- Global cellular IoT connections grew 29% YoY to reach 2.7 billion in 2022 with 4G continuing to grow its majority share.

- China held more than two-thirds of total cellular IoT connections in 2022, followed by Europe and North America.

- NB-IoT dominates in China, while LTE-M is preferred in Australia, Japan and North America; Europe supports both.

- 4G and NB-IoT are the most preferred technologies for cellular IoT applications.

- 5G is nascent as module prices and breadth of applications reflect early-stage dynamics.

- IoT growth drivers are shifting, with the enterprise and transformation initiatives key in propelling IoT connections forward.

San Diego, Buenos Aires, London, New Delhi, Hong Kong, Beijing, Seoul – June 12, 2023

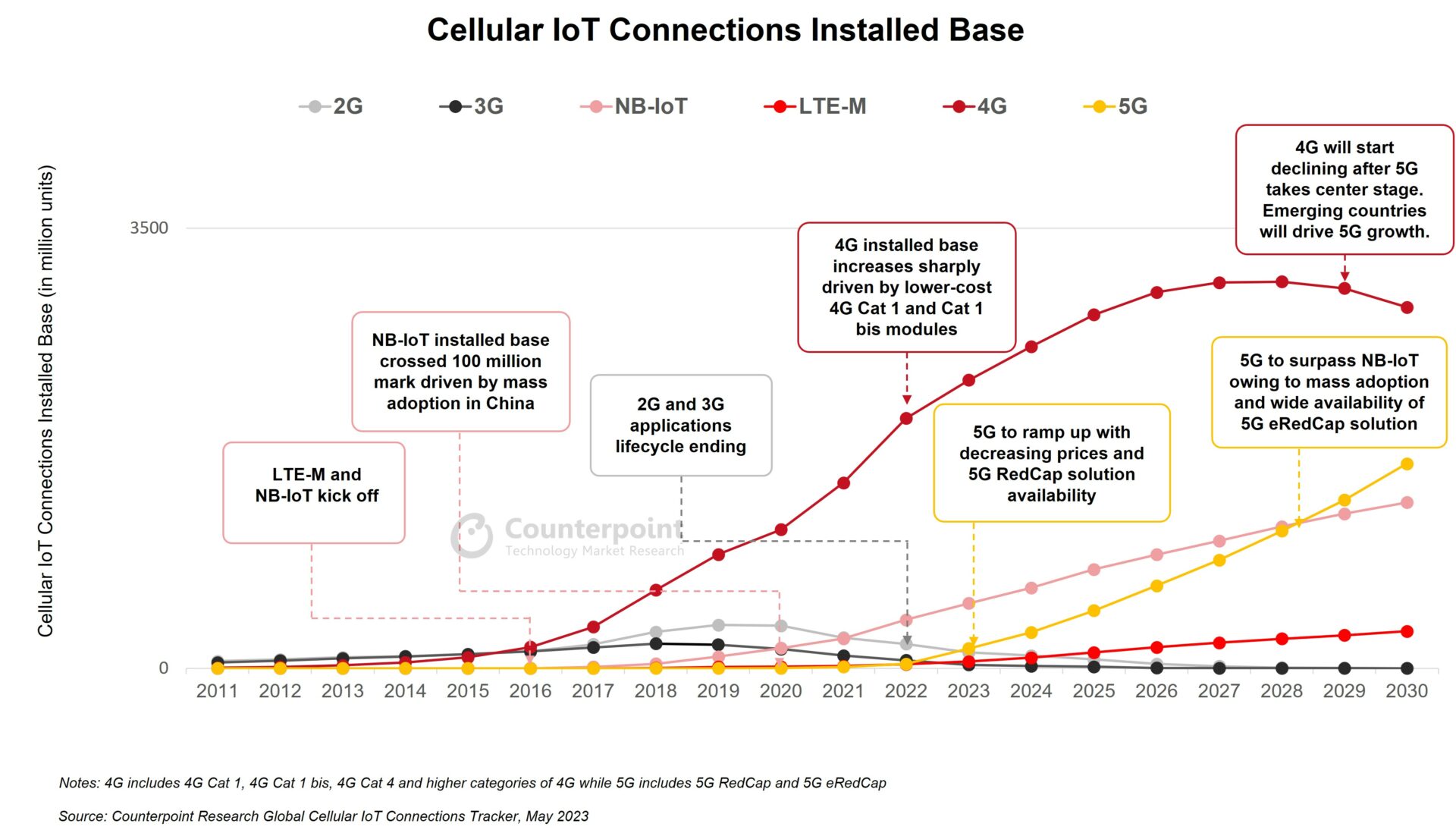

Global cellular IoT connections grew strongly at 29% YoY to reach 2.7 billion in 2022, according to Counterpoint’s latest Global Cellular IoT Connections Tracker report. They are expected to grow at a CAGR of 10.8% to reach an installed base of over 6 billion by 2030. China held more than two-thirds of total cellular IoT connections in 2022, followed by Europe and North America.

Amid the challenges faced by various industries, such as inflation, macroeconomic headwinds and supply chain constraints, the cellular IoT market has experienced remarkable growth fuelled by the digital transformation initiatives undertaken by various industry applications like smart meters, automobiles and asset tracking in particular. Cellular IoT connectivity has played a significant role in enhancing productivity, streamlining operations, minimizing downtime, automating processes and generating cost savings for industries. The COVID-19 outbreak unexpectedly proved beneficial for enterprise IoT players, accelerating their digital transformation efforts.

Commenting on the cellular IoT connectivity technology dynamics, Senior Research Analyst Soumen Mandal said, “At the end of 2022, 4G and NB-IoT together accounted for nearly 90% of the installed base of cellular IoT connections. 4G emerged as the most preferred technology for cellular IoT connections after surpassing 2G and 3G-based IoT connections in 2016. NB-IoT has gained significant popularity in China, while Japan, Australia and North America prefer LTE-M technology for lower-end applications. Europe has adopted a combination of NB-IoT and LTE-M, supported by roaming services offered by most operators.

In recent times, 4G Cat 1 bis technology has gained significant popularity over NB-IoT due to its superior performance. Applications such as POS, telematics and smart meters are increasingly adopting this technology on a larger scale. The rising shipments of devices based on 4G Cat 1 and 4G Cat 1 bis technologies are contributing to the stagnant market growth of NB-IoT.

5G is still nascent but we expect 5G-based applications to pick up as the module ASP (average selling price) drops to sub-$100 and more 5G RedCap-based solutions become available in the market. The introduction of 5G RedCap and 5G eRedCap will play a crucial role in driving mass adoption of 5G, particularly in developing and underdeveloped countries.”

Commenting on the market outlook, Research Vice President Neil Shah said, “The global cellular IoT connections installed base is expected to surpass 6 billion by 2030 with a CAGR of 10.8%. The growth will be mainly driven by cellular connectivity adoption across various sectors such as utilities, automotive, industrial, retail and healthcare. Unlike the previous decade, where consumer devices like smartphones and PCs played a significant role in driving cellular connections, this decade will see a shift towards cellular connections being propelled by the digital transformation initiatives undertaken by enterprise IoT payers. The widespread adoption of cellular connectivity will also contribute to a further reduction in prices for cellular-connected devices, making them more competitive against alternative non-cellular connectivity technologies like LoRa, Sigfox and Wi-SUN. Over the past year, the cellular IoT industry has witnessed many consolidations, including Telit’s acquisition of Thales’ cellular IoT business, Semtech’s acquisition of Sierra Wireless, and Aeris Communications’ acquisition of Ericsson’s IoT accelerator and connected vehicle cloud business. As the cellular IoT module market continues to mature, we can expect more consolidations aimed at providing improved solutions and maintaining competitiveness against other non-cellular connectivity technologies.”

The comprehensive and in-depth ‘Global Cellular IoT Connections Tracker, 2022’ report is now available for purchase at report.counterpointresearch.com.

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Soumen Mandal

Neil Shah

Mohit Agrawal

Counterpoint Research

press@counterpointresearch.com

Related Posts

- Qualcomm Aware: Pivotal SaaS Play to Catalyze the Complex IoT Ecosystem

- AI, Digital Twins, Real-time Compute Emerge as Top Technology Trends for 2023

- Global Cellular IoT Module and Chipset Tracker by Application: Q1 2023

- Global Connected Construction Machine Market, 2022

- Global Connected Livestock Monitoring Market, 2022

- Global Connected Crop Farming Market, 2022

- Global Connected Agriculture Tractor Market, 2022

- Global Cellular IoT Module Shipments Jump 14% YoY in 2022 to Reach Highest Ever

- Global Connected Agriculture Node Shipments to Reach 187 Million Units by 2030

- Global Connected Construction Machine Shipments Grew 6.7% YoY in 2022