- Global connected car sales grew 28% YoY in Q3 2023.

- Developed countries with strong government push lead in connected car sales.

- By 2030, more than 90% of connected cars sold will have embedded 5G connectivity.

Seoul, Beijing, Boston, Buenos Aires, Hong Kong, London, New Delhi, San Diego – January 17, 2024

Global connected car sales* grew 28% YoY in Q3 2023, according to the latest research from Counterpoint’s Global Connected Car Sales Tracker. Every 2 out of 3 cars sold in Q3 2023 had embedded connectivity in them. China led with around 33% share in global connected car sales, followed by the US and Europe. These top three regions constituted more than 75% of the global connected car sales in Q3.

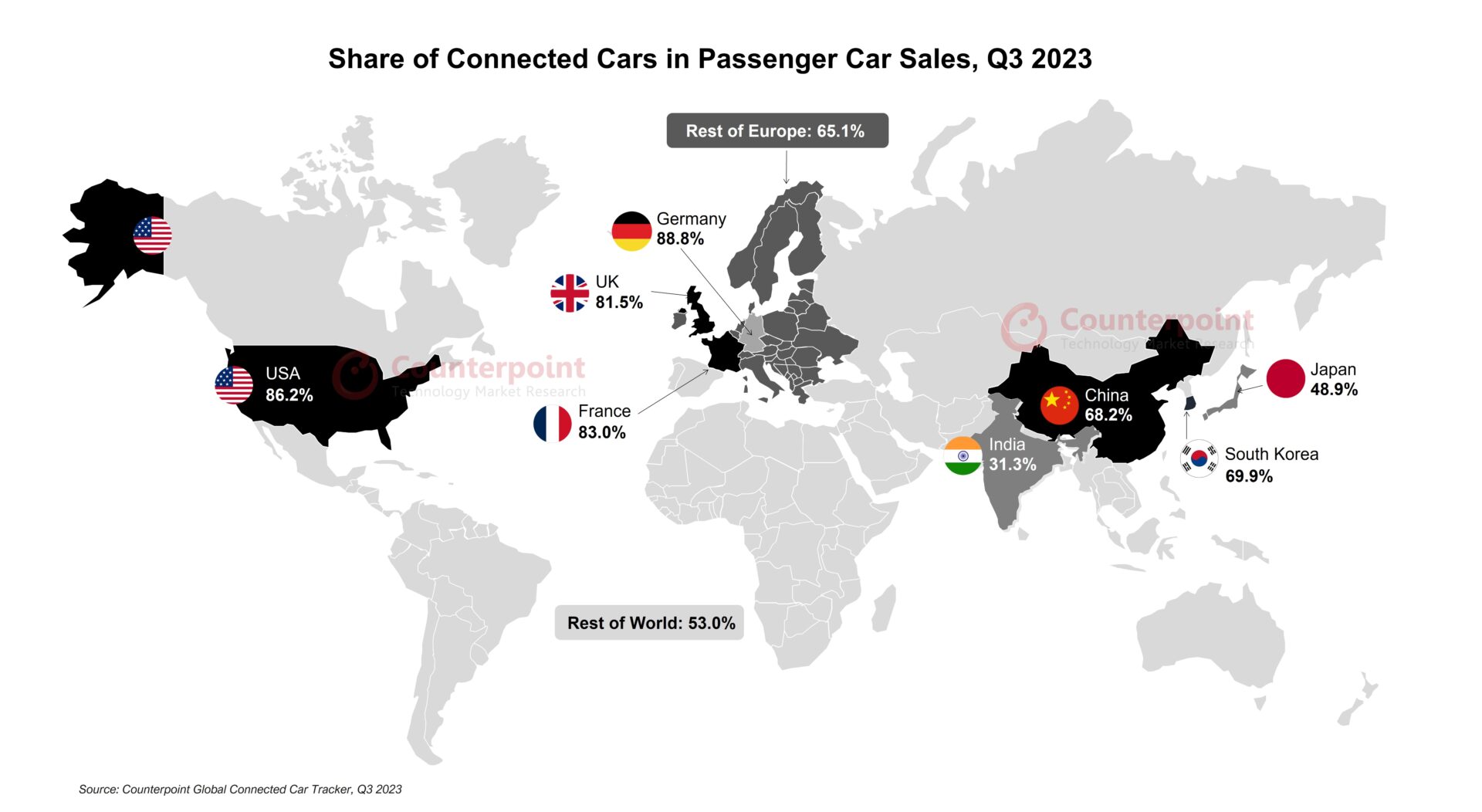

Commenting on the market dynamics, Senior Analyst Soumen Mandal said, “Germany has the highest share of connected cars in its passenger car sales owing to the initial government push towards connected vehicles through mandates like eCall. After Germany, the US, France, and the UK have the highest share of connected cars in their respective passenger car sales.

With the increasing adoption of electric vehicles and autonomous vehicles, the connectivity penetration in a car is increasing. 4G still dominates this space with more than 95% sales share, while 5G adoption is slower than the industry’s projections earlier. The lack of robust 5G infrastructure along the highways, non-availability of unique 5G use cases within the car, and supply chain issues are some of the reasons for slower adoption of 5G in passenger cars.”

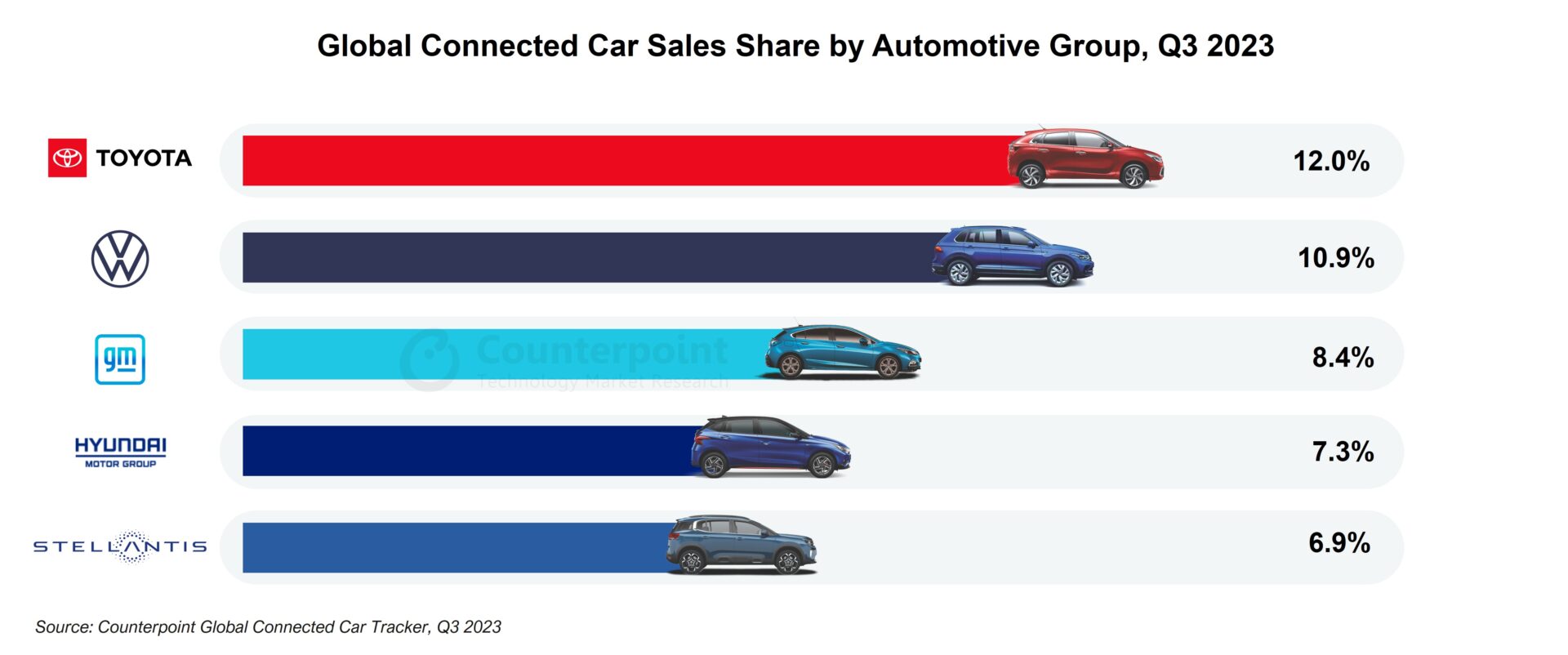

Mandal added, “With growing consumer tech awareness and need for connectivity, the sales of non-connected cars are steadily declining. The top five automotive groups accounted for nearly 45% of the connected cars sold in Q3 2023. Toyota Group led the charts in terms of shipments with a 12% sales share, closely followed by the Volkswagen Group. GM Group, Hyundai Kia Automotive Group and Stellantis were the other three in the top five.”

Commenting on the market outlook, Vice President Research Neil Shah said, “The connectivity in cars is slowly gaining preference in developing economies too and becoming the main differentiator in the market. It is expected that more than 95% of all new passenger cars will have embedded connectivity by 2030. 4G connectivity will continue to dominate, while 5G connectivity will gradually rise with the introduction of more L3 and above cars in the market. 2026 will likely be the inflection point for adopting 5G in automotive applications. By 2030, more than 90% of connected cars sold will have embedded 5G connectivity.”

* Sales here refer to wholesale figures, i.e. deliveries out of factories by respective brands, and consider only passenger cars with embedded connectivity.

The comprehensive and in-depth ‘Global Connected Car Tracker, Q3 2023’ and ‘Global Connected Car Forecast, 2019-2030F’ are now available for purchase at report.counterpointresearch.com.

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media, and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research

press(at)counterpointresearch.com