- LATAM smartphone shipments decreased 13% YoY and 17.3% QoQ in Q3 2022.

- All the top brands’ volumes declined QoQ, except for OPPO.

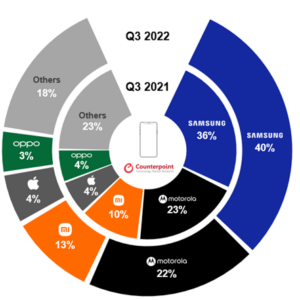

- Samsung led the market with a 40% share, followed by Motorola with a 22% share.

- The >$700 price band saw the highest growth.

Buenos Aires, New Delhi, Hong Kong, Seoul, London, Beijing, San Diego – December 12, 2022

The Latin American and Caribbean smartphone shipments fell 13% YoY and 17.3% QoQ in Q3 2022, according to the latest research from Counterpoint’s Market Monitor service. All the top brands’ volumes declined QoQ, except for OPPO.

Commenting on the market, Principal Analyst Tina Lu said, “Q3 2022 shipments were impacted by high inventories carried over from Q2 2022. During the previous quarter, several OEMs pushed high shipment volumes, but consumer demand was slowing down. Therefore, it resulted in excess inventories in most sales channels, and Q3 2022 mainly corrected it. But still, the issue has not been completely fixed and the sales channels will feel the pain of higher-than-acceptable inventories in Q4 2022 too.”

Lu added, “Consumer demand remains weak in LATAM. The regional economic crisis, triggered by high inflation, currency depreciation and a change in political power, resulted in a sharp decrease in consumer demand. OEMs, operators and retailers have all launched aggressive promotional bundles or double-digit discounts to increase sales.”

Research Analyst Andres Silva noted, “Samsung and Xiaomi were the biggest share gainers YoY during the quarter. Samsung remained the absolute leader in the region and all the individual countries. Xiaomi continued to grow by entering new countries and expanding both the operator and its own retail channels. This drove Xiaomi’s share and shipment volume growth in the region.”

Commenting on the price band performance, Silva said, “Despite the economic crisis, the >$700 price band saw the highest growth. Apple and Samsung’s flagships drove the growth of this segment. On the other hand, the <$150 price segment saw the biggest drop YoY, reflecting the lack of adequate entry-level smartphone supplies from the biggest brands, especially Motorola.”

Top Smartphone OEMs’ Market Share in Latin America, Q3 2021 vs Q3 2022

Source: Counterpoint Research Market Monitor, Q3 2022

Q3 2022 Market Summary

- Amid weakened consumer sentiment and massive shipments in Q2 2022, Samsung’s high inventory impacted its shipments in Q3 2022. On the other hand, demand for low-end and low-to-mid-end devices remained robust, showing a flat YoY volume growth.

- Motorola’s shipments fell 6% QoQ as its entry-level models were in short supply. Motorola also dropped YoY as it had an exceptional quarter in Q3 2021. The brand’s performance was particularly hit in Brazil, Argentina and Mexico. The recently launched Edge 30 flagship series also failed to click with consumers.

- Xiaomi’s shipments rose 15% YoY driven by the Redmi Note 11, which has proven to be the rising star. However, high inventory in operator channels and low demand in certain countries like Peru resulted in a QoQ shipment drop.

- Apple saw only a slight volume decrease YoY despite the launch of the new iPhone. But the iPhone 14 was launched late in the region even as Colombia imposed restrictions on 5G iPhone imports. The good demand for the iPhone 11 helped soften the fall. Apple is expected to improve its performance over the next quarter.

- OPPO’s share rose one percentage point QoQ driven by the launch of the new Reno 7 in the region. Mexico and Colombia helped the brand navigate overall market softness.

- The region’s smartphone market is becoming more concentrated. The top three brands represented 69% of the shipments in Q3 2021 and 75% in Q3 2022. While the new Chinese entrants are facing a tough time in such a market, it is the regional and smaller brands that are suffering the most.

- The “others” category decreased in volume and share YoY. Big brands, with their deeper pockets for promotions and better negotiation power, are making it tough for smaller brands.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Tina Lu

Andres Silva

andres.silva@counterpointresearch.com

Peter Richardson

Peter@counterpointresearch.com

Follow Counterpoint Research

press@counterpointresearch.com