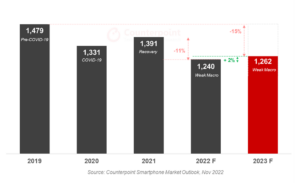

- Smartphone shipments for 2022 lowered to 1.24 billion units on economic headwinds from the previous forecast

- 2022 replacement cycle stretched to record levels

- H1 2023 will be weaker than expected, but the outlook for a rebound in H2 still stands

Los Angeles, Denver, Buenos Aires, Toronto, Montreal, London, New Delhi, Hong Kong, Beijing, Seoul – Dec 1, 2022

The global smartphone market will see 2% YoY growth in 2023, according to Counterpoint’s Market Outlook Service. The latest forecast has been revised downwards from the previous forecast of 6% YoY growth in 2023, as macroeconomic headwinds and consumer weakness continue to pressure the smartphone sector. It is expected to continue underperforming through H1 2023 and only start to grow from Q3 2023.

Global Smartphone Shipment Forecast 2022 / 2023 (million units)

Peter Richardson, Vice President at Counterpoint Research, said, “Persistent inflation, expectations of future interest rate hikes, souring corporate earnings, China’s stalled economy, the protracted Ukraine-Russia war, political turmoil in Europe, and a sweeping new set of export controls on China from the US, all contributes to the downward adjustment of the smartphone market forecast. OEMs focusing on the premium segment, which is more resilient than the low to mid-end, are better positioned to deal with these issues, with deep technological expertise and diversified businesses capable of weathering the storm.”

Liz Lee, Associate Director added, “Given an increase in ASP and a consequent long replacement cycle, we expect the annual smartphone shipments are unlikely to come back to pre-COVID levels for the short-term. This year’s replacement cycle is estimated to reach 43 months, its highest level ever. Although the replacement cycle gets shortened sequentially from next year, it will stay above 40 months.”

From 2024, the global market for 5G devices is expected to show healthy growth as efforts to spread low and mid-priced 5G devices continue. Operators are actively promoting 5G, and the incentives are sufficient in many markets to cause consumers to switch to the new technology. The new form factors, such as foldables, will also drive the growth of premium smartphones. With more OEMs entering the foldable segment, the market will see the prices of these phones stabilizing and the foldable segment growing to become more prominent along with the 5G segment.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Liz Lee

Follow Counterpoint Research

DISCLAIMER:

Counterpoint Technology Market Research All Rights Reserved. Reproduction of this publication in any form without prior written permission is forbidden. The information contained herein has been obtained from sources believed to be reliable. However, we disclaim all warranties as to the accuracy, completeness of this report. Counterpoint shall have no liability for errors, omissions or inadequacies in the information contained and any direct/indirect damages. All opinions and estimates herein are subject to change without notice.

Related Posts

* Key Southeast Asia countries include Indonesia Thailand Philippines and Vietnam