- More and more smartphone OEMs are adopting the circular approach. Apple and Samsung stand out as leaders in sustainable initiatives.

- Each of the top OEMs performs differently across the three major stages of the smartphone circular economy – production, usage and end of life.

- OEM tie-ups with local sustainability partners have increased, leading to circular initiatives across geographies. But OEM initiatives fall short when compared to the volumes of new smartphones being shipped every year.

London, Jakarta, Hong Kong, Boston, Toronto, New Delhi, Beijing, Taipei, Seoul – December 27, 2022

Apple leads the smartphone space in the overall approach towards sustainability, according to Counterpoint Research’s latest “Smartphones and Circular Economy: Creating a Sustainable Future” report. This report assesses how well the OEM is reducing its impact on the environment by reusing materials, recycling devices, and minimizing waste at each stage, from the design of the smartphone, processing chips, and packaging to power consumption. The report also encompasses corporate-level initiatives, progress on carbon neutrality, and SDG 13 (one of the 17 Sustainable Development Goals adopted by the United Nations).

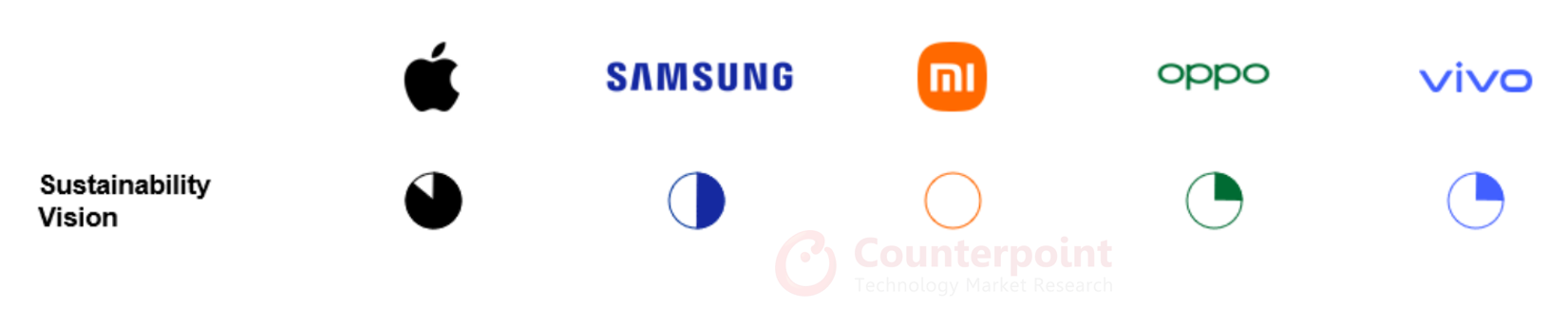

The Smartphone Circular Economy Report Scorecard includes a robust metric system that evaluates the top five smartphone OEMs globally. Each OEM has its own vision and overall approach toward sustainability. Apple’s vision seems to be clearer than its competition and its actions support the said vision.

Apple on Top in Sustainability Vision Rankings Compared to Immediate Competition

Source: Counterpoint Research’s Smartphones and Circular Economy Report

While sustainability vision is just the start, each of these OEMs has performed quite differently across the three major stages of the smartphone circular economy:

- Production

- Usage

- End of Life

Production

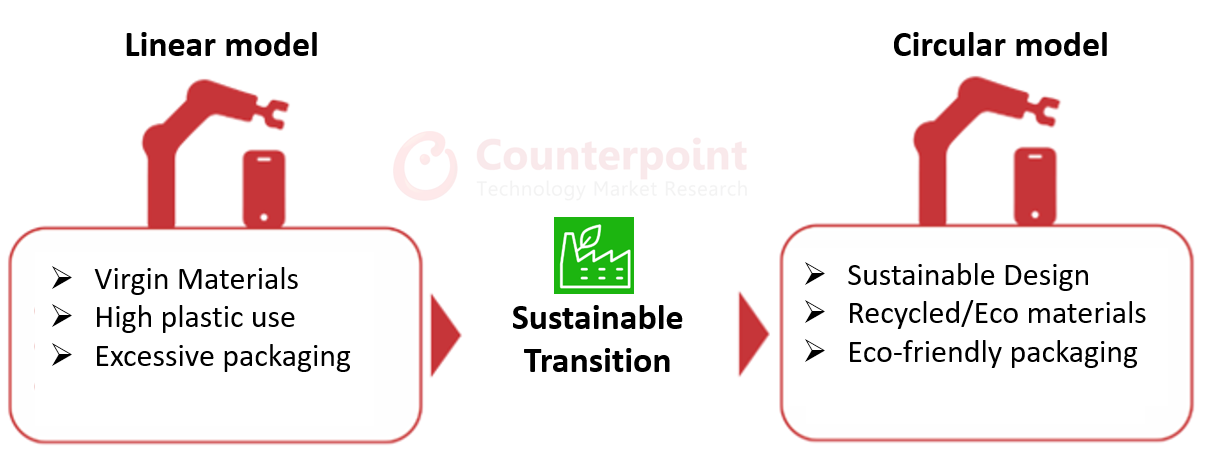

Production of a smartphone is responsible for about 80% of the total carbon footprint in its life cycle, and hence it is the most vital of the stages. OEMs have concentrated on and advertised this aspect the most. Newly sourced materials are being replaced with eco-friendly components, while biodegradable and eco-friendly packaging is the norm now. Even water-saving mechanisms are being adhered to in the entire manufacturing ecosystem. OEMs are now expecting their vendors to adhere to environmental norms as well. Top brands like Samsung, Apple, and OPPO have started propagating environmental benefits through their initiatives in production. The details, however, are more complex than what is being advertised. While the initiatives are a big step in the right direction, revenue and profit remain the apex objectives.

Usage

Most consumer durable brands inherently work towards motivating consumers to replace their devices with newer, more technologically enhanced versions. But due to sustainability efforts, OEMs have to maintain a balance between enticing the consumer and saving the environment. Chinese leaders like OPPO, Xiaomi, and, vivo are consistently trying to improve battery life and energy efficiency.

While Apple scores high on overall longevity, updates, and innovations toward sustainability, Samsung scores higher in repair, energy efficiency and after-sales networks. In the end, it depends on how long a consumer chooses to use a device. Any steps taken by OEMs to support this endeavor matter most.

End of Life

OEMs have a lot to do when it comes to reclaiming their smartphones once their useable life comes to an end. Getting pre-owned smartphones back into the system is necessary to handle them sustainably. They need to be repaired/refurbished for reuse or recycled responsibly to complete the circular loop. The main objective here is to reduce e-waste. It is vital to know how much OEMs are doing for this cause.

The global refurbished market has grown by leaps and bounds in the last few years. In 2021, the market grew 15% YoY and shows promise to grow further in the coming years. Carriers and retail refurbishment players are growing but OEM initiatives on reclamation, refurbishment, and e-waste reduction are quite limited. Even the best brands are not active enough in pulling back their used stock. The highest potential now rests with initiatives like trade-ins, which ensure a buyback of the older devices. This takes volumes of landfills. Brands like OPPO, vivo and Xiaomi have a long way to go with reclaiming and refurbishing devices if we consider the volume of new smartphones shipped by them every year. Apple and Samsung lead here as well but most of the reclaiming and refurbishing is done by the other players in the secondary ecosystem. The end-of-life stage is quite complex but one of the most rewarding if done right.

OEM tie-ups with local sustainability partners have increased, leading to circular initiatives across geographies. But such initiatives need to grow at a faster rate to be in consonant with the volumes of new smartphones being shipped every year. There are opportunities as well. Sustainability and its different aspects, initiatives and players can be broken down into many sectors with varying opportunities. The benefits for the environment compound when the industry and government take steps in the right direction.

OEMs already have a name for themselves, but their sustainability initiatives will either make or break their perception in the years to come.

Feel free to contact us at press@counterpointresearch.com for questions regarding our latest research and insights.

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Analyst Contacts

Glen Cardoza

Follow Counterpoint Research