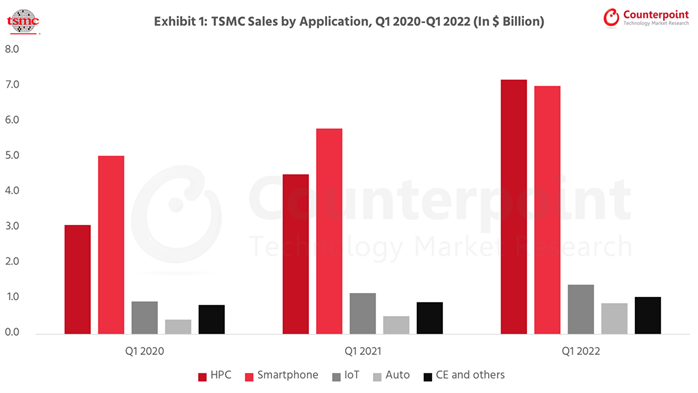

- TSMC reported its Q1 2022 revenue at $17.6 billion (up 12% QoQ). Among its different segments, the high-performance computing (HPC) segment posted the highest growth rate at 26% QoQ.

- HPC accounted for 41% of TSMC’s Q1 2022 revenue, while the smartphone segment accounted for 40%. It is the first time in TSMC’s history that HPC has become the largest sales contributor during one fiscal quarter.

- TSMC’s major HPC customers in 2021 likely included AMD (including Xilinx), Nvidia, Broadcom, Marvell and Intel besides Apple as the top-selling one due to its Apple Silicon (M series) in PCs and tablets.

- Intel appeared to be the next major HPC customer by outsourcing more graphic silicon (discrete Arc series and iGPU tiles) and other CPU cores this year. Accordingly, it would be the second-largest customer in TSMC’s 3-nanometer node in 2023.

- TSMC’s HPC segment is expected to account for 42% of its total revenue in 2022, including wafer and 2.5D/3D packaging services.

Before TSMC’s investor conference on April 14, semiconductor industry experts were waiting for the company to tune down its annual growth outlook due to weakening consumer sentiment on consumer electronic products. Counterpoint projects the global smartphone sell-through units to decline by over 10% YoY in Q1 2022, impacted by a slowing replacement cycle, geopolitical uncertainties, COVID-19 lockdowns in China and inflation concerns. Recent data on smartphone order cuts implies the risk for foundry wafer demand in the next few quarters and the previous IC shortage concerns have been improved.

Surprisingly, TSMC beat market expectations not only in its Q1 2022 financial results (with gross margin improving to 56%), but the upside of full-year sales guidance also approached 30% YoY growth. While the demand softness from smartphones has been known, TSMC believes the momentum of HPC and automotive businesses is getting stronger in 2022 and will offset the uncertainties from consumer electronics. Notably, TSMC reported $7.2-billion HPC sales in Q1 2022, exceeding the sales from smartphone clients to become the largest business of the company for the first time in history.

Other than retaining its revenue outlook for 2022, TSMC reiterated its capital spending budget at $40-$45 billion during the year, with a focus on leading-edge technology nodes (5 nm and below). The longer lead time of equipment/tool production becomes more challenging in the light of labour crunch and IC component shortages (like FPGA) from global suppliers. But TSMC has demonstrated its solid execution in ramping up new fabs as the capacity expansion plans are largely unchanged.

HPC silicon demand is on a multi-year, structural growth trajectory

The silicon demand of HPC-related ICs is well above that of the end devices and equipment. In 2022, global PC shipments are likely to decline 0%-5% YoY. The server shipments growth rate is also expected to be modest (5%-8% YoY). At the same time, 5G infrastructure growth is not accelerating in many countries, with the growth cycles of edge computing or open RAN being at the initial stages.

So, why TSMC and its HPC customers are expected to deliver a very robust growth outlook in the next 1-2 years? The answer can be found in the mega trends of digital transformation since COVID-19, which have witnessed a boost in capital spending mainly by US-based cloud service providers (CSPs) expanding their global data centre footprints. The total capex by global CSPs, based on Counterpoint estimates, may increase 23% YoY in 2022. In the three years to 2025, the annual compound growth rate (CAGR) will be in double digits. The acceleration in mega data centre buildouts is for AI services, Metaverse and autonomous driving in need of the most advanced semiconductor components. The AI accelerator IC market, which has been dominated by Nvidia, is a typical example of the market where the demand CAGR is likely to exceed 30% in the next few years as GPU, CPU, FPGA and ASIC compete for AI training and interference applications.

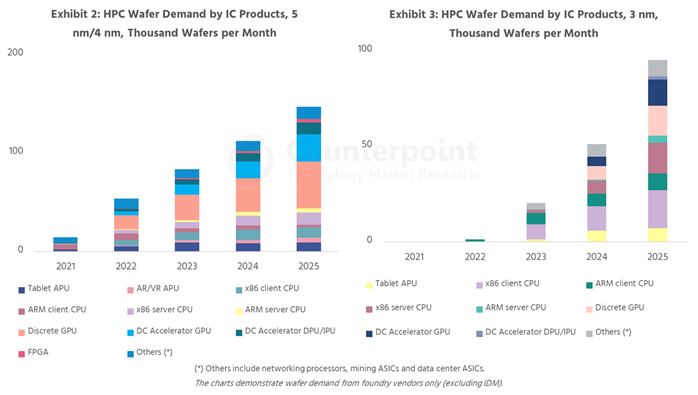

All main processors in server and data centres today apply foundry nodes below 10 nm. As computational performance improves significantly and demands more transistors, the roadmap of node migrations beyond 10 nm will get accelerated in the HPC semiconductor industry. In 2022, both AMD and Nvidia’s new graphic processors will move to 4 nm and 5 nm nodes. Further, we expect the next phase of 3 nm generation processors to start to ramp up after 12-18 months. Besides, the increases in larger die size in processors implies more wafer demand and higher dollar content in advanced packaging technologies that TSMC offers for complete solutions.

In our view, the HPC semi demand in foundry remains the seller’s market in the next few years, as TSMC captures over 90% of market opportunities, including Intel’s CPU outsourcing orders. Competition in the HPC semi market from the global top three chipmakers – Intel, AMD and Nvidia – is intensifying by entering new areas, like Intel’s entry into the discrete GPU market and Nvidia’s plan for ARM-based server CPUs, leading to strong wafer demand in advanced nodes.

TSMC offers the leading-edge technology to enable these HPC applications to pursue the best PPAC (performance, power, area and cost) over each technology geometry. This has become TSMC’s fastest-growing business segment in the past three years from the revenue perspective. In Q1 2022, it reported HPC business sales reaching $7.2 billion with nearly 60% YoY growth, overtaking smartphones as the company’s largest segment. While TSMC did not disclose any client information, we believe AMD, Nvidia, Broadcom, Marvell and Intel were the major traditional HPC customers during the quarter, with Apple as the top-selling one due to its Apple Silicon (M series) in PCs and tablets.

5/4 nm is the mainstream today, 3 nm to ramp up from 2023

The reason why TSMC’s revenue is increasing from the HPC segment is that the majority of wafers in HPC applications apply the leading-edge nodes (from 7 nm and 6 nm to 5 nm and 4 nm in 2022). Wafer prices at these nodes are multiple times higher than the foundry industry ASPs due to more expensive equipment tools. During Q1 2022, the mainstream of HPC ICs was at 7/6-nm, including discrete GPUs, data centre GPUs (AI accelerators), x86 CPUs, ARM CPUs for client devices (tablets and laptops) and specific processors like crypto mining ASICs. TSMC will also start to ramp up multiple new CPUs/GPUs at 5/4 nm in H1 2022, leading to its robust wafer demand likely through the end of the year.

Based on our estimates, in 5/4-nm nodes, the total wafer demand from HPC products (see Exhibit 2) will account for 37% of the total foundry (excluding IDM) industry capacity in 2022. Smartphone AP/SoCs will remain the largest portion of wafer demand (over 50%) in this node during the year. With new product cycles from Nvidia and AMD in H2 2022, more wafers will be procured into 2023 as HPC might reach half of the total wafer capacity at 5/4 nm in the next year.

During its Q1 2022 financial result conference, TSMC reiterated 3 nm would enter mass production in H2 2022, with wafer sales contribution from the beginning of 2023. As we all know that the new iPhone application processor (A16) will adopt 4 nm instead of 3 nm due to initial supply constraints from TSMC, HPC products will be the main body of 3 nm in H1 2023, especially the demand from Intel’s wafer outsourcing in its new CPU line-ups. We believe Intel would be the second-largest client after Apple on TSMC’s 3 nm in 2023 as the volume of outsourced wafer orders is highly subject to Intel’s in-house EUV availability in the early stage. HPC applications will be a stable part (Exhibit 3) in 3 nm with 40%-60% of total foundry wafer demand during 2023-2025.

Conclusion

The crossover point between HPC and smartphone sales at TSMC, observed in Q1 2022, is more like the beginning of the future trend where semiconductors will shift growth drivers from mobile devices to multiple computing focus areas for the next wave of technology applications. We estimate TSMC’s HPC segment to account for 42% of its total revenue in 2022, including wafer and 2.5D/3D packaging services.