- South Africa’s smartphone market growth supported by accelerated feature phone-to-smartphone migration.

- Samsung led the market but its share declined as HONOR, Huawei and TECNO gained.

- HONOR was the fastest-growing brand and captured the second position for the first time in Q3 2023.

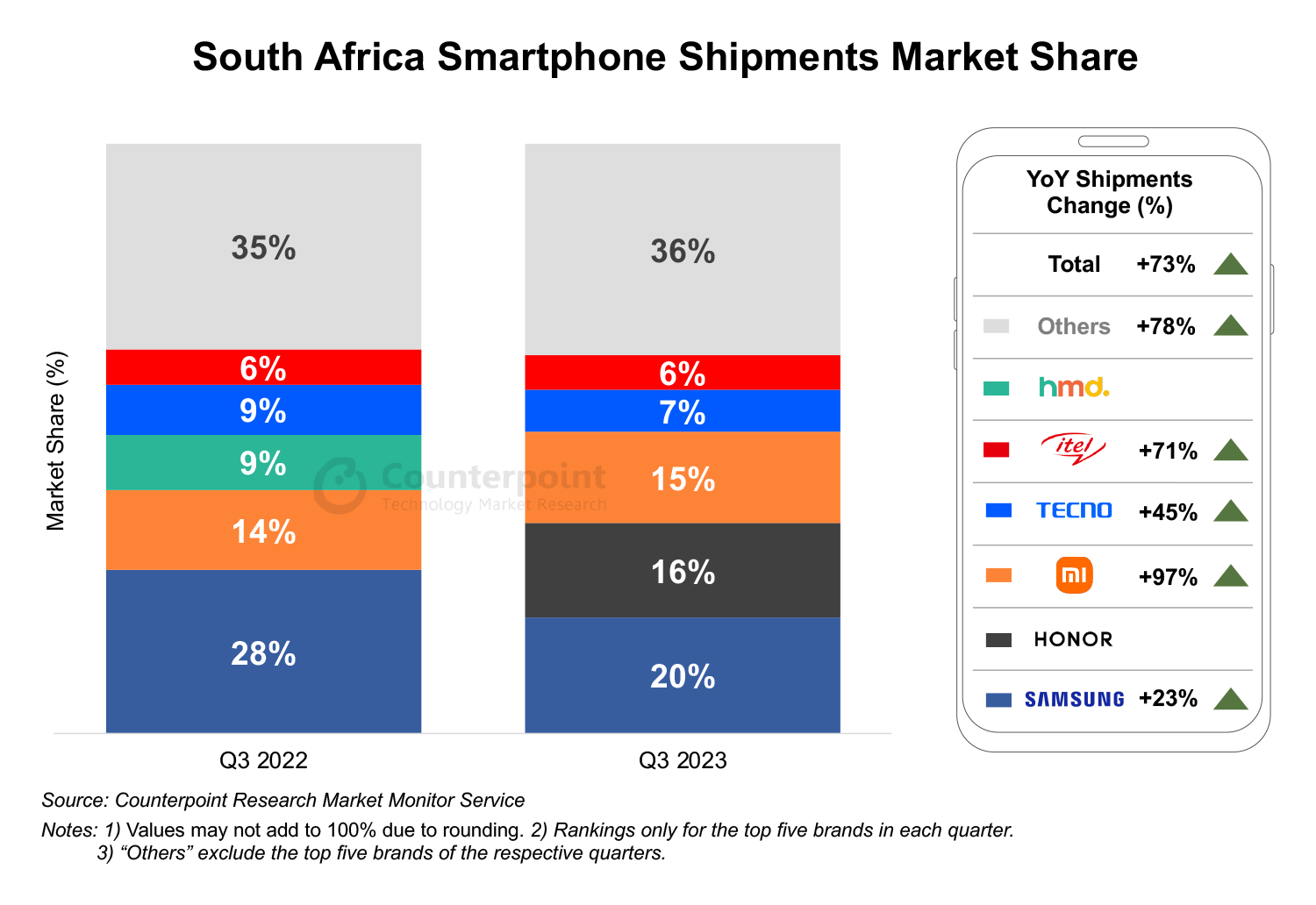

Smartphone shipments in South Africa grew 73% YoY and 44% QoQ in Q3 2023, according to the latest research from Counterpoint Research’s Market Monitor Service. The market reached its highest levels since 2021, just before the macroeconomics-related global slowdown started. In Q3 2023, the market was also helped by the increased feature phone-to-smartphone migration as Chinese OEMs tapped into the entry price bands.

Commenting on the market performance, Senior Research Analyst Yang Wang said, “South Africa is among the fastest-growing smartphone markets in the MEA region, and major Chinese players are increasing their focus on this market. South Africa’s market is growing rapidly and has breached its 2021 levels before the macroeconomic crisis put a dent in the global economy. As the nation’s economic situation is recovering, Chinese OEMs are aggressively trying to capture demand. The entry of HONOR has further tightened competition in the market as it poses a strong competitor against Xiaomi and Samsung in the low- and mid-tier segment.”

Most of the major smartphone brands recorded a double-digit YoY percentage growth during the quarter and are rushing to fill the market with newer offerings to capitalize on the recovery in demand. Major Chinese players are getting aggressive and are launching multiple products in the lower price tier to further accelerate the migration from feature phones to smartphones.

Samsung led the market during the quarter, despite stiff competition from the aggressive Chinese players. It was the leading brand across all the price segments and the A-series devices continued to drive volumes. Samsung’s foldable devices are among the leading models in the premium segment.

HONOR surpassed Xiaomi to become the second-biggest smartphone brand during the quarter due to aggressive marketing activities, and improved device availability across channels. HONOR focused on low- and mid-priced smartphones and provided stiff competition to Chinese players Xiaomi and TECNO. During the quarter, HONOR also entered the premium segment with the launch of the HONOR 90 5G and 90 Lite 5G. The brand offered a free HONOR Watch 4 with the 90 5G model and HONOR Choice Earbuds X5 with the 90 Lite 5G.

Xiaomi narrowly lost its second spot to HONOR, despite its share increasing YoY during the quarter. It is focusing on increasing its channel reach. Xiaomi’s Redmi 10 and Note 11 series were the volume driver. Xiaomi is among the leading players in the low-tier price segment (< $100) due to the popularity of its Redmi 10A, 10C, and A1 series.

Transsion Group is another major player in the market, benefitting from strong demand for the TECNO and itel brands. Meanwhile, Infinix has not been able to make a presence in the market. TECNO is focusing on the low- to mid-end market while itel is focusing on the lower-end market and is the leader in its segment. TECNO’s Pova and Pop, and itel’s A series were the volume drivers. TECNO is among the leading players in the sub-$200 price range, while itel leads the <$100 segment.

South Africa is still facing an energy crisis, but we note that major macro indicators are stabilizing due to the easing of inflation and unemployment rates. Chinese players are starting to notice MEA markets in general, and South Africa will be seen as a particularly attractive market due to the higher income levels and better connectivity infrastructure. South Africa’s market is expected to grow further in the high-end segment driven by the increasing premiumization trend, and Samsung and Apple are likely to benefit the most.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com