- India’s semiconductor market is expected to reach $64 billion by 2026 with the ‘telecom stack’ and industrial applications accounting for two-thirds of the total.

- India’s Central and State Governments are incentivizing more than 70% of the total cost in setting up a semiconductor manufacturing facility.

- The Central Government funds 50% of the project and has also earmarked outlays for R&D, skill development and training.

New Delhi, Beijing, Jakarta, London, Boston, Toronto, Taipei, Seoul – May 09, 2023

Invest India, the National Investment Promotion and Facilitation Agency, India Semiconductor Mission (ISM), and Counterpoint Research, recently hosted a series of webinars with key industry speakers to discuss the opportunities in India for establishing a semiconductor manufacturing base and in becoming a key destination for supply chain diversification.

The webinar covered four central topics, namely the semiconductor market across sectors and applications; government programs and incentives for foreign manufacturers; talent availability and initiatives for re-skilling; and the current infrastructural capabilities and support for semiconductor manufacturing.

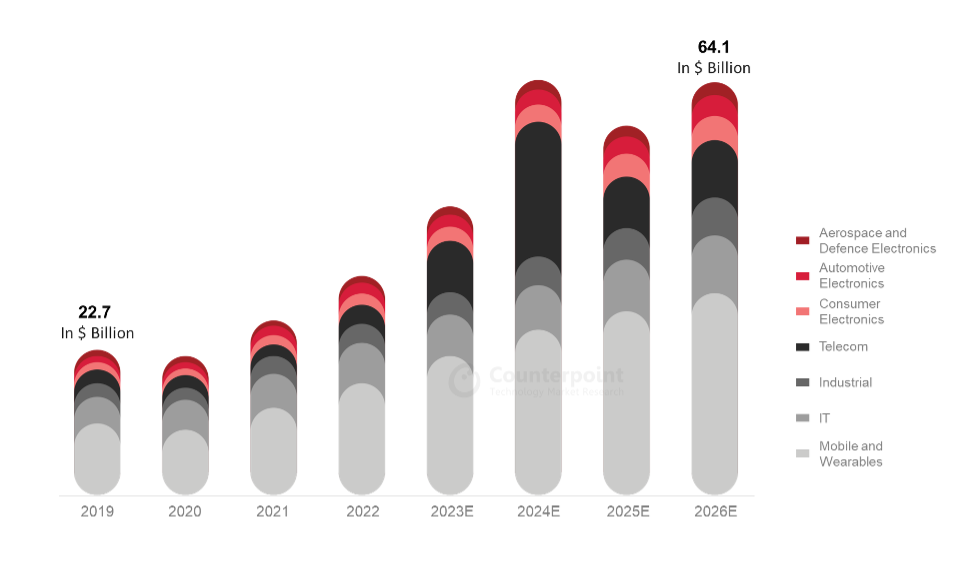

With India’s semiconductor market expected to balloon to $64 billion by 2026, the country presents a considerable opportunity for global semiconductor manufacturing. India’s semiconductor market was valued at $22.7 billion in 2019, according to a joint report by Counterpoint Research and the India Electronics & Semiconductor Association (IESA). The 2026 forecast is set to be driven by both domestic and export markets with significant demand from the consumer electronics, telecom, IT hardware and industrial sectors. India’s ‘telecom stack’ and industrial applications are expected to account for two-thirds of the total.

India Semiconductor Market Size by Application

Meanwhile, components leveraging mature technology nodes (28nm and higher) are expected to see significant short-term opportunities as they support India’s growing automotive and industrial sectors.

“In the short term, there is a huge opportunity being driven by domestic demand across applications like sensors, logic chips and analog devices,” said Tarun Pathak, Research Director at Counterpoint.

He also said “Local sourcing is already happening in a significant way. It accounted for around 10% of the overall market in 2022.”

At the global level, the Government of India has committed to being a reliable partner in the semiconductor supply chain, introducing various incentives and programs that facilitate foreign investments across a broad array of sectors.

Mr. Amitesh Kumar Sinha, CEO of ISM and Joint Secretary, Ministry of Electronics and Information Technology, said, “India is committed to becoming a reliable partner in global supply chains and we are working towards that by framing long-term policies, keeping the next 25 years in mind.”

Mr. Sinha further added, “More than 70% of the project costs for semiconductor manufacturing are incentivized by the Central and State Governments in India of which 50% is funded by the Central Government on an upfront basis while the rest is covered by the State Governments.”

The Semicon India Program, which has an outlay of about $10 billion, funds 50% of the semiconductor manufacturing project costs with 2.5% of the budget earmarked for R&D, skill development and training.

Apart from market sizing and fiscal support, the fourth area addressed during the webinar was the existing infrastructural capabilities and the availability of a skilled workforce, materials supply and other parts of the local supply chain.

India’s own fabrication unit, Semiconductor Laboratory (SCL), provided an end-to-end case study emphasizing India’s supply chain’s robustness across utilities, materials and talent.

Dr. Manish Hooda, Head of Technology Development at SCL said, “SCL has been an end-to-end manufacturer for 30 years, providing products for space and railway applications. For the last 15 years, SCL has received uninterrupted power supply and stable, continuous flow of ultra-pure quality water, which highlights India’s readiness to support high-volume manufacturing of semiconductors.”

An edited version of the webinar recording can be found here.

Contacts:

Nupur Yadav

nupur.yadav@counterpointresearch.com

Rohan Thomas Abraham – Sector Lead, ESDM – Invest India

Media Contacts

press@counterpointresearch.com

Follow Counterpoint on LinkedIn and Twitter

About Counterpoint Research

Counterpoint Technology Market Research is a global research firm specializing in TMT. It services major technology and financial firms with data, monthly reports, and detailed analyses of key technology markets.

About Invest India

Invest India is the national investment promotion and facilitation agency of India. The agency’s team of domain and functional experts provide sector- and state-specific inputs, and hand-holding support to investors through the entire investment cycle, from pre-investment analysis and decision making to after care and grievance redressal. Additionally, all facilitation support to investors under the “Make in India” program is provided free of cost by Invest India.

Website: https://www.investindia.gov.in/

About India Semiconductor Mission (ISM)

India Semiconductor Mission (ISM) is a specialized and independent business division within the Government of India’s Digital India Corporation. The organization aims to build a vibrant semiconductor and display ecosystem in India to facilitate the country’s emergence as a global hub for electronics manufacturing and design. Led by global experts in the semiconductor and display ecosystem, ISM’s mission is to serve as a focal point for the comprehensive, coherent, efficient and smooth deployment of the Program for Development of Semiconductor and Display Ecosystem, in consultation with government ministries/departments/agencies, industry players and academia.

Website: https://ism.gov.in/