- The global smartwatch market rebounded with a 9% YoY rise in Q3 2023 shipments, continuing the upward trend from the previous quarter.

- Growth was propelled by strong performances in the Indian market, particularly from Fire-Boltt, and Huawei’s significant surge in China.

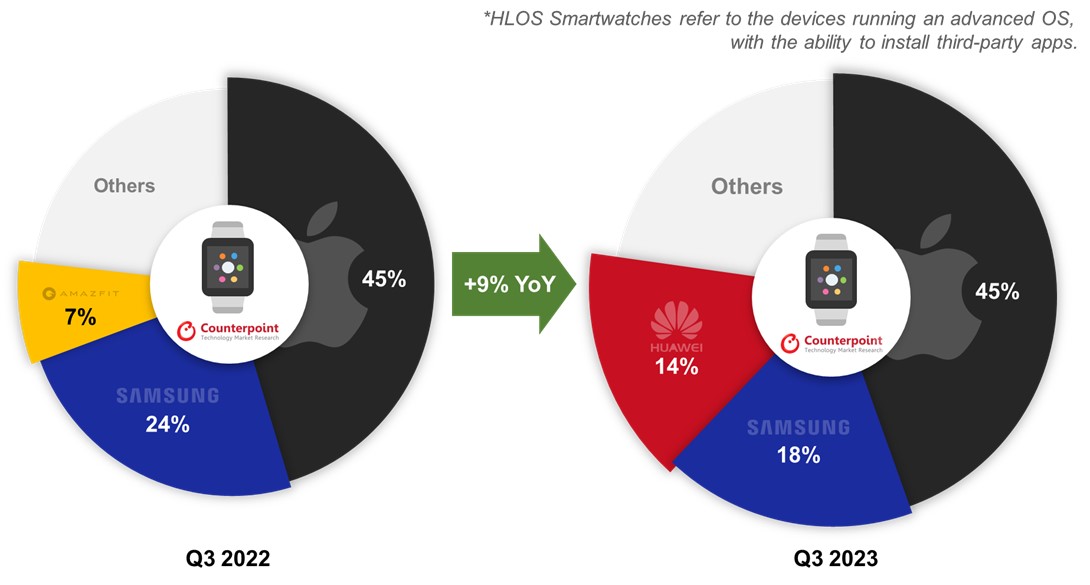

- Outside India, the rise in high-specification HLOS smartwatches, driven by new Apple, Huawei, and Samsung releases, dominated the market.

Seoul, New Delhi, Hong Kong, Beijing, London, Buenos Aires, San Diego – December 01, 2023

Global smartwatch shipments increased 9% YoY in Q3 2023, according to Counterpoint Research’s latest Global Smartwatch Model Tracker. After experiencing a slowdown earlier this year, the smartwatch market regained momentum in Q2 2023 and continued the positive trend in Q3 as well. The primary drivers of this growth were the sustained strong performance of the Indian market led by Fire-Boltt, as well as Huawei’s tremendous rebound in China.

Research Analyst Woojin Son said, “There is significant value in examining the growth drivers of the global smartwatch market in Q3 2023. Amid a global economic slowdown, most consumer device markets like smartphones are still experiencing stagnation compared to a year ago. In contrast, the smartwatch market has recorded YoY growth for two consecutive quarters in both premium and budget segments. Notably, High-level Operating System (HLOS)* smartwatches, typically featuring higher specification and price, have grown largely driven by Huawei in Q3 2023 as the company posted its highest quarterly performance ever. Most of this surge occurred in the Chinese domestic market, coupled with the launch of new Huawei 5G smartphones.”

High-level Operating System (HLOS)* Smartwatch Market Share, Q3 2022 vs Q3 2023

Son added, “Meanwhile, the Indian market, which has been powerfully leading the Basic* smartwatch sector, maintained robust growth in the quarter. The country contributed to 35% of total global shipments, securing its position as the leader in the global market for the third consecutive quarter.”

Market Summary

- Apple delivered its best-ever Q3 performance, with a 7% YoY increase in shipments. This achievement is particularly noteworthy given that the latest Apple Watch, a key product in their lineup, was released slightly later than the previous year. The strong shipments of the 2nd-generation SE model significantly contributed to the growth of the industry leader.

- Huawei witnessed an impressive 56% YoY increase in overall shipments for the quarter, with HLOS smartwatches seeing a remarkable 122% surge. Its Watch 4 and 4 Pro series, released in Q2 2023, and the Watch GT 4, released in Q3 2023, have achieved good popularity. The increase in Huawei’s shipments was due to the return of its smartphones and the bundled sales model induced by various sales channels.

- Samsung experienced a 19% YoY decline in shipments. However, the new products released in August exhibited only a 3% drop compared to the previous ones. In essence, the decrease in Samsung smartwatch shipments this quarter appears to be primarily attributed to a sharper decline of legacy models. Meanwhile, the proportion of the Galaxy Watch 6 Classic significantly increased compared to last year’s 5 Pro, contributing to the rise in the ASP of the brand.

- Fire-Boltt reclaimed its leadership position in India after recording its all-time highest quarterly shipments. All the three major Indian brands — Fire-Boltt, Noise and boAt — are experiencing a slower growth rate than before. However, this is interpreted not as a sign of sluggishness, but rather as an indication of entering a phase of stabilization.

*Types of smartwatches:

- HLOS smartwatch: Electronic watch running a high-level OS, such as Watch OS (Apple) or Wear OS (Samsung), with the ability to install third-party apps.

- Basic smartwatch: Electronic watch running a lighter version of an OS, with no ability to install third-party apps.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.