- Global smartphone CIS shipments in H1 2023 fell 14% YoY to 2 billion units on weak demand, inventory adjustment and reduction in the number of cameras per smartphone.

- The average number of cameras per smartphone fell further to 3.8 units in H1 2023 from 3.9 units in H2 2022.

- Sony was the only supplier to see YoY growth, which was driven by the iPhone 14 series’ strong performance.

- We expect the market to see a sequential recovery in H2, but the recovery will be quite mild given the ongoing macro headwinds.

- Global smartphone CIS shipments are expected to drop 10% YoY to 4.2 billion units in 2023.

Global smartphone CMOS image sensor (CIS) shipments in H1 2023 fell 14% YoY to 2 billion units due to weakened market demand, further reduction in the number of cameras per smartphone and channel inventory adjustment, according to the latest Counterpoint Smartphone Camera Tracker.

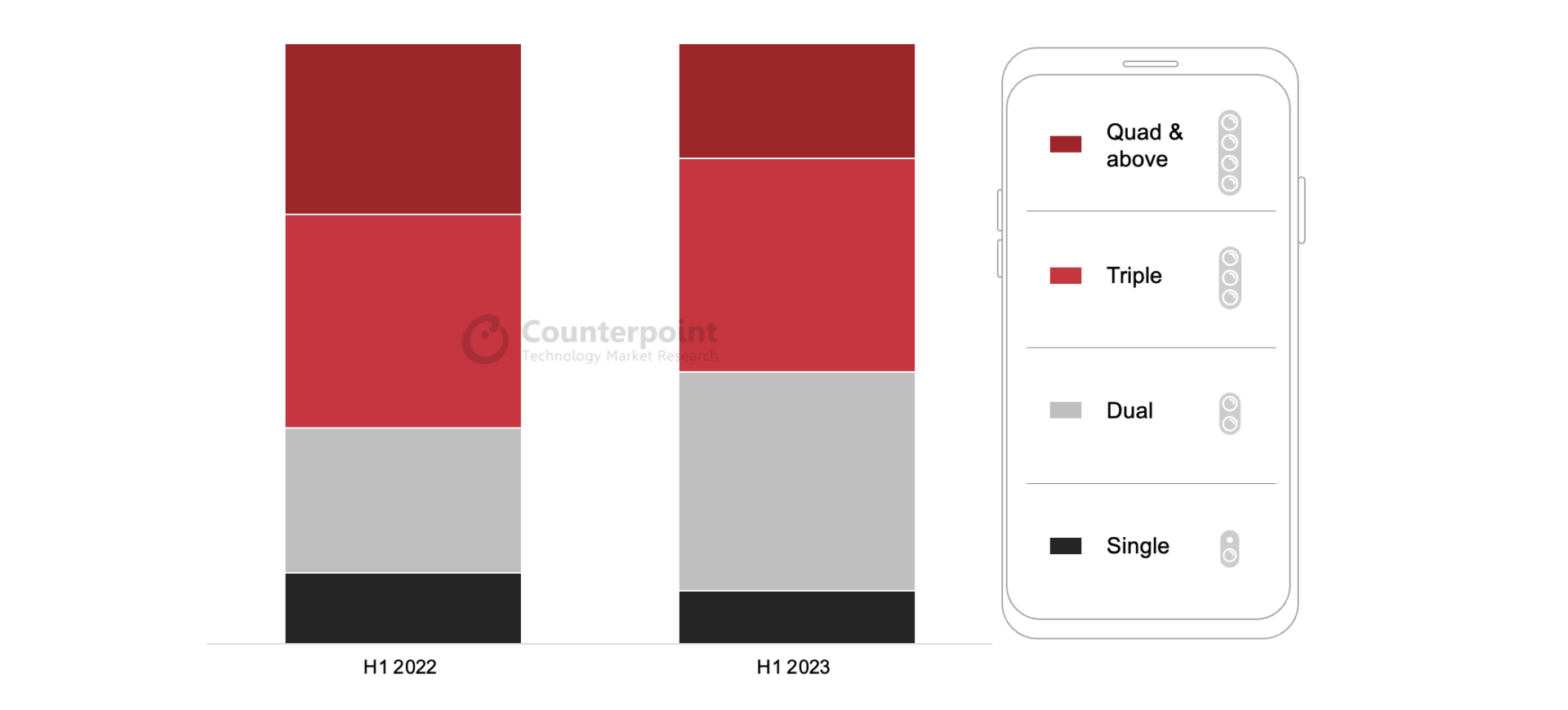

Commenting on the end market, Research Analyst Alicia Gong said, “The challenging macroeconomic environment, including persistent inflationary pressure, took a toll on consumer sentiment, resulting in lower-than-expected smartphone shipment volume. During H1 2023, the average number of cameras per smartphone also fell further to 3.8 units from 3.9 units in H2 2022. For rear cameras, the share of smartphones featuring dual- and triple-camera setups has been increasing at the expense of the quad and above setup. Android OEMs, especially Chinese, have been actively reducing the number of cameras to save cost or space. Meanwhile, the fusion of camera, processing units and algorithm is at the core of improvement in the overall camera performance and image quality.”

Dual- and Triple-Rear Camera Setups Volume Share Continues to Rise

Note: CIS counts include ToF sensors

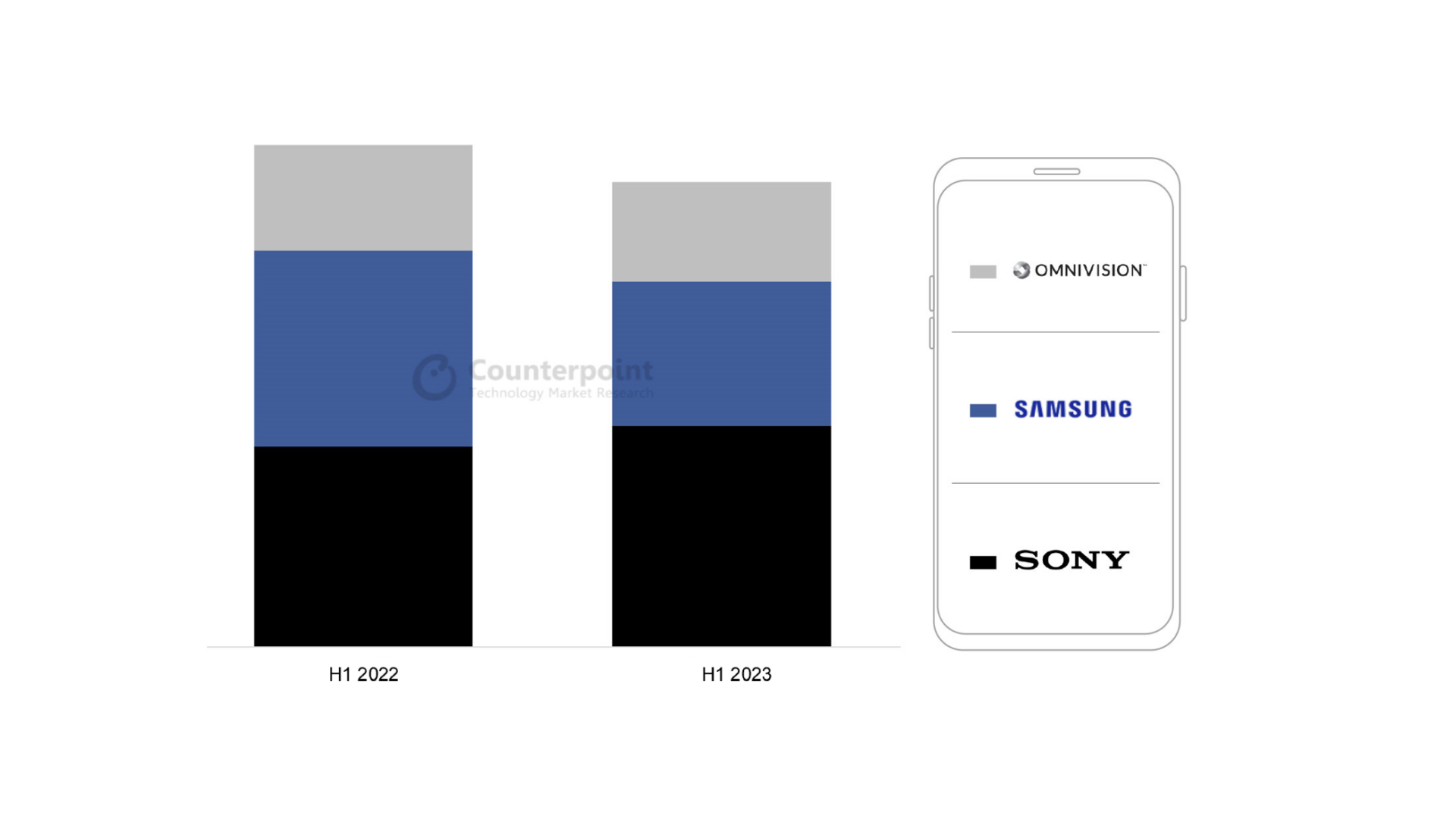

Looking from the supplier perspective, Associate Director Ethan Qi said, “In H1 2023, Sony was the only supplier to see YoY growth in CIS shipments, thanks to the strong performance of Apple’s iPhones, which remained resilient during the market downturn. Samsung and OmniVision experienced YoY declines in varying degrees due to weakened sales and channel inventory adjustment in the Android space.”

Sony Only Supplier to See Volume Growth in H1 2023

Note: CIS counts include ToF sensors

Though the end market remains weak, we expect smartphone OEMs to start restocking from Q3 to prepare for new model launches and alleviated inventory levels. However, due to the macro headwinds, the recovery will be quite mild compared to H1. Global smartphone CIS shipments are expected to drop 10% YoY in 2023 to 4.2 billion units.