- realme led the market during the quarter, followed by Samsung and vivo.

- Transsion Group brands’ (Infinix, itel and TECNO) shipments grew 67% YoY in Q3 2022.

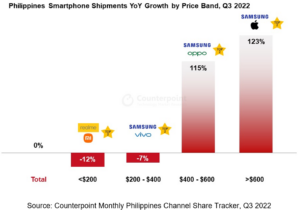

- Demand for premium smartphones increased considerably; >$400 price bands rose 115% YoY.

- Online shipments increased 16% YoY in Q3 2022 and will likely increase further in Q4 2022.

- 5G smartphone shipments soared 241% YoY, accounting for 31% of total shipments.

Jakarta, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – November 24, 2022

Smartphone shipments in the Philippines remained flat YoY in Q3 2022, according to Counterpoint’s latest Monthly Philippines Smartphone Channel Share Tracker. The figure mirrors the macroeconomic stability of the nation compared with that of its neighbours. During the quarter, the Philippines faced low inflationary pressure and an increase in consumer spending as the domestic market experienced some recovery from the year-ago period. However, growth is yet to set in as the market is not at its normal level.

Transsion Group brands’ shipments collectively grew 67% YoY with TECNO leading the pack, followed by Infinix and iTel. Aside from the Transsion Group brands, realme had the next biggest growth in shipments, at 7% YoY, driven by its C-series smartphones. realme led the market in terms of share, followed by Samsung and vivo. Among the top five brands in terms of shipments, only realme saw YoY growth.

The $400-$600 and >$600 price bands jumped 115% and 123%, respectively, in Q3 2022 boosted by new launches and higher customer preference for premium models. All the top five brands – realme, Samsung, vivo, OPPO and Xiaomi – experienced growth in the $400-$600 price segment.

Commenting on the price range analysis, Senior Analyst Glen Cardoza said, “The $400-$600 segment surged during the quarter because of realme, Samsung, OPPO and Xiaomi’s new launches in the price band. The financially well-off Filipinos now prefer premium smartphones more than ever. Gaming is a major factor as well. The Philippines is also known as the world’s e-sports capital. Not surprisingly, there is high demand for premium gaming smartphones, such as the Black Shark 4 Pro and Asus’ ROG Phone 6 series. E-sports has become a game changer and has affected the purchase decisions of Filipino consumers.”

Online channels grew 16% YoY in Q3 2022 and accounted for 20% of the total shipments. Online platforms offered discounts, cashbacks, and easier financing options, which helped these online channels gain more share. Pre-orders along with replacement options and bundling of devices with TWS at a discounted price were some of the other appealing promotions from online channels. realme’s 9 series, Samsung’s Galaxy A53 and A33, OPPO’s Reno8 and Xiaomi’s POCO F4 series were among the most preferred models.

5G smartphone shipments surged 241% YoY in Q3 2022 and accounted for 31% of the country’s total shipments as more consumers upgraded to 5G devices. Major telecom operators have been increasing their coverage and offering lower-cost plans to cater to a wider range of customers in metro areas. Operators have also been working to improve service in the prominent areas as demand for more data increases and as more people upgrade to 5G from 4G devices.

As of Q3 2022, Smart was the leading provider of 5G services across the Philippines. Smart and Omnispace have partnered to provide satcom-supported 5G internet in the country. Meanwhile, Globe Telecom has signed two major tower sale deals with Stonepeak and will use the funds raised to expand its network. Globe is constructing the 2,500-km Philippine Domestic Submarine Cable Network which is expected to be completed in 2023.

While the impact of the Ukraine-Russia war has eased, rising inflation continues to weigh on the Philippines economy. However, consumer demand remains comparatively high as the government has been taking preventive measures to boost the service and industry sector. About 95% of the country’s GDP relies on these two sectors. During the quarter, goods and services exports increased to a one-year high of 13.1%, while the unemployment rate fell due to favourable labour market dynamics. We are optimistic about Q4 2022 as the holiday season arrives. The popularity of premium smartphones will be an advantage, and the recently launched iPhone 14 series will boost Apple’s shipments. However, the country’s overall shipment growth may likely remain flattish for Q4 2022 as well.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in technology, media, and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects, and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research

press(at)counterpointresearch.com