- Global brands led India’s smart TV segment with a 40% share, followed by Chinese brands with a 38% share. Indian brands showed the fastest YoY growth to take a 22% share of the shipments.

- Smart TVs are coming with better features, such as Dolby Audio, higher refresh rates and higher sound output, in the sub-INR 30,000 ($400) price range.

- Smart TV contribution to overall TV shipments reached its highest ever share of 93% during the quarter.

- Online channels contributed 35% of the overall shipments during the quarter.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – December 2, 2022

India’s smart TV shipments grew 38% YoY in Q3 2022, according to the latest research from Counterpoint’s IoT Service. The growth was primarily driven by festive season supplies for meeting the strong pent-up demand, multiple new launches, discount events, and promotions.

Source: India Smart TV Shipments Model Tracker, Q3 2022

The share of smaller size TV is increasing, with 32”-42” displays making up approximately half of the total shipments during the quarter. Although LED displays remain the preferred choice, advanced technology displays such as OLED and QLED are gaining ground. More models are being launched with QLED displays. Dolby Audio and better speakers are other features that are increasingly being provided by brands.

On the market trends, Research Analyst Akash Jatwala said, “Dolby Audio is becoming popular. Most of the new TV models have Dolby Audio support. 32” is still the most popular screen size, as it caters to a wide array of consumers and comes with an affordable price range, whereas 43” is gaining popularity in the mid-range. On the software side, newer models are increasingly coming with Google TV, mainly in the >INR 25,000 ($300) segment. The major benefit of Google TV is its user interface and content recommendations, as it can recommend content across various streaming apps, and YouTube, which is not available on Android TV.”

On the smart TV shipments by brand origin, Jatwala said, “Global brands lead the market with a 40% share, followed by Chinese brands with a 38% share. The share of Indian brands doubled in Q3 2022 to reach 22% of the overall shipments. Many new Indian brands are entering the highly competitive market.”

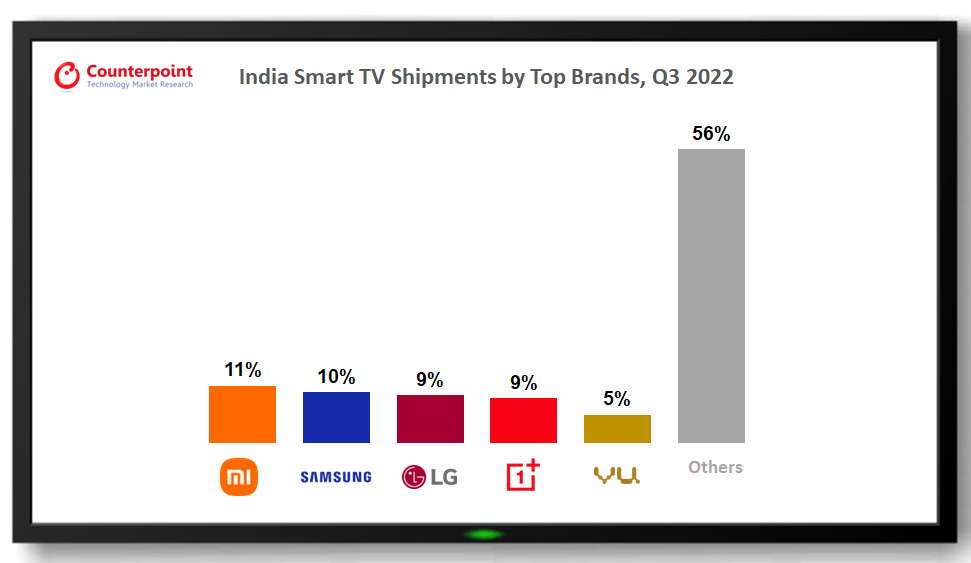

Looking at the brands’ growth, Senior Research Analyst Anshika Jain said, “OnePlus, Vu and TCL were the fastest growing brands in the smart TV segment in Q3 2022. Xiaomi led the overall smart TV market with an 11% share, followed by Samsung. LG once again secured the third spot due to the introduction of new models, especially in the INR 20,000-INR 30,000 ($250 – $400) price range. Other emerging brands in the top 10 included realme, Sony and Haier.”

Smart TV penetration of overall shipments reached its highest ever share of 93% during the quarter. The penetration is expected to go up further due to more launches in the sub-INR 20,000 ($250) price range. Online channels increased their contribution to the total shipments to 35% during the quarter. Major online platforms offered various promotions and discounts, along with exclusive launches, during the recent festive season sales.

Market summary

- Xiaomi continued to lead the smart TV market in Q3 2022 with an 11% share. During the quarter, Xiaomi launched the Mi TV X series, which comes with a 4K display and has Dolby Audio and Vision. The models also have PatchWall, which has more than 300 live channels along with other features. Xiaomi’s Mi 4A Horizon Edition, 5A series and Redmi Smart TV series were its major volume drivers.

- Samsung took the second spot in Q3 2022 with a 10% share of the smart TV market. During the quarter, Samsung launched new models in 32” and 43” screen sizes. The T4000 and T5000 series models were the volume drivers. Samsung offers a mode that turns the TV into a personal computer, offers a content recommendation guide, a web browser, and streams free TV channels with Samsung TV Plus.

- LG had a 9% share of the smart TV market in Q3 2022. During the quarter, LG launched QNED TVs, while its OLED TVs were among the popular products in the premium segment. LG offers profile options, where viewers can create their profiles for personalized content, game optimizer, and cloud-based gaming in its lower-tier models.

- OnePlus grew 89% YoY during the quarter and had an 8.5% share in smart TV shipments. The Y1, Y1S and Y1S Pro series served most of the volume during the quarter. OnePlus has some better features, such as Dolby Audio support, 4K displays and Oxygen Play, which has a recommendation system along with other features for a personalized viewing experience.

- VU’s share more than doubled in Q3 2022. During the quarter, VU launched GloLED series, which comes with a 4K display, Google TV support and a built-in subwoofer with 104 W sound output. The series was among the brand’s best-selling.

Note: Xiaomi’s share includes Redmi’s share

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Anshika Jain

Akash Jatwala

Counterpoint Research

press@counterpointresearch.com