- The JioPhone Next is one of the cheapest 4G smartphones available in the market.

- The device will help Jio shift hundreds of millions of 2G and 3G users to 4G.

- The device will also make it easier to shift 4G users to 5G once the coverage has reached a good threshold.

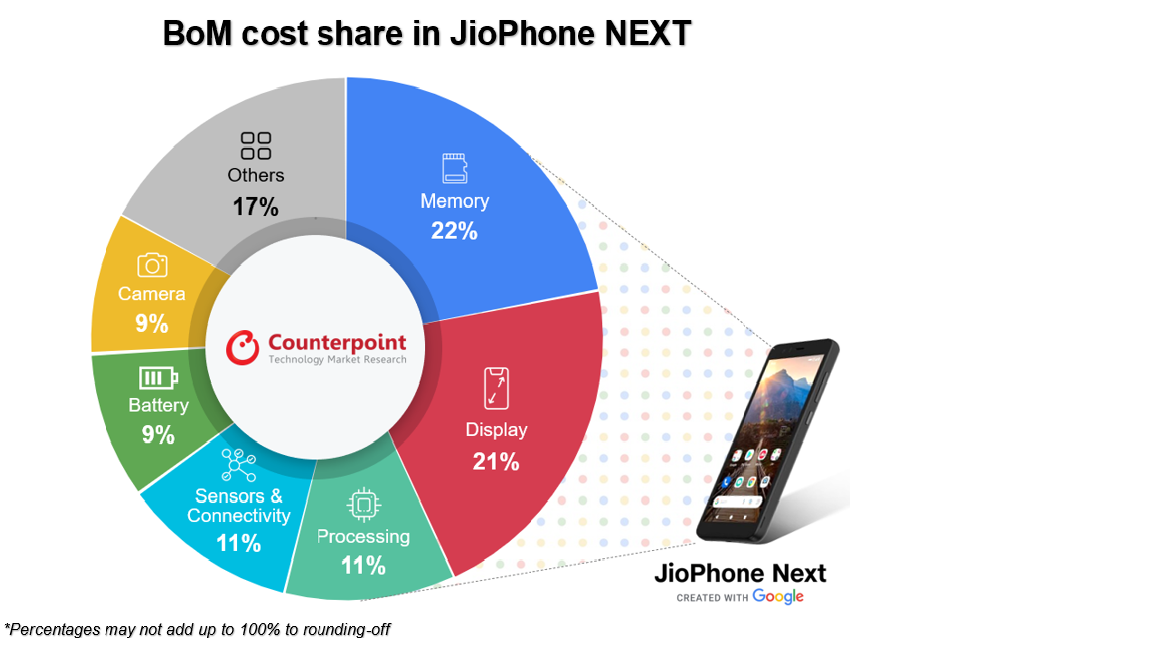

Reliance Jio, in partnership with Google, launched the JioPhone Next 4G Android smartphone on November 4 last year. With an aim to shift hundreds of millions of 2G and 3G users to 4G, the telecom operator has worked hard with suppliers to maintain a very disruptive bill of materials (BoM) at around $58. The smartphone is being manufactured at Reliance Jio’s Neolync facilities in Tirupati and Sriperumbudur in southern India. While Qualcomm, Samsung and AI start-up Syntiant have benefitted from the first generation of JioPhone’s 4G Android smartphone offering, Chinese suppliers have also won some important design slots in the multi-million seller. This can be seen in the following BoM and specification analysis:

Display

The JioPhone Next features a 5.45-inch LCD display with 720×1440 pixels resolution and 60Hz refresh rate. The LCD is illuminated by backlight and is relatively inexpensive, making it an ideal solution for budget smartphones. The display is manufactured by upstart Chinese supplier TXD. For the cover glass, Jio has opted for Corning Gorilla Glass 3, which has alkali-aluminosilicate that offers some resistance to scratches and protection from accidental drops. The display, along with the cover glass, takes ~21% share of the BoM cost.

Storage and memory

When it comes to low-end budget smartphones’ memory, most brands opt to use an eMMC (embedded multimedia card) storage. However, Jio has opted to go for an eMCP (embedded multi-chip package) solution due to space and power constraints on the PCB. An eMCP offers a smaller footprint compared to an eMMC. Sitting between eMMC and UFS (universal file storage) solutions, an eMCP storage combines NAND and DRAM to minimize latency and cut down on power consumption. 2GB of single-channel LPDDR3 SDRAM running at 672 MHz and 32GB of eMMC 5.1 flash is manufactured by Samsung and accounts for ~22% of the BoM cost.

Processor

The JioPhone Next is powered by Qualcomm’s QM215 SoC produced on a 28nm process node. The QM215 is a toned-down variant of the Snapdragon 425. This chipset is specifically designed to work on ultra-low-cost Android Go phones. The QM215 packs four ARM Cortex-A53 cores clocked at 1.3 GHz, which aim to increase the CPU performance by 50% compared to the earlier Qualcomm 2-series platform. The QM215 also packs in a third-generation Adreno 308 GPU clocked at 500 MHz, which has 24 ALUs (arithmetic logical units) that can perform 27 Giga-floating-point operations per second [GFLOPs FP32 – (single precision)].

Neural Processing Unit (NPU)

Neural Processing Unit (NPU)

The smartphone also packs in a special speech recognition NPU from Syntiant. This NPU – NDP101 – is manufactured on a 40nm ULP (ultra-low power) process node featuring a single Core Arm Cortex-M0 CPU coupled with 112KB of SRAM that is capable of running deep learning algorithms efficiently for all the offloads from CPU and in ultra-low power consumption use cases as well.

The NPU supports an always-on listening feature, and wake-up-to-speech and voice commands, a key differentiator for the phone to bridge the “digital divide” by supporting multiple local languages not only for wake word but also translation. Reliance Jio’s partnership with Google has also brought along Pragati OS, an optimized solution of Android GO.

The processing section together contributes ~11% to the BoM cost.

Camera

The smartphone offers a single 13MP camera, with a 1/3″ sensor from SK Hynix, on the rear flanked by an LED flash. On the front, there is an 8MP camera with a 1/4″ sensor. Both camera modules contribute to ~9% of the BoM cost.

Sensors and connectivity

The JioPhone Next’s nominal sensor array includes accelerometer, proximity and ambient light sensors. Wireless connectivity choices include Wi-Fi 802.11 b/g/n, Bluetooth 4.1, and AGPS (indoor positioning). The single-band Wi-Fi and Bluetooth combo IC is powered by Qualcomm’s WCN3610.

In terms of connectivity, the Qualcomm 215 sports a Snapdragon X5 LTE Cat 4 modem with support for VoLTE, VoWiFi, EVS and Dual SIM Dial VoLTE, which are a key feature for emerging markets such as India. It is the first 2-series platform to support 802.11ac and Bluetooth 4.2. The SoC also supports dual camera ISPs. Sensors and connectivity together contributed around ~11% to the BoM cost.

Battery

The Jio smartphone packs a lithium polymer 3400mAh battery with a 13.09Wh rating. It is manufactured by Guangdong Fenghua NEW Energy. The battery is charged via a micro-USB port. The device features Qualcomm’s Quick Charging IC. The battery along with the power management ICs accounts for ~9% of the BoM cost.

Key takeaways

The JioPhone Next is a unique smartphone for its price segment, retailing at around $55-$80 (INR 4,400-INR 6,400) depending on the seasonal/regional/buyback offers, supported by a compact design. This makes it a compelling device for budget-oriented and feature phone users to cross the chasm.

Leveraging its scale, Jio has designed an optimum BoM for this smartphone despite supply chain constraints and increasing component prices. Jio has closely worked with Google to optimize the entire experience for the chosen hardware stack.

The device rounds up Jio’s strategy well — first, to use the JioPhone Next 4G to attract hundreds of millions of 2G feature phone users to its 4G network and second, to aim to deliver a sub-$100 to sub-$150 (INR 8,000-INR 12,000) affordable 5G smartphone once the coverage has reached a good threshold to attract the mass-market 4G smartphone users to its 5G network. This two-pronged strategy will be the key to Jio’s growth and extend its leadership to the 5G era as well. Further, at some point in 2024, Jio will also be compelled to launch an affordable 5G mmWave + Sub-6 GHz smartphone as the cost deltas between the two would have narrowed significantly from the BoM perspective.

For detailed component and pricing analyses, queries or to acquire this research, contact info@counterpointresearch.com