- The smartphone industry is set for a revolutionary change with the introduction of Generative AI-based devices.

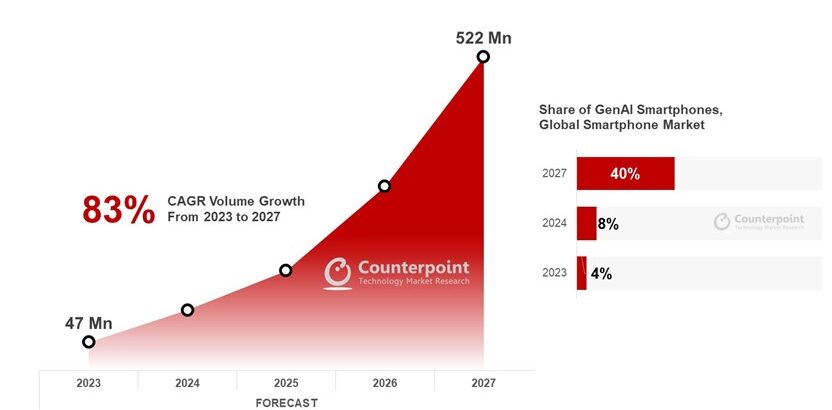

- The share of GenAI smartphones will be 4% of the market in 2023 and is likely to double next year.

- By 2027, we expect the GenAI smartphone share to reach 40% and surpass half a billion in shipments.

- Samsung will capture half of this market next year followed by key Chinese OEMs like Xiaomi, vivo, HONOR and OPPO.

- Qualcomm and Samsung are immediate leaders as current product offerings and capabilities position them as first movers.

- Qualcomm is likely to capture over 80% of the GenAI smartphone market for the next two years. MediaTek is likely to catch up with its Dimensity 9300-based devices.

Seoul, Beijing, Boston, Hong Kong, London, New Delhi, Taipei, Tokyo – December 20, 2023

The coming year will be pivotal for Generative AI (GenAI) smartphones with preliminary data projecting their shipments to reach over 100 million units in 2024, according to an upcoming report, “GenAI Smartphone Shipments and Insights”, from Counterpoint Research’s Smartphone 360 Service. By 2027, we expect GenAI smartphone shipments to reach 522 million units, growing at a CAGR of 83%.

Counterpoint Research defines GenAI smartphones as a subset of AI smartphones that uses Generative AI to create original content, rather than just providing pre-programmed responses or performing predefined tasks. These devices will run size-optimized AI models natively and come with certain hardware specifications. Our short-term GenAI landscape sees OEM roadmaps touching on four main areas – info provisioning, image building, live translation, and personal assistant applications.

Samsung and Qualcomm are immediate leaders as current product offerings and capabilities position them as first movers.

Similar to what it did with foldables, Samsung is likely to capture almost 50% share for the next two years, followed by key Chinese OEMs like Xiaomi, vivo, HONOR and OPPO. Samsung earlier highlighted the use case of its Galaxy AI on smartphones. This is one example of how OEMs are geared to differentiate their upcoming smartphones and GenAI will play a key role in that differentiation.

Qualcomm is likely to capture over 80% of the GenAI smartphone market for the next two years. MediaTek is likely to catch up with its Dimensity 9300-based devices.

Research Director Tarun Pathak said, “The share of GenAI smartphones in the overall smartphone market will be in single digits through next year. But those numbers will not accurately reflect the amount of excitement and marketing hyperbole we are expecting to see.”

Pathak added, “We are working to a standard definition developed with our clients and partners, reflecting inputs from across these key players. Next year is about learning and we expect GenAI smartphones to hit an inflection point in 2026 as the devices permeate through the broader price segments.”

Global GenAI Smartphone Share and Forecast, 2023-2027

Source: Counterpoint Research Smartphone 360 Service, GenAI Smartphone Shipments and Insights Report

VP & Research Director Peter Richardson said, “AI has been a feature of smartphones for the last few years. We now expect to see the emergence of smartphones optimized to run GenAI models in addition to the normal use of AI in smartphones. The likely use cases will include creating more personalized content, smarter digital assistants with unique personalities and conversation styles, content recommendations, and more. However, this will also require addressing issues like running into memory constraints and will likely lead to a hybrid approach in some cases. Nonetheless, one thing is for certain – we are entering an era where smartphone users no longer need to align to their devices; it will be the other way around with GenAI smartphones.”

Our analyst interviews

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

Recommended Reads: