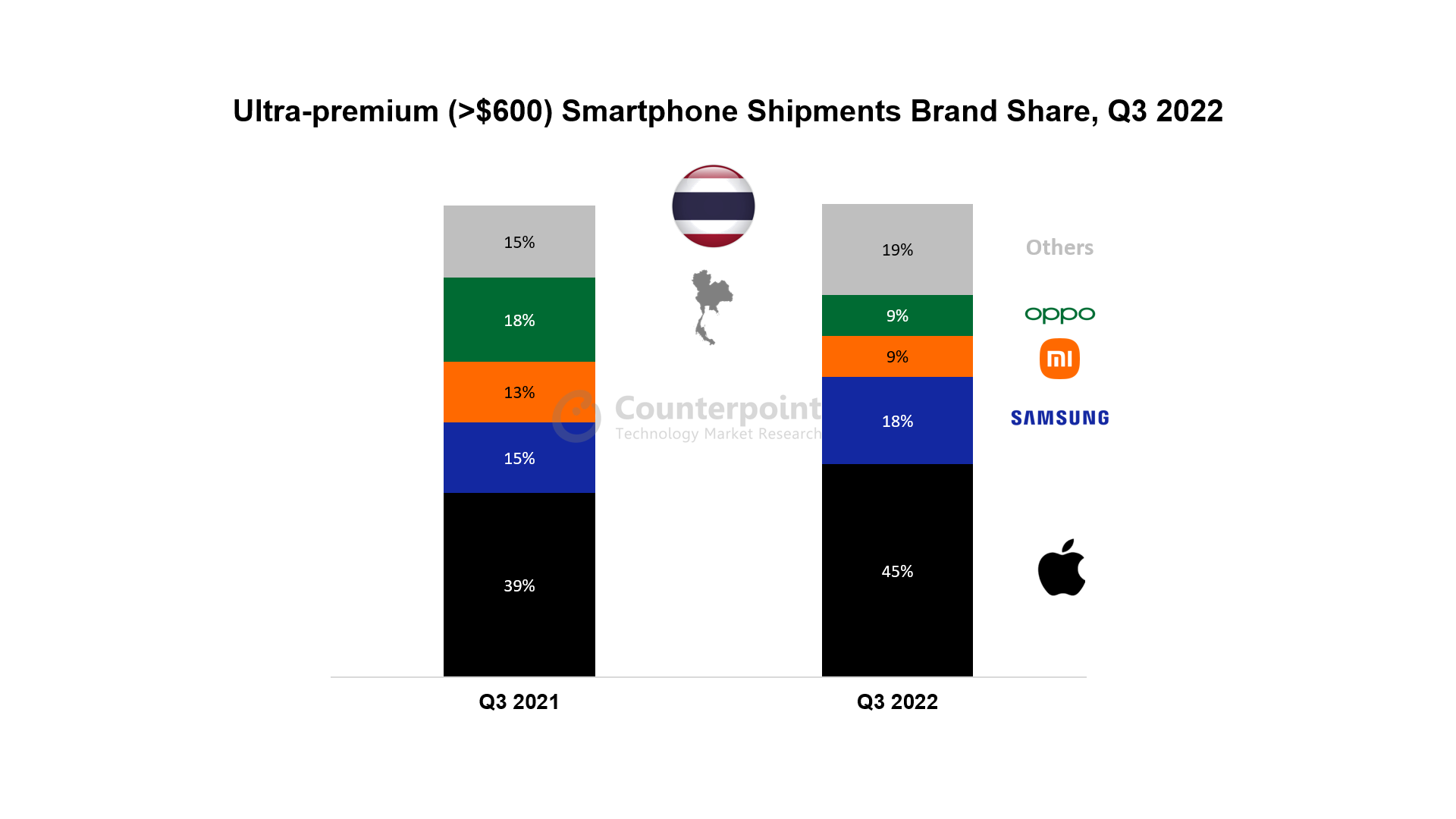

- Apple led the ultra-premium segment with Samsung a distant second.

- Thailand’s overall smartphone shipments fell 12% YoY in Q3 2022.

- Samsung took the highest share in overall smartphone shipments.

- Online shipments fell 11% YoY due to the overall decline in shipments.

Jakarta, Hong Kong, London, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – December 8, 2022

5G smartphones accounted for 47% of Thailand’s overall shipments in Q3 2022. Currently, 5G is a huge appeal for consumers who want to upgrade their older LTE smartphones and the technology might be a major factor for increasing shipments in Q4 2022.

In Thailand, operators like AIS are more focused on gaining share through 5G penetration and growing their broadband connectivity, both of which facilitate smartphone usage among Thai consumers. Since more people are opting for premium smartphones, most of which are now 5G compatible, 5G will continue to increase penetration in the market.

Meanwhile, Thailand’s smartphone shipments fell 12% YoY in Q3 2022 even as the ultra-premium segment (>$600) shipments grew 32% YoY, according to Counterpoint Research’s Monthly Thailand Smartphone Channel Share Tracker. In Q3 2022, the Thai economy struggled with inflation, sustained Russia-Ukraine war effects on trade and faced reduced tourism, which negatively affected consumers’ purchase decisions. However, a greater number of financially comfortable consumers purchased ultra-premium smartphones during the period. Apple led the premium market with an impressive 53% YoY increase in shipments. Apple’s earlier models went off the shelves swiftly in July and August, while there was an increase in shipments in September following the launch of the iPhone 14 series. Thailand’s shipments in the sub-$200 price band fell 18% in Q3 2022. Consumers in this segment might still need another quarter or two to recover from the economic turmoil.

Source: Counterpoint Monthly Thailand Smartphone Channel Share Tracker, December 2022

Commenting on Thailand’s smartphone market, Senior Analyst Glen Cardoza said, “Sub-$200) smartphone shipments fell 18% in Q3 2022. To a certain extent, Thailand’s smartphone market is depending on the premium consumer for revenue at a time of economic uncertainty. OEMs have continued providing promotions on their launches even during the economic slowdown. Apple offered discounts on the iPhone 13 series, realme focused on occasion-based online sales, Xiaomi promoted IoT devices with its smartphones and Infinix provided promotions on the Lazada platform through Lazada Payday. All these initiatives were somewhat lost to most consumers who kept a tight leash on their finances during the quarter.”

Online shipments fell 11% YoY in Q3 2022 due to the overall decline in shipments. However, the online channels have been bringing in their own initiatives. Lazada has been aggressively promoting its brand membership program to lure consumers. JD Central is actively promoting smartphones, especially those of Xiaomi. In Q3 2022, 24% of Thailand’s overall shipments came from online channels. We expect this share to rise in Q4 2022 due to seasonality. As pent-up demand begins to grow in Q4 2022, online channels will use all means to entice consumers, which should help boost market share.

To a certain extent, the Thai government has shielded consumers from increasing prices, but the economy continues to face weak business sentiment and reduced consumer demand due to increasing interest rates, reduced tourism levels and a weaker Baht. The country’s tech sector also faces weak investments. All in all, Thailand’s smartphone market might take longer than expected to bounce back. For now, the country’s affluent class is helping balance and sustain the country’s smartphone market.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the technology, media and telecom (TMT) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

![]()

Follow Counterpoint Research

![]()