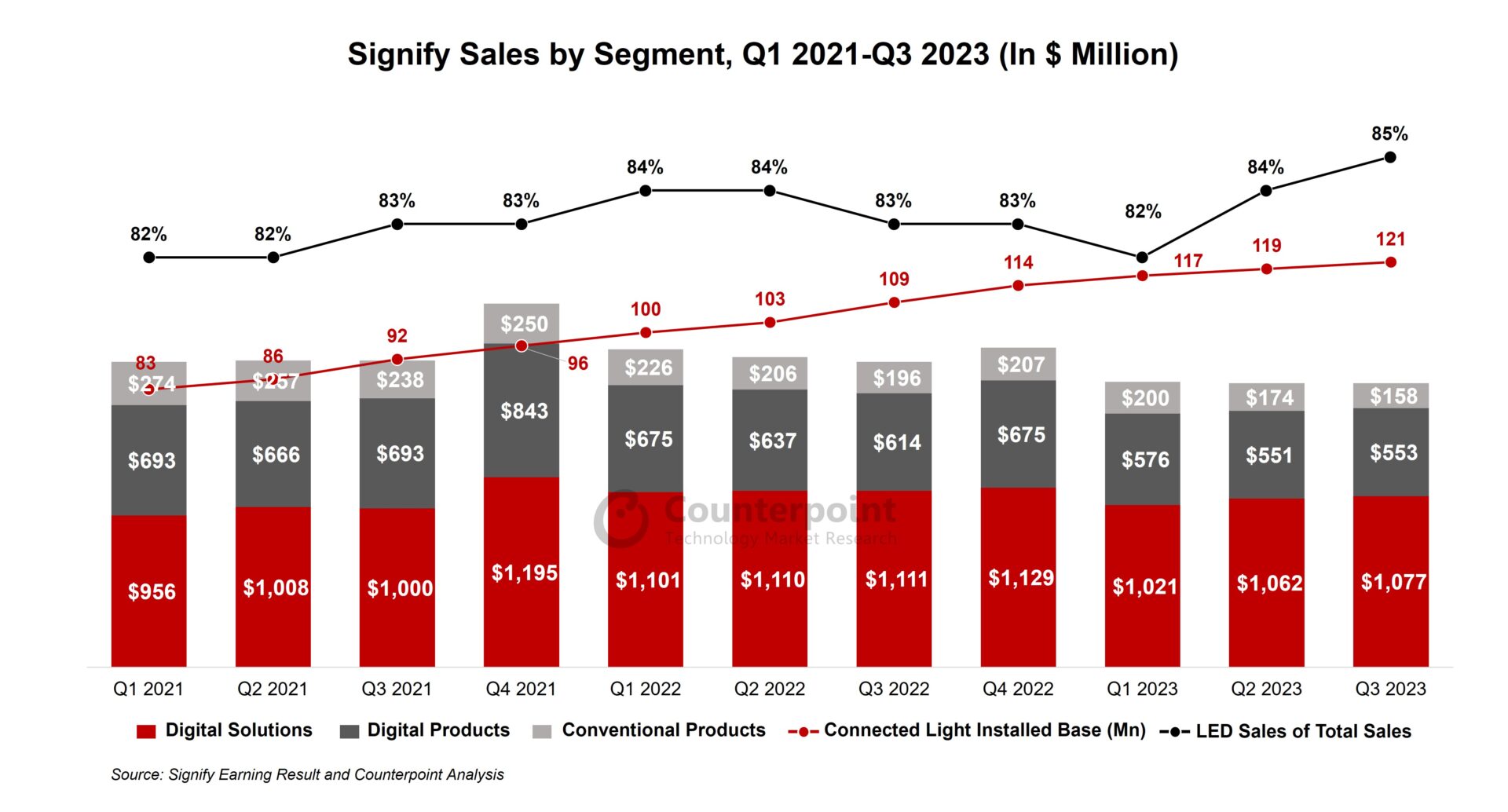

- Signify’s installed base of connected light points reached 121 million in Q3 2023.

- LED-based sales represented 85% of total sales.

- Signify gained market share in the professional segment, driven by strong demand for connected systems and services.

Signify reported a 13.8% YoY decline in Q3 2023 sales to reach $1.8 billion, as the global lighting services provider was hurt by persistently weak performance across all three major product lines and the negative currency impact from the depreciation of the US dollar. Signify’s installed base of connected light points reached 121 million by the end of Q3 2023.

Signify CEO Eric Rondolat, during the earnings call, discussed a few key things such as business and operations performance and outlook:

Business and Operations Performance

CEO Eric Rondolat: “In the third quarter, we continued to recover our gross margin, which is a 2023 priority. Operating margin and free cash flow growth were in line with our expectations. While we see persistent weakness in China, in the connected consumer and LED electronics businesses, we gained market share in the professional segment, driven by strong demand for connected systems and services. We are also pleased to report that we have been able to bring our Conventional Products division back to its historical performance levels.”

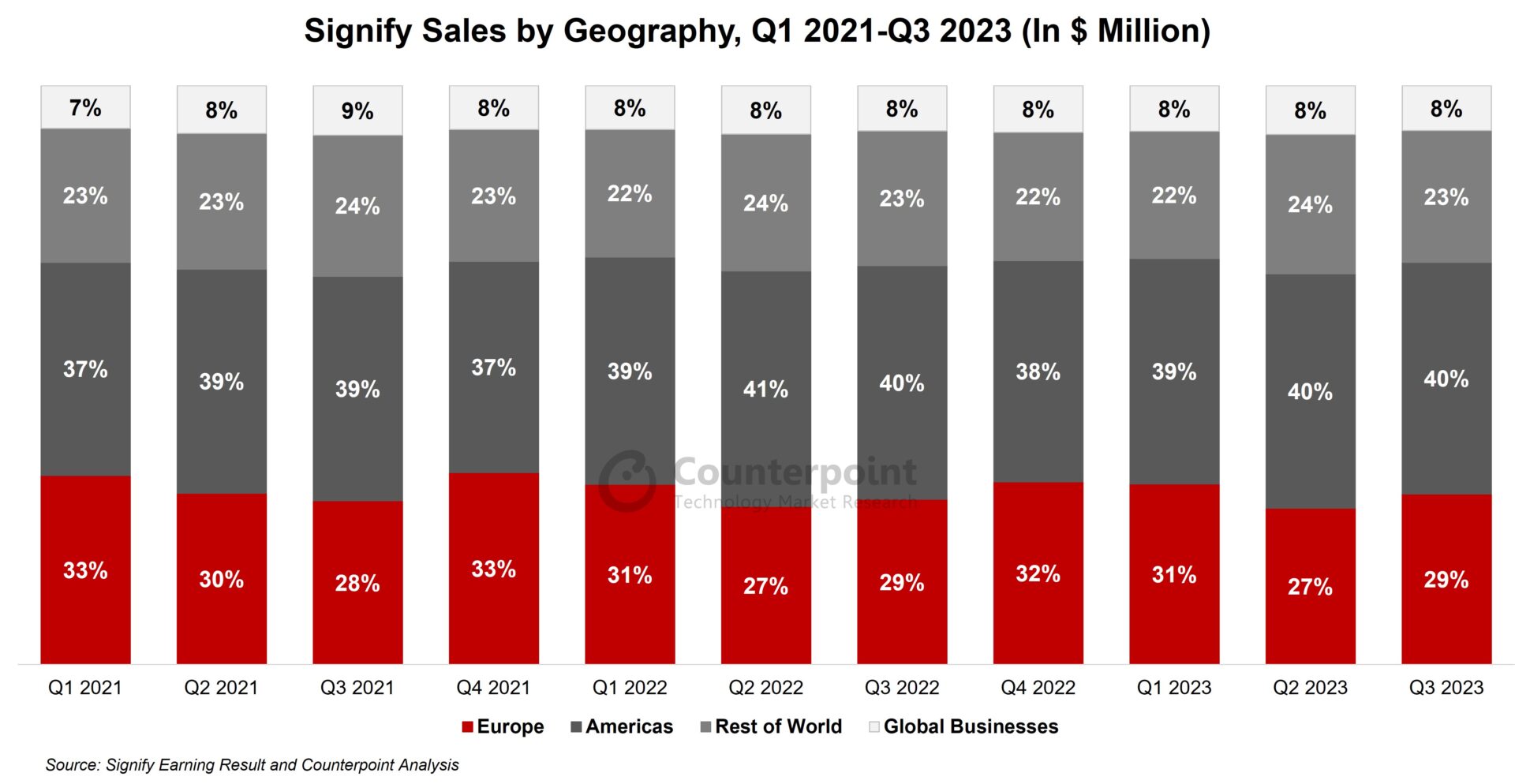

Analyst Take: “Signify is facing increasing competition from Chinese and South Korean manufacturers, which are offering lower-priced lighting products. Additionally, the company is still heavily reliant on traditional lighting markets, such as Europe and North America, which contribute to more than 60% of its sales. This makes it vulnerable to economic downturns in these regions. Signify needs to continue to innovate and expand into new markets to maintain its leadership position.”

Outlook

CEO Eric Rondolat: “With the visibility we have into the final quarter, we confirm our guidance for the full year. However, we expect macroeconomic external factors to continue to put pressure on our topline in the quarters ahead. We are well positioned by the cost reduction actions that began earlier this year. Further structural measures will be implemented through Q1 2024 to improve our efficiency and speed of execution, and enhance our focus on the growth opportunities presented by the accelerating transition to ultra-efficient LED and connected lighting technologies.”

Analyst Take: “Muted demand for lighting systems resulting from the difficult macroeconomic situation and negative currency impacts has weighed on Signify’s Q3 2023 performance. However, Signify’s pricing strategy is expected to improve the company’s efficiency in the coming quarters. The strong demand for LED and connected lighting systems and services is expected to help Signify bring its top-line sales back to normal levels.”

Q3 2023 Result Highlights and Summary:

- Signify’s Digital Solutions segment reported sales of $1,077 million in Q3 2023, down 10% YoY, as the order intake during the quarter was lower due to high energy costs. Meanwhile, the company saw strength in professional systems and services, which was, however, more than offset by weakness in indoor professional lighting, particularly horticultural lighting.

- The Digital Product segment saw sales decline by 17% YoY in Q3 2023 to $553 million primarily due to continued weakness in the consumer-connected segment, the OEM business and top-line weakness in the Chinese Klite business.

- The Conventional Products segment sales fell 26% in Q3 2023 to $158 million. The decline in volume is in line with company expectations for conventional product segment. However, adjusted EBITA margin improved helped by lower cost of goods sold and a positive effect on price.

- In Europe, sales declined by 11% to $529 million as most markets in the region declined except the Nordics and Italy. In the Americas, sales fell 15% to $718 million as solid growth in Latin America did not manage to offset weakness in the US. In the Rest of World, sales declined by 16% to $408 million mainly due to continued weakness across most markets except the Middle East and as China has yet to recover. Global business sales declined by 14% to $139 million mainly due to weak performance of the Klite and Fluence lighting.

- LED-based sales accounted for 85% of total sales, reflecting the steady growth in adoption of energy-efficient LED lighting solutions.

- Over the years, Signify has acquired a number of well-known lighting brands, including Philips Lighting, Interact, Color Kinetics, and WiZ, which has helped the company establish a leading position in all major lighting segments, including professional lighting, consumer lighting, and horticultural lighting.

- Signify has a strong track record of innovation in the lighting industry. It invests heavily in R&D and has several patents for lighting technologies, which shows the company’s emphasis on innovation in lighting technologies. Signify recently introduced the new Philips Hue Secure cameras, sensors, and app features to help secure homes. Signify is also exploring new ways to use smart lighting systems to integrate with smart devices and improve home security.

- Signify offers a wide range of lighting products and solutions, from traditional light bulbs to the latest LED lighting and connected lighting technologies. Apart from these, Signify has a large and diverse customer base, including businesses, governments, and consumers. Given these advantages, Signify is expected to navigate through these difficult times of macroeconomic uncertainty and maintain its leading position in the lighting industry.