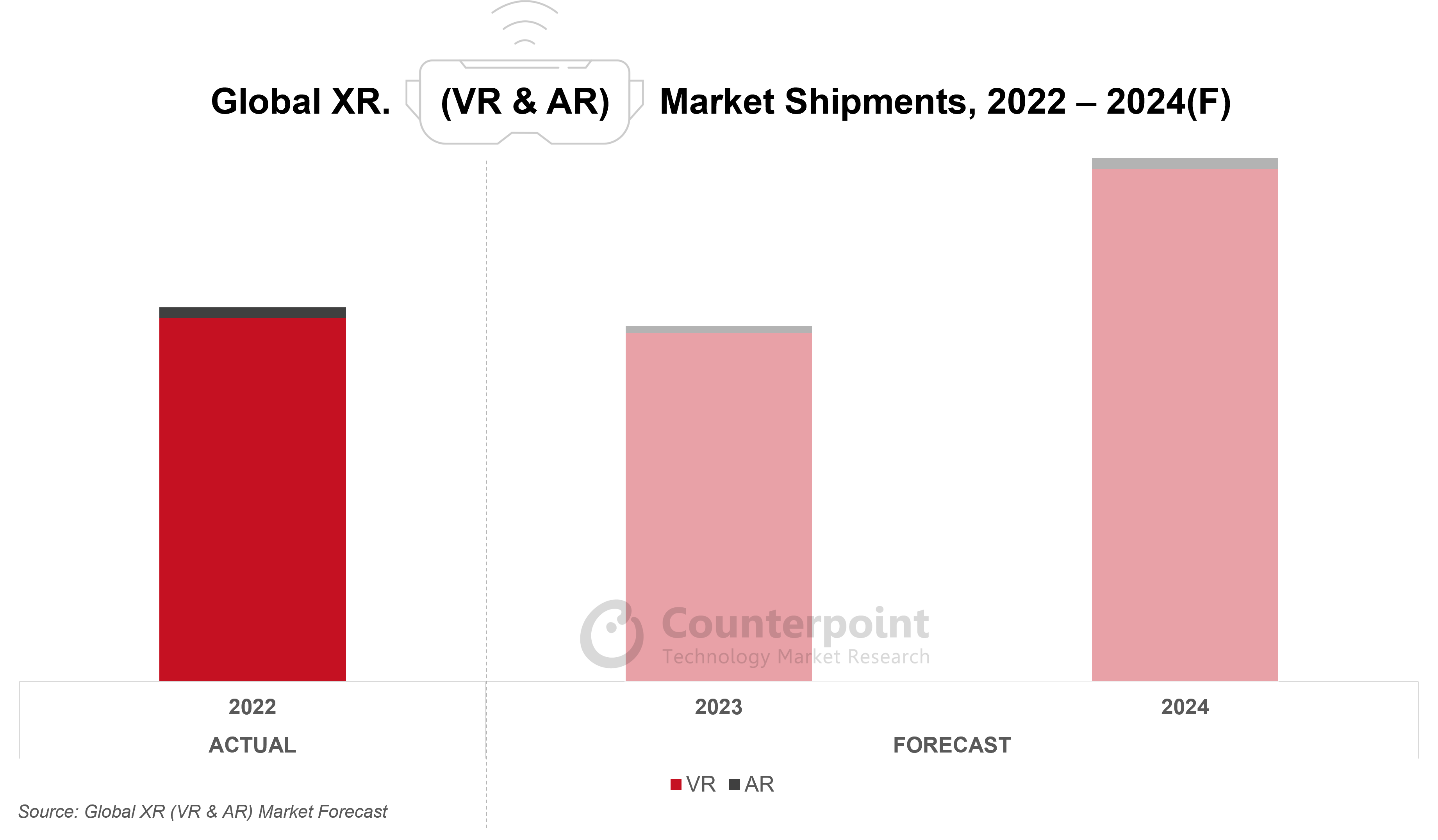

- XR headset shipments are expected to increase by a record 3.9 million units in 2024, marking a high double-digit YoY growth from a small base.

- Major releases in 2024, including Apple’s Vision Pro, will sustain the momentum generated by Meta and Sony in 2023 with the launch of Quest 3 and PlayStation VR2 respectively.

- AR is projected to grow from a very small base, driven by successful launches like XREAL’s Air 2 and Air 2 Pro.

- North America, the biggest XR market, will further widen its lead in 2024 as Apple’s Vision Pro is exclusively available in the region for much of the year.

Seoul, Beijing, Boston, Buenos Aires, Hong Kong, London, New Delhi, San Diego – January 9, 2024

Extended Reality (XR) headset shipments are projected to increase by a record 3.9 million units in 2024 to clock a high double-digit YoY growth, according to the latest Counterpoint Global XR (VR/AR) Forecast. Apple’s Vision Pro, which goes on sale in the US on February 2 (with pre-orders starting on January 19), will generate user interest and industry movement which will benefit incumbents. 2024 will also carry forward the momentum from 2023, marked by several launches from major players like Meta and Sony.

Commenting on the market dynamics, Senior Analyst Harmeet Singh Walia said, “Apple’s highly-anticipated entry into the XR space has long been expected to mark a watershed moment for the industry. However, we expect Apple to sell about half a million units of Vision Pro, its $3,500 mixed reality (MR)* headset, in 2024. This makes up a low single-digit share of the 2024 global XR market. The first iteration of the Vision Pro headset will primarily attract die-hard Apple fans, developers, early adopters and enterprise users. A more optimistic scenario could unfold if Apple successfully boosts the supply of key components for the headset and experiences higher-than-expected interest from the end market. Moreover, the consumer interest Apple’s entry is generating will benefit market incumbents offering competitively priced headsets, towards which many enthusiasts who wish to try the technology without incurring Apple’s hefty price tag would gravitate, boosting the global XR market.”

2024 will see the continuation of another trend – the transition from pure virtual reality (VR) to MR* as major players, both existing and upcoming, rush to launch MR products or add passthrough to successors of their pre-existing headsets. Since Counterpoint considers such headsets as part of its VR category*, it remains dominant. The standalone form factor is preferred and is likely to remain so despite Apple’s Vision Pro requiring a wired connection with an external battery case.

Augmented Reality (AR) is projected to grow by 54% YoY in 2024, bucking the trend of three years of consecutive declines. This growth will be driven by XREAL’s Air 2 and Air 2 Pro AR Glasses, which quickly became the best-selling AR glasses in China. Besides XREAL, which targets the larger consumer segment, AR will be driven by high-spec and high-price products in the niche enterprise segment. At just about 2%, AR, however, will remain a small contributor to overall XR shipments.

Commenting on the regional performance, Senior Analyst Karn Chauhan said, “North America was already the biggest contributor to XR shipments with nearly 70% of the best-selling Meta headsets shipping in the region. This will grow further in 2024 as Apple’s Vision Pro is available for sale exclusively in the US for most of its first year. While Europe remains a major market, as with its economy, its share of the XR market is expected to lag further behind North America due to slower adoption and limited content. Streaming not taking off as a use case, strict gaming regulations, and the education and enterprise segments, in which XR is popular in China, being niche, growth in China too will remain sluggish in 2024. The rest of Asia-Pacific benefited from the launch of Sony’s PlayStation VR2, which did well in its home country of Japan, among the few major XR markets in the region together with South Korea, Australia and New Zealand that will continue performing strongly in 2024.”

Samsung’s re-entry into the segment, likely with an MR* headset in 2024, will also generate traction, but regardless of its launch price, it will contribute less than Apple to global shipment growth due to a late-year launch.

Pico, owned by TikTok’s parent ByteDance, is unlikely to fully recover from the setbacks its latest Pico 4 suffered in 2023. DPVR, another major Chinese player, while remaining strong in the Chinese education sector, will struggle to break out as a major global player despite having launched E4, its gaming PC VR headset.

*Counterpoint’s XR services currently divide the market into two device types – VR and AR. AR includes glasses and headsets with transparent displays. VR includes headsets that substantially or fully obscure the real world but may use video-pass-through (VPT) technology to feed real-world views to the wearer and/or combine them with digitally created environments, hence covering headsets (including Apple’s Vision Pro) commonly marketed as MR, which Counterpoint currently buckets under its VR category.

Feel free to reach us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Follow Counterpoint Research