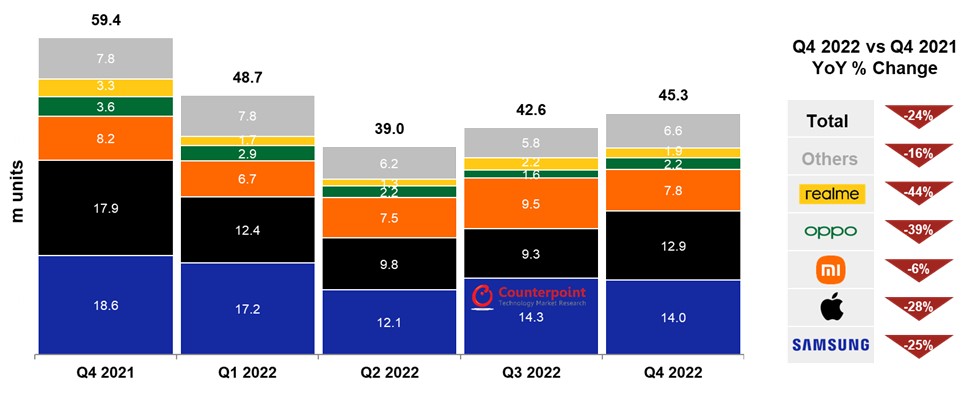

- The Europe smartphone market declined by 24% YoY to 45 million units in Q4 2022; the lowest fourth quarter total since Q4 2011.

- Annual shipments reached 176 million units in 2022, a 17% decline versus 2021 and the lowest annual total since 2012.

- Samsung maintained leadership despite a 25% YoY shipment decrease, and despite a sequential drop in Q4 2022 versus Q3 2022

- Apple regained second position from Xiaomi, even though the iPhone 14 was its weakest major European launch since the iPhone 5 in 2012

- Xiaomi’s YoY decline was the lowest of the top OEMs as it largely recovered from a challenging 2021

- OPPO and realme swapped places again as realme managed its inventory in Eastern Europe following a big boost in Q3 while OPPO regained ground lost earlier in the year

London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – February 22, 2023

The European smartphone market continued to suffer from a dire economic climate and ongoing geopolitical uncertainty with shipments declining by 24% year-on-year in Q4 2022, according to the latest research from Counterpoint Research’s Market Monitor service. This made Q4 2022 Europe’s worst fourth quarter since Q4 2011, and 2022 the worst year since 2012. However, Apple’s iPhone 14 launch, despite being its weakest major launch in Europe for a decade, and wider seasonal promotional activity helped shipments to grow by 6% compared to Q3 2022.

Q4 2022 European Smartphone Shipments and Growth

Note: OPPO includes OnePlus

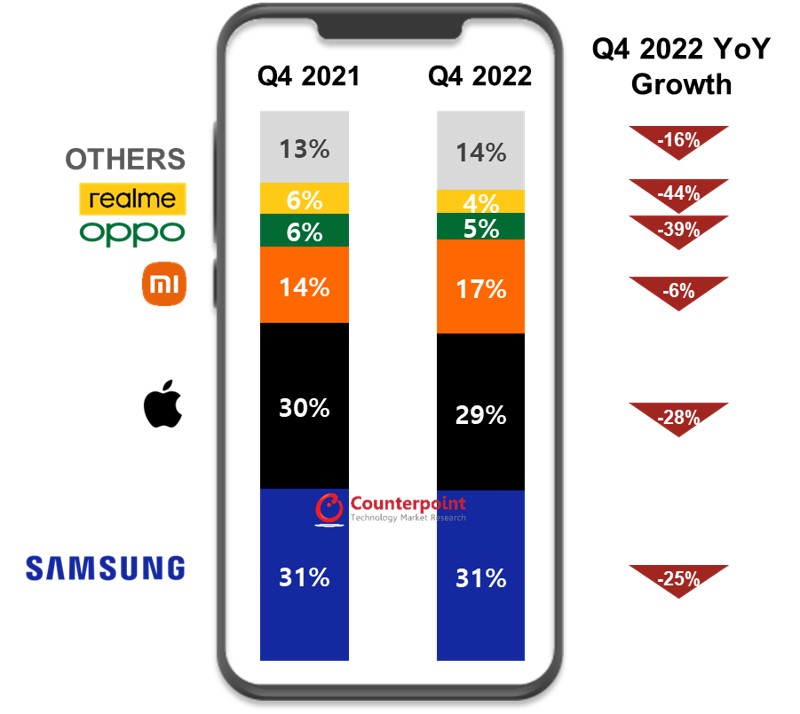

Counterpoint Research’s Associate Director, Jan Stryjak said, “there was no let up for European consumers in Q4 as the cost of living remained at record levels. Yes, the traditional Christmas boost meant quarterly shipments increased compared to Q3, but consumer demand remained muted. Apple’s usual strong end to the year was weaker than expected, allowing Samsung to maintain its leadership of the European market. There was relatively good news for some OEMs though. Xiaomi’s YoY decline of ‘only’ 6% indicated a recovery from its troubles in 2021, while OPPO regained ground as realme looked to manage inventory in Eastern Europe.”

Q4 2022 European Smartphone Shipments Share

Note: OPPO includes OnePlus

Commenting on the outlook for 2023, Stryjak added “the challenging macro climate and ongoing geopolitical tensions will continue into 2023 and potentially get worse initially as the cost-of-living crisis deepens through Winter. Some countries are likely to fall into recession, so with weakened consumer demand and high inventory levels for some OEMs, the first half of 2023 will be tough. However, inflation has stabilised and wholesale energy prices have dropped, leading to hopes of interest rate and energy bill cuts later in the year. This should boost consumer confidence and spur demand, leading to a better second half of the year.”

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Jan Stryjak

Peter Richardson

Follow us on LinkedIn and Twitter

Related Posts