Boston, Toronto, London, New Delhi, Beijing, Taipei, Seoul – January 20, 2020

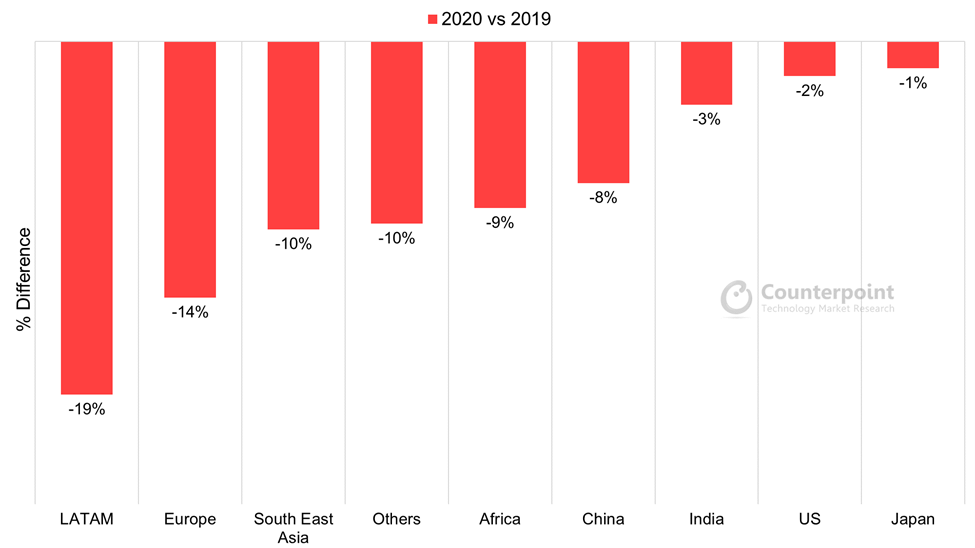

The global refurbished smartphone market fell 9% YoY in 2020, according to the latest Counterpoint Refurbished Smartphone Market Update. The market saw a dramatic 16% decline in the first half of 2020 compared to the first half of 2019. It rebounded slightly in the second half of 2020 due to increases in new device sales and a very strong Apple iPhone launch cycle which helped the supply of devices in the secondary market. All major countries and regions showed a decline for the full year of 2020, mainly due to COVID-19.

Counterpoint focuses its refurbished smartphone market research on those devices which go through repairs and enhancements before being resold. Devices sold ‘as is’ are also tracked but not included in the refurbished market numbers. Refurbished smartphone volumes are important because these devices compete with new mid-tier devices.

Commenting on the secondary market, Senior Research Analyst Glen Cardoza said, “New device sales fell by around 9% in 2020 due to COVID-19 lockdowns and related economic deterrents. This reduced the number of upgrades and smartphones hitting the secondary market. The pandemic caused a significant number of smartphone owners to avoid or delay new purchases. Key secondary markets India and Latin America saw 20% and 24% declines respectively during the first half of 2020 due to strict and extended lockdowns.”

Exhibit 1: Key Country, Regional Refurbished Smartphone Growth Rates, 2020 vs 2019

Commenting on the decline in the refurbished market, Research Director Jeff Fieldhack said, “China, the most important country in the refurbished market ecosystem, saw significant declines during 2020. The Chinese refurbished smartphone market was hit by tensions between China and Hong Kong and trade battles with the US. Many resellers in the secondary market ecosystem avoided China due to more scrutiny by the Chinese government, the potential for higher import duties, and the rising cost of replacement parts.”

Positive signs

Not all segments of the secondary market declined. Cardoza said, “There were some bright spots in the refurbished smartphone ecosystem. Apple grew its share in the secondary market from 39% to 42%. There were some marketplaces in the secondary market which saw growth, such as Back Market and Recommerce. An increased number of new businesses dealing in preowned smartphones also sprang up. Despite the proliferation of 5G networks, average selling prices (ASPs) of refurbished LTE smartphones grew.”

Background

Counterpoint Technology Market Research is a global research firm specializing in technology products in the TMT industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analysis of the mobile and technology markets. Its key analysts are experts in the industry with an average tenure of 15 years in the high-tech industry.

Analyst Contacts:

Counterpoint Research

press(at)counterpointresearch.com

![]()