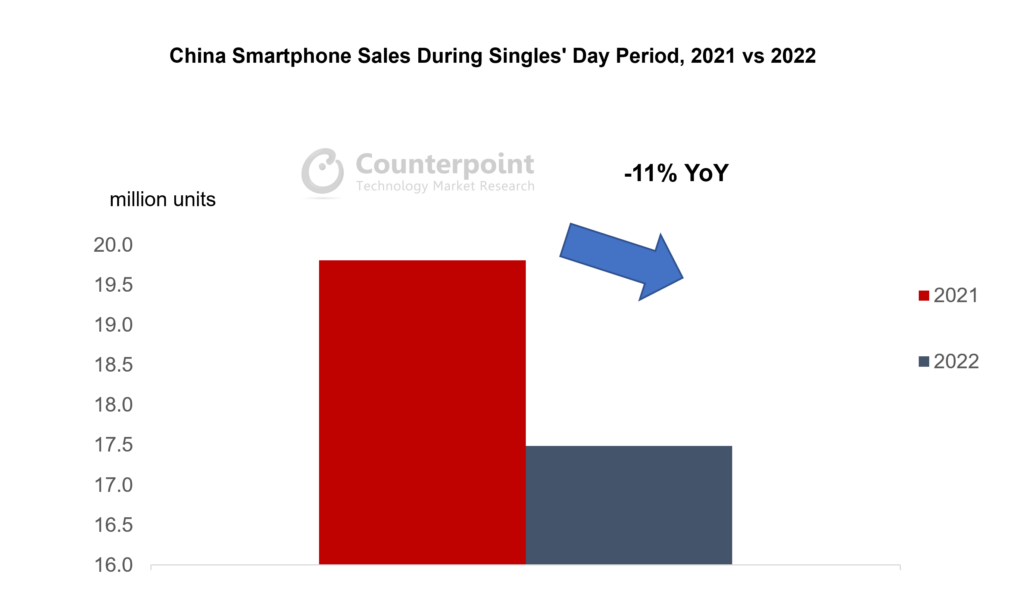

- The Singles’ Day smartphone sales this year dropped about 11% YoY.

- Apple’s Singles’ Day promotions were the biggest highlight of the festival this year.

- On the Android side, online-focused brands offered bigger discounts than others.

China Singles’ Day smartphone sales dropped about 11% YoY in 2022 as the market stayed weak due to the sustained strict COVID-19 policy in the country. Apple joined the promotions season to step up sales of its iPhone 14 model, while online-focused Xiaomi offered the biggest promotions among Android OEMs.

Source: Counterpoint Weekly Smartphone Sales Tracker

The Singles’ Day online shopping festival, which is the world’s biggest shopping festival in terms of gross merchandise value (GMV) and revenue, lasted from October 20 to November 11 this year. However, against the backdrop of sluggish demand amid macroeconomic headwinds, platforms declined to reveal their 2022 Singles’ Day sales performance in detail.

Apple’s promotions were the biggest highlight of the festival this year. The American smartphone brand joined the promotions season with a huge splash. Apple announced its participation on its official WeChat account and the discount on the iPhone14 was the biggest in recent years. The final price of the iPhone14 this year was around RMB 5,298, lower than the RMB 5,699 for the iPhone13 during last year’s festival. The stronger promotions were effective in boosting sales of the iPhone 14, which were performing weaker than the model’s predecessor.

On the Android side, online-focused brands including Xiaomi and OnePlus offered bigger discounts than others to benefit from the rising online traffic. Xiaomi’s sales rose on weekly basis but still dropped around 17% from last year’s comparable period. Xiaomi offered up to RMB 1,300 (or ~$180) off on its Mi12 series, while other products from the Redmi K series to the Redmi Note series were available for RMB 100 to RMB 300 (~$14 to ~$42) off. Besides, Xiaomi teamed up with Tmall and JD.com to offer additional discounts for e-commerce membership or on every RMB 300.

In terms of price-band distribution, high-frequency data indicated that premium models, especially iPhones, and low-end models performed better than the mid-end ones.

However, most Android OEMs did not update their killer product lines to benefit from the Singles’ Day rising traffic. OPPO’s Reno 9, vivo’s X90 and HONOR’s 80 will launch in late November, so it can be expected that these new models will lift sales in Q4. However, they will not be enough to change the negative double-digit growth rate projected for 2022.

To find more information on China’s smartphone sales during the Singles’ Day period, please refer to the report 2022 China Singles’ Day Smartphone Market Analysis.