- Q3 was uniquely good for STMicro as it ramped up production of multiple products for its top customers.

- STMicro is profiting from continued high levels of investment in silicon carbide (SiC).

- The company is also benefitting from the increase in production capacity.

- Material shortages and supply disruption were the likely reasons for consumer and personal market disturbances.

Franco-Italian chipmaker STMicroelectronics (STMicro) has reported stronger-than-expected net revenue growth in its automotive (ADG) and Analog (AMS) segments for Q3 2022. Overall, the company is in a solid position from the capital, liquidity and balance sheet perspective. It is likely to see continued top-line growth in ADG. STMicro is also enabling an assortment of solutions for electrification and advanced digitalization for more affordable EVs with better range, power efficiency improvements in industrial application, AI and ML use, and secure connectivity.

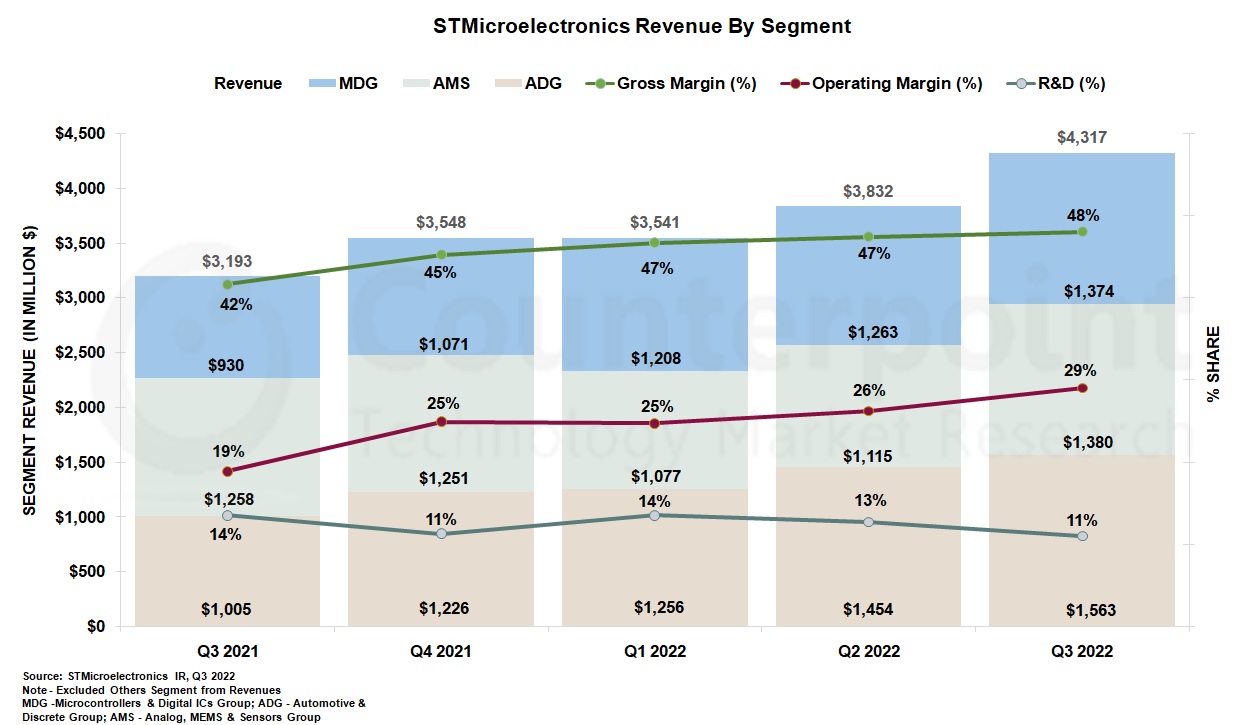

- STMicro announced net revenue of $4.32 billion for Q3 2022, primarily driven by the strong demand from the automotive, discrete and microcontroller segments. Net revenues grew 35.2%YoY with growth across all product units.

- Gross margin at 47.6% was above the mid-point, driven by favorable pricing and improved product mix, and partially offset by inflation of manufacturing input costs.

- Automotive: Sustained demand across the automotive supply chain due to the ongoing electrification has also increased the adoption rate of silicon carbide (SiC). In EVs, SiC is used for inverter switches, which is a breakthrough development in the semiconductor industry. It offers higher operational speed, improved efficiency, longer lifespan and faster recovery times. 150mm SiC epitaxial substrates will be manufactured in Italy for now with commitments to develop 200mm wafersin the near future. STMicro also has around 110 projects on hand, of which 60% are from automotive customers.

- Industrial: This sector saw strong demand in Q3 2022 largely driven by STMicro’s broad product portfolio. The industrial market has seen major trends that include energy and power efficiency improvements, digitalization of devices and massive semiconductor content growth in power, analog, sensor, and embedded processing products. Medical-grade wearables with wireless capabilities supporting short-range wireless protocols and AI capabilities are being embedded into the MCU.

- Personal electronics: Due to the ongoing trade tensions and global macroeconomic weakness along with inflation, STMicro has seen some price pressure and competitiveness in the consumer segment. The company is targeting high-volume applications with a primary focus on smartphones and wearable devices leveraging proprietary technologies for optical and wireless infrastructure ICs with leading-edge mixed-signal processes. Gaming console makers are also implementing MCUs designed by STMicro. CPUs for space applications are now based on 28nm FD-SOI.

Segment revenues

- ADG: Revenues for Q3 2022 were $1,563 million, increasing 55.5% on growth in both automotive and power discrete segments.

- AMS: Revenues for Q3 2022 were $1,380 million, increasing 9.7% on growth in analog, MEMS and imaging segments.

- MDG: Revenues for Q3 2022 were $1,374 million, increasing 47.7% on growth in both microcontrollers and RF communications segments.

- Forecast: Q4 2022 net revenues are expected to be around $4.40billion, an increase of 1.8% QoQ, plus or minus 350 basis points. Also, for the full year of 2022, the guided revenues are in the range of $16.1billionto $16.4 billion, representing growth of about 26.2% YoY, with a gross margin of about 47.3%.Primary growth can be expected in Q4 from the automotive and high-volume application sectors.

- Demand and supply: Strong demand was seen throughout Q3, especially in B2B industrial, with some slowdown in the consumer market. Increased semiconductor content in automotive was seen, along with the ongoing replenishment of inventories across the automotive supply chain as bookings remained strong across customers. The backlog remained above 18 months, which was above the planned manufacturing capacity through 2023.

- Capex and investment: Capex in Q3 2022 was $955 million, compared to $437 million in the year-ago quarter. STMicro is building an integrated SiC substrate manufacturing facility in Catania, Italy, to support the increasing demand from customers for SiC devices across automotive and industrial applications. An investment of €730 million in Catania over five years will partially support Italy in building the framework of its National Recovery and Resilience Plan.

Key takeaways

- STMicro has been a top chip supplier for the automotive industry, which is seeing an increase in EV adoption and semiconductor content in vehicles.If STMicro can attain good margins on the products sold, along with increasing its manufacturing capacity, it can become a more significant player in the automotive industry, further supporting the company’s $20-billion-plus revenue ambition.

- STMicro is harnessing wide bandgap semiconductors (boron, carbon and silicon dioxide materials) that are mostly used in radio frequency applications and radars. STMicro’s focus on wide bandgap semiconductors allows the device to operate at much higher voltages, frequencies and temperatures than conventional semiconductor materials.

- To help counter the lack of adequate chip capacity in Europe and the effects of the ongoing Russia-Ukraine war, STMicro-Global Foundries partnership will set up a factory that will reach its full production capacity of 620,000 wafers a year by 2026. Optimally utilizing the fab [mature process technology is likely being utilized for smart power, analog mixed signal and RF process (130nm – 65nm)] could be a key factor for competitive wafer pricing and high volume production.