio starts at INR 300 per month for 24 months and offers 5GB of data per month with 100 minutes of calling. Considering the data usage in India is over 14GB per month per user (Source: Ericsson Mobility Report, 2021), the 5GB per month mark is too low.

The next plan is the Large plan. It offers 1.5GB of data per day with unlimited voice calls at INR 450 per month for 24 months. When the device is bought at full price (INR 6,499), with a comparable prepaid plan of INR 199 for 28 days offering the same benefits as the Large plan of the JioPhone Next, the total cost of ownership for 24 months is reduced by 13%. The cost can be brought down further if a consumer chooses to use a refurbished device or a lower-cost device.

Also, if we subtract the data plan cost in the prepaid plan (INR 199) from the total cost of ownership of the JioPhone Next for 24 months with the Large plan, the device cost comes out to INR 7,681, compared to INR 6,499 when paying the full price. This is the same as charging interest on the EMIs for the device, which might not be a feasible value proposition in the segment Jio is targeting.

Conclusion

Jio has tried to launch a device with key features done right, which makes the transition from feature phone to smartphone easier. Overall, the JioPhone Next checks a lot of boxes except the most important one for this segment – pricing. Therefore, the overall value proposition falls short of being lucrative.

There were a lot of expectations from Jio for a lower-priced device, especially after how it disrupted the feature phone market with the JioPhone. The JioPhone Next definitely brings down the initial cost of device ownership and somewhat lowers the barriers of entry into the smartphone segment. But it also locks the users for 18 to 24 months in EMIs at a cost which is less lucrative than other available options. Unlike the JioPhone, the JioPhone Next fails to create its own market segment.

One of the reasons for more than expected pricing for the JioPhone Next is the ongoing component shortages, which are leading to price increases. OEMs that run on lower margins have no option but to pass on this added cost to consumers. Then there are other costs which have also increased, like transportation.

Jio is trying to address the difficult-to-capture lower-tier market at a scale that has not been seen before. In the process, it is building products, supply chain and mind share in the lower-tier segments. Therefore, consumers will think of Jio first when deciding to transition from feature phones to smartphones.

For a more detailed analysis on pricing, specs comparison with competitors and forecast for the JioPhone Next, subscribing clients can refer to the following report:

JioPhone Next Component Shortages Weigh Down on Pricing Strategy